Alphabet Inc (ISIN: US02079K3059) enjoyed a fairly decent quarter after both it’s top and bottom lines beat Wall Street Expectations. Earnings were reported at $1.17 per share versus $1.07 per share expected, while revenue was $69.79B, up 1.30% against consensus.

The positive earnings quarter marks the first in a string of four consecutive quarters in which Google missed its earnings mark. According to Google’s highest office, the economic environment remains uncertain due to the challenging economic climate. With a likely recession looming, Google’s top line is under threat as advertising spend is already starting to show cracks. Will the macroeconomic challenges weigh down Google’s Fiscal year?

Technical

Google’s share price has shed 30.91% since last year’s highs as price action shifted into a downtrend, forming a descending channel pattern and crossing below the 100-day moving average. Support and resistance were established at the $88.33 and $121.66 per share levels, respectively.

Bullish investors have recently found hope in the company’s share price performance, taking it above a prior high and the ascending channel’s resistance. However, despite positive earnings, buying at present levels could mean buying into a premium share price. Investors will likely be better placed to find long opportunities if the price retraces within the descending channel pattern.

The first level of interest for bullish investors could be the 61.80% Fibonacci Retracement Golden ratio at the $96.21 level. Alternatively, the support level at $88.33 per share could interest bullish investors looking for a steeper discount. If price action approaches either level on declining volume, it could indicate the market’s lack of interest in a lower price, signalling a probable reversal at play. Bulls will likely aim for the $121.66 per share level as a take-profit level if they enter the market.

Fundamental

Revenues moved 3% higher Year-over-year to $69.79B, primarily driven by a 28% surge in Google Cloud’s segment revenues. The Google Advertising segment shed 20 basis points of revenue to $54.55B from the quarter a year ago as marketing budgets are being dialled back in the face of a potential recession and subdued consumer spending.

However, the slight gains in the top line were not enough to offset the decline in profitability induced by layoff charges. $2.6B in charges related to workforce and office space reductions ate into the bottom line this quarter, resulting in Operating income declining 13% to $17.42B, while Net Income was down 8% to $15.05B.

To protect itself from the downsides of weakness in advertising, Google has been forced to lay off 12000 employees, about 6% of its workforce, making it the most extreme job cut in its history.

After discounting for future cash flows, Google’s share price was derived at $117.50 per share. The share price currently trades at an 11.38% discount to the fair value, leaving room for significant upside gains.

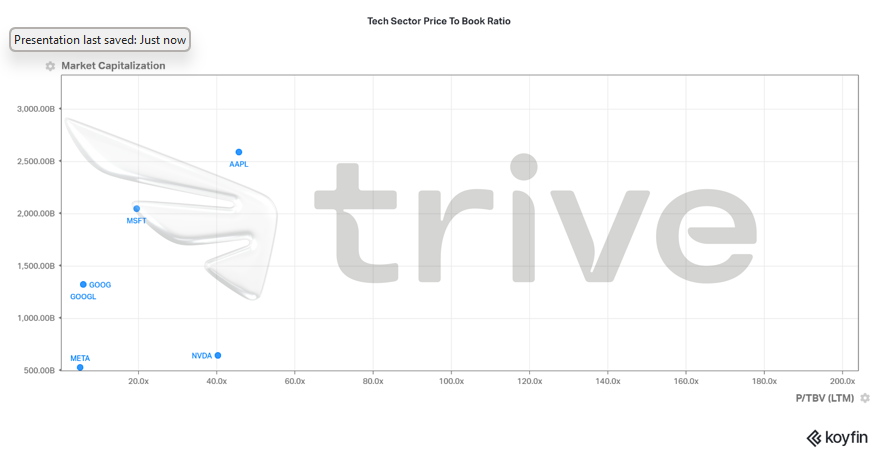

Compared to its peers, Google’s price-to-book ratio is much lower but reflects that the share price could be trading nearer to its fair value. However, given its peer’s much higher ratios on average, Google’s share price could be considered undervalued, giving it room to catch up with its peers, if supported by strong business fundamentals and performance.

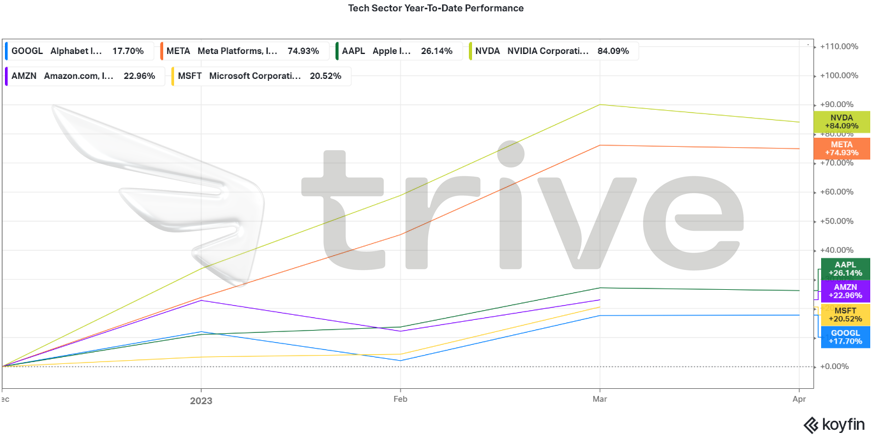

Compared to its peers, Google’s share price has been outperformed year-to-date, reflecting its fair value, represented by the price-to-book ratio. However, there is a positive correlation between Google and its peers as their share prices move in the same direction. Investors will closely watch the year unfold to determine whether Google can find some strong points.

Summary

Despite the main business, advertising, taking a slight downturn, Google has found hope in its other segment’s revenue growth, including Google Cloud and Google Other. Artificial Intelligence could be the company’s new frontier for growth if integrated successfully, as the hype around it is still fresh, while innovation is only starting to pick up steam.

Sources: Alphabet Inc, Nasdaq, CNBC, Reuters, Refinitiv, TradingView, Koyfin