Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Nvidia Corporation (ISIN: US67066G1040), a juggernaut in the semiconductor industry, has captured the spotlight in the $100 billion-plus market cap category with a stellar performance in 2023. The year witnessed a meteoric rise in Nvidia’s stock, delivering over 200% returns, propelled by the seismic wave of Artificial Intelligence (AI) adoption that has reshaped global industries.

As AI technology continues its rapid ascent, Nvidia stands at the forefront as a key enabler, and its stock reflects this prowess. The company boasts a 5.20% surge in the current quarter alone, poised to mark a fifth consecutive quarter in positive territory.

The true testament to Nvidia’s extraordinary growth lies in its second-quarter earnings, which shattered expectations, surging an impressive 29.69% above estimates to reach a remarkable $2.70 per share, all against a robust revenue backdrop of $13.51 billion. This outstanding performance exceeded estimates and dwarfed the prior year’s second-quarter results by a substantial margin, underscoring the company’s unwavering growth trajectory.

Nvidia’s success story is intrinsically linked to the widespread adoption of AI across various industries. Tech giants like Alphabet Inc (ISIN: US02079K3059), Amazon.com Inc (ISIN: US0231351067), and Meta Platforms Inc (ISIN: US30303M1027) have embraced Nvidia’s AI infrastructure, cementing its pivotal role in the evolution of accelerated computing and generative AI, poised to redefine the business landscape. This is a compelling testament to Nvidia’s resilience and dominance in a transformative era of technology-driven growth.

Technical

Nvidia’s shares have soared to unprecedented heights, reaching an all-time pinnacle at $502.16 per share. This surge is underpinned by a compelling confluence of technical indicators: a notable gap up, an ascending channel pattern, and trading consistently above the 100-day moving average. This $502.16 level has now become a critical resistance point, triggering a retracement after a recent reversal.

A vital support level at $409.80 per share aligns harmoniously with the lower boundary of the ascending channel pattern and the 100-day moving average. This level proved instrumental in ushering in a bullish resurgence after a selloff, propelling the share price halfway towards the formidable resistance, as per Fibonacci Retracement levels.

Optimistic investors will likely keep a watchful eye on breaching the $502.16 mark, spurred on by the prevailing upward momentum. Nevertheless, should the 50% level pose a formidable interim resistance, a reversal scenario could unfold, potentially leading the stock back to the reliable support at $409.80 per share. This juncture might entice bargain hunters should market sentiment sway in their favour.

Fundamental

Nvidia Corporation’s recent financial performance tells a tale of technological triumph. The demand for Nvidia’s chips, driven by the growing necessity for AI systems with advanced language capabilities, has reached unprecedented levels. This surge in demand has captivated a global audience, from AI startups to industry behemoths like Microsoft, all eagerly adopting Nvidia’s state-of-the-art chips. The Chinese market has also moved swiftly to secure these chips ahead of potential U.S. export restrictions.

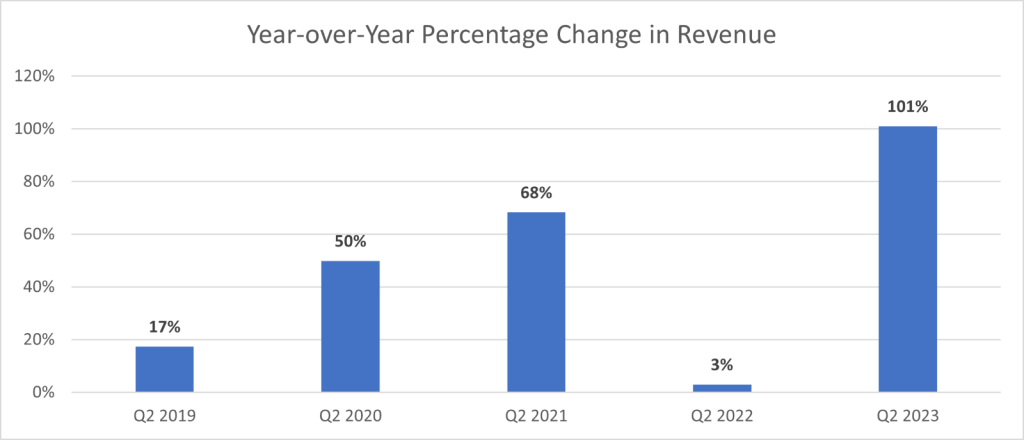

With a remarkable 53% increase in inventory commitments, standing at $11.15 billion in the prior quarter, the company is strategically positioning itself to meet the surging demand for its data centre chips, a crucial facet of its success. And what a success it has been: Nvidia has achieved a historic revenue of $13.51 billion, marking an astonishing 88% surge from the prior quarter and a doubling (101%) from the same period last year.

Source: Trive – Factset, Nkosilathi Dube

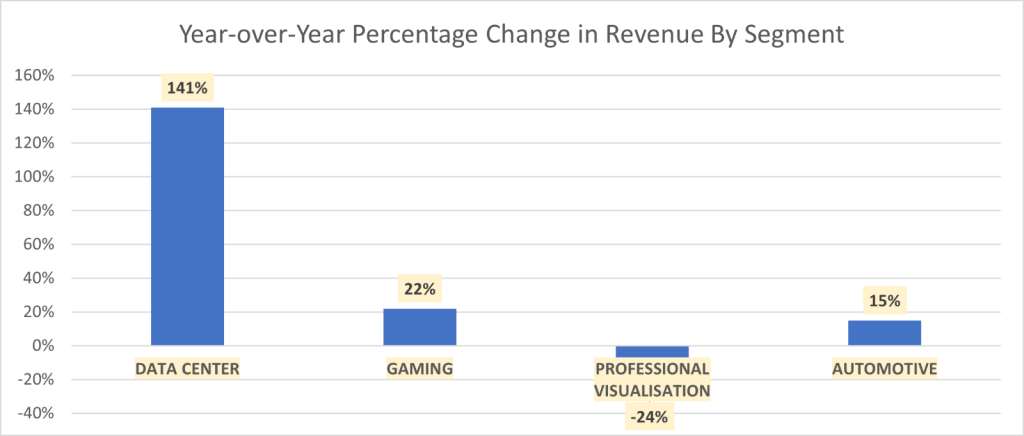

Nvidia’s rapid ascent is chiefly attributed to its robust data centre business, serving as the foundation of its exceptional performance. This segment’s revenue surged to an astonishing $10.32 billion, marking an extraordinary 141% increase from the previous quarter and an impressive 171% rise from the prior year. Nvidia’s A100 and H100 AI chips, pivotal in developing and operating AI applications like ChatGPT, have emerged as the linchpin of its outstanding performance.

However, Nvidia’s success story is multi-dimensional. Once the primary revenue driver, the gaming segment experienced a noteworthy 22% year-on-year revenue growth, totalling $2.49 billion, surpassing expectations. This significant shift in revenue distribution underscores Nvidia’s diversification and broader market influence.

Source: Trive – Nvidia Corporation, Nkosilathi Dube

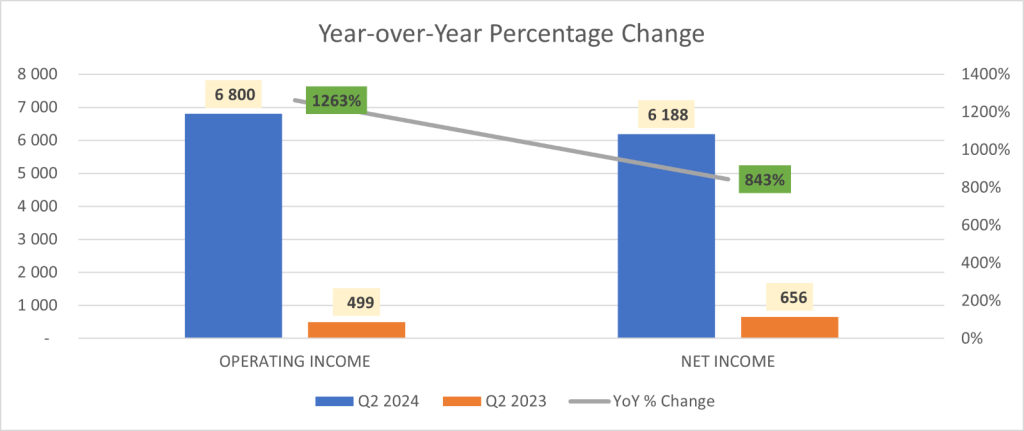

Notably, this upward trajectory isn’t confined to top-line figures. Operating income and Net income for the quarter surged to $6.8 billion and $6.19 billion, respectively. This marked an astonishing 1263% and 843% increase from the prior year from the same quarter a year ago. The company’s gross margin reached an impressive 70.1%, surpassing the previous year by a remarkable 26.6 points, showcasing both robust sales and heightened profitability. Financial indicators narrate a story of exponential growth.

Source: Trive – Nvidia Corporation, Nkosilathi Dube

Nvidia’s vision for the future is upbeat. Its third-quarter outlook paints an optimistic picture, projecting revenue of $16.00 billion, a substantial leap from Refinitiv’s forecast of $12.61 billion. Gross margins are expected to hover around 71.5%, affirming the company’s commitment to sustained profitability.

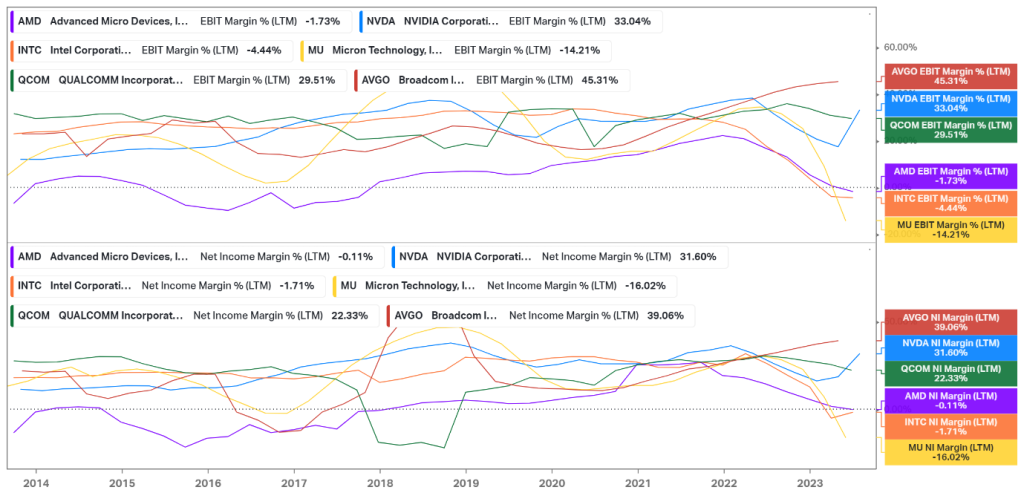

Nvidia stands out prominently among U.S. chip manufacturers, demonstrating impressive profitability with an EBIT Margin of 33.04% and a Net Income Margin of 31.60%. The only company slightly ahead is Broadcom Inc (ISIN: US11135F1012). Nvidia’s surging demand for processors has led to a remarkable surge in profitability over the course of 2023. With unprecedented year-on-year expansion, the likelihood of Nvidia emerging as the most profitable U.S. chipmaker seems increasingly plausible.

Source: Trive – Koyfin, Nkosilathi Dube

Nvidia is making a significant move towards enhancing its return on equity, displaying a sharp upward trajectory compared to its U.S. chipmaking counterparts. With profitability soaring due to unprecedented chip demand, the company is well-positioned to further bolster its return on equity. Notably, Nvidia’s dedication to its shareholders is evident, as it returned a substantial $3.38 billion during the second quarter through dividends and share buybacks. With $3.95 billion still set aside for repurchases and a recent authorization of an additional $25 billion, the company’s strategic approach to allocating capital underscores its confidence in sustaining value for investors.

Source: Trive – Koyfin, Nkosilathi Dube

After discounting for future cash flows, a calculated fair value of $529.23 per share was derived.

Summary

In this era of transformative technology, Nvidia’s dominance in AI chips has propelled it to a position of industry leadership. The fusion of technological innovation, global demand, and sound financial strategy has solidified Nvidia as a cornerstone of the tech landscape, promising a future where AI and computing seamlessly converge to redefine industries and reshape economies.

Sources: Nvidia Corporation, Reuters, CNBC, TradingView, Koyfin