Microsoft Corporation’s (ISIN: US5949181045) share price surged by 8% after it reported upbeat third-quarter earnings results. Earnings beat Wall Street expectations by 9.42 %, landing on $2.45 per share, while the top line beat expectation by 3.60% with $52.86 billion generated in the quarter. Microsoft’s cloud computing business was by far the best performer, driving investors’ appetite for the stock higher.

Optimism over the future of Artificial intelligence (AI) and Microsoft’s strong positioning in the progression of the technology have played a huge role in restoring faith in the company’s stock. After shedding over a quarter of its value in 2022, Microsoft is back on a recovery path, with the stock up 27% year-to-date.

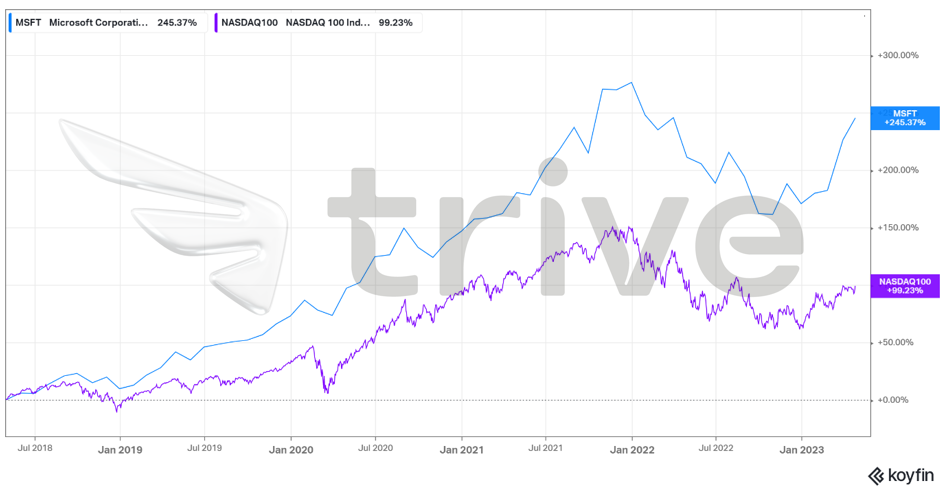

Over five years, Microsoft’s share price has moved in tandem with the NASDAQ100 Index, suggesting a positive correlation, but outperformed the tech-heavy index by a strong margin. This could indicate that Microsoft’s perceived value exceeds the industry standard, giving it a high-return status against the benchmark.

Technical

Microsoft’s share price trended lower for most of 2022, driven by weakening valuations on higher interest rates and borrowing costs. Price action formed a descending channel pattern, while a crossover below the 100-day moving average validated the downtrend. Support and resistance were established at the $222.79 and $315.67 levels, respectively.

Lately, Microsoft’s fortunes have begun to change, with the U.S. economy showing signs of weakness, prompting expectations of a Fed pivot in the near future, while positive earnings results boosted the performance. Microsoft’s share price broke above the descending channel pattern, with high volumes supporting the move. Bullish investors pushed the price higher, above the 100-day moving average, restoring the uptrend.

Investors interested in buying Microsoft’s shares would likely be better off sitting out at present due to the high premiums placed on the stock, especially after earnings results. Buyers could look to enter the market on a retracement, with the next best price likely at the $247.49 per share level, which forms the swing low prior to the price running higher.

Alternatively, if the share price begins to retrace, buyers could look to enter the market when the share price reverses on lower volumes, indicating the dying out of bearish momentum and a reversal imminent. Bullish investors will likely hold onto the share with the aim of taking profit at either resistance or fair value of $335.99 per share.

Fundamental

The top line surged 7% to $52.86B compared to the same period a year ago. Microsoft’s Intelligent Cloud business segment primarily drove revenues higher, after generating revenue of $22.08B, up a mouth-watering 16%. Following closely behind was the Productivity and Business Processes segment which grew 11%, primarily due to growth in income of the cloud services and LinkedIn subcategories. However, offsetting the top-line growth was a 9% decline in revenues in the Personal Computing segment, suffering declining demand from the Pandemic peak.

The positive top-line performance filtered down through Microsoft’s income statement as operating income and net income increased 10% and 9% to $22.4B and $18.3B, respectively, representing healthier profitability in the company’s operations.

After discounting for future cash flows, Microsoft’s fair value was derived at the $335.99 mark. With the share price trading below fair value, the share price represents a 8.97% discount, leaving room for significant gains if bullish investors pile into the market.

Summary

Given the positive outlook surrounding AI, Microsoft could be in a good position to take advantage of the possible growth the technology will bring while demand for cloud services peaks, with online data storage becoming a necessity. The share price will likely head northward as more value is generated from AI and cloud computing, leaving the fair value of $335.99 per share probable.

Sources: Microsoft Corp, Reuters, Forbes, CNBC, Nasdaq, Refinitiv, TradingView, Koyfin