PayPal Holdings (NASDAQ: PYPL) is set to report its fourth-quarter earnings after the market close on Thursday, an important day for the fintech company. Amid speculation that their growth prospects are eating away at their reputation as the leading player in the online payment market. The share price is currently trading 72% lower than all-time highs, raising the question of whether it can be considered “cheap” in relation to what it once was. But all is not as simple as it seems, and the earnings report on Thursday may be the answer to the questions hanging on investors’ lips.

PayPal posted solid Q3 earnings in November, as they posted free cash flows of $1,8Bn, their highest quarterly free cash flow in the company’s history. More good news followed, with their total active account numbers growing by 4% year on year to 432M and a $337Bn total payment volume rising 9% year on year. The share price reacted to a further upward revision of their 2022 EPS guidance to $4,07 – $4,19. This gave investors optimism that the substantial drop in share price may see a reversal, but since then, macroeconomic conditions have continued to strain the company’s bottom line. Thursday will be key for the price action as the company reveals whether their guidance for EPS materialized.

Technicals

The weekly time chart shows a massive drop from the highs of over $300 per share as macroeconomic conditions ate into discretionary spending demand. The share price now consolidated in a much tighter range and is trading close to the 50-day moving average as investors await a pivot in the economic circumstances, along with clarity on whether the once fast-growing online payment giant can reignite the growth prospects that once surrounded them.

On the daily timeframe, some critical levels of importance open up that investors may keep an eye on going into the earnings release. Currently, at a resistance of $83,23, the market is awaiting news to decide the direction of their next move. If earnings positively surprise, a breakout above the current resistance may occur. This will bring the first estimated target of $88,93 into play. A breakout above that level might be further pushed to an estimated fair value of $91,13. However, if a negative earnings surprise confirms investors’ fears, a breakout to the downside may push the price to seek support at $75,06. If the support level does not hold, then we could possibly see further downside to the next level of support, around $67,42 a share.

Fundamentalanalyse

Expectations for the fourth quarter earnings per share are $1,20, which would indicate growth of 7,2% from the period before. Revenue for the quarter of $7,4Bn is expected to realize quarterly growth of 7%. However, metrics that investors will also be keeping a close eye on include their new account growth numbers and their free cash flow growth. PayPal has historically been firm in its free cash flow generation ability. Compared to their competitors, they are relatively undervalued on a Price/Free Cash Flow basis, as seen in the graph below. Whether they can sustainably grow their free cash flows at current rates will be critical in sentiment about their growth prospects. Wall Street estimates predict a CAGR of only 12,2% from 2022 through to 2026, which is not seen as enough to retain their stronghold in the market.

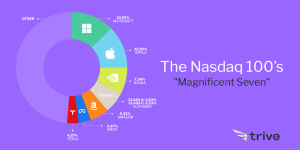

Furthermore, the likes of Apple Pay and Google Pay have seen disruption in the online payment market. Apple Pay recorded record purchases during the holiday season, and investors are becoming concerned that this disruption could hurt PayPal’s ability to grow and retain their account users. This has caused downgrades in the outlook for the stocks by Raymond James. However, suppose new solid account growth numbers and higher total payment volumes are seen in the latest quarterly results. In that case, investors may be reassured that PayPal still holds the majority of the market for online payments. Finally, PayPal also reiterated their efforts to cut costs in the months going forward, with a 7% cut in their employee base already announced. The market has recently awarded companies who shift focus onto cutting costs, as was seen with Meta. If their quarterly results show resilience in these efforts, there could be some upside in the share price. However, even if these metrics positively surprise, the outlook the company will give for the next financial year might overshadow any positives if recession fears continue to doubt their growth capacity for the year going forward.

Summary

The key metrics investors may be keeping an eye on in the fourth quarter earnings release for PayPal include new account growth, total payment volumes, free cash flow growth and cost-cutting resilience to indicate whether they can maintain the fast growth needed to keep their stronghold in the online payment business that exciting competitors are disrupting. However, if they give investors optimism, a long entry point may exist with a long-term fair value target price of $91,13 and a 9% potential upside.

Sources: Koyfin, TradingView, PayPal Holdings, Investor’s Business Daily