The final day of this week is likely the most critical for the EURUSD currency pair traders as high-impact economic events are lined up. Bullish traders have generally had the final say as the pair has been upheld nearer to its highs. But will this change with economic data releases?

Germany’s unemployment rate remained flat, while CPI data ticked lower across various regions in Europe’s biggest economy. Preliminary GDP growth was below consensus and could mark the beginning of the slowdown of the European economy as the rate hikes begin to take effect.

Technical

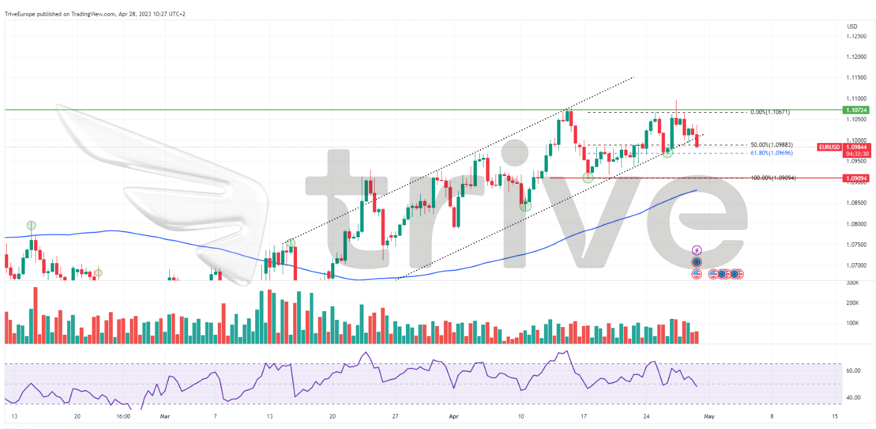

The EURUSD currency pair has traded higher in recent weeks as price action ran away from the 100-day moving average, forming an ascending channel pattern. Support and resistance were established at the 1.09094 and 1.10724 levels, respectively. However, bulls have upheld support at the 61.80% Fibonacci Retracement Golden Ratio at 1.09696, with bearish momentum fading as the price approached the level.

If bulls continue to dominate, the Golden Ratio could hold as support with the 1.10724 level set out as a probable level of interest should the pair be bid higher. Alternatively, a high volume breakout below the Golden Ratio could indicate the build-up of bearish momentum. Bears will likely look to the 1.09094 level as a probable target if they outweigh the bulls.

Summary

The 1.09696 level will be critical in defining the market’s overall sentiment, combined with the U.S.’s PCE Index, which is the preferred inflation gauge for the Federal Reserve. Fears of a possible recession could weigh down the Euro as it takes a toll on the appetite for risk assets. A breakdown below the 1.09696 level could grow the likelihood of the pair taking a downturn.

Sources: Reuters, TradingView