According to S&P Global Market Intelligence, the consumer discretionary sector was the most shorted U.S. stock sector. While short interest, the percentage of outstanding shares held by short sellers, averaged 2.25% for the S&P500, the consumer discretionary sector averaged 5%, the highest of all sectors in December 2022.

The short-selling hype was uplifted by persistently high inflation and the erosion of consumer demand. The consumer discretionary sector will likely be weighed down further by unrelenting inflation and interest rate hikes which adversely affect consumer demand.

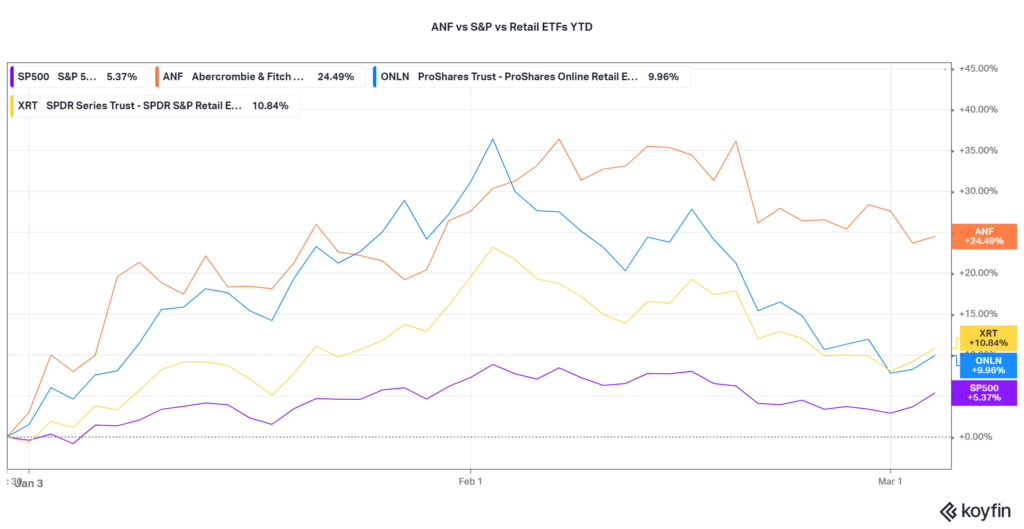

Below is a comparison of the Year-to-date return of the Abercrombie & Fitch Company (ANF), S&P500 (SP500), the SPDR Series Trust SPDR S&P Retail ETF (XRT) and the ProShares Trust ProShares Online Retail ETF (ONLN). ANF has outperformed the broader S&P500 and Retail ETFs by a wide margin. Part of the recovery resulted from relaxed hawkish sentiments among investors due to a tick down in inflation growth. This was, however, short-lived as inflation proved to be sticking around.

Source: Koyfin

Technical

Following the release of Q1 2022 earnings, ANF has traded in a downtrend within a descending channel on declining volumes, representing the fallout of bearish momentum. Support and resistance were forged at the $14.57 and $36.20 per share levels, respectively.

Given that momentum is pointing to the upside, price will likely be directed higher towards resistance at the $36.20 per share level. If bullish investors take the resistance level with a pinch of salt, a breakout above the level on high volumes could validate further price action to the upside. The next level of interest would be the $46.44 per share level, which formed the highs of 2021.

Alternatively, if bullish investors succumb to bear pressure, price will likely be dragged lower. Bearish investors will probably be interested in taking profits at the $14.57 per share level.

Fundamental

ANF’s 2022 was relatively flat in the face of macroeconomic challenges, including rampant inflation and multiple interest rate hikes. Despite growing its physical presence with a 12.82% growth in Total stores with a new format (now 440 stores), ANF’s sales growth on a year-by-year basis for the quarter did not match up after realising a 3% growth. Sales growth was partly due to ANF’s progress in key growth initiatives across the digital space, technology and stores. Digital penetration came in at 44%, reflecting strength in consumer access.

ANF expects sales growth of 1% to 3% in 2023, mainly driven by Net store expansion, an expected net improvement in freight and raw material costs and cautious optimism on consumer demand.

After discounting for future cash flows, a fair value of $31.70 was derived. Price currently trades within a 10% discount to fair value. With the gap between fair value and share price, there is room for upside if ANF performs over and beyond its guidance for the year.

Summary

Inflationary developments will be the main driver for the consumer discretionary sector in 2023. Higher inflation levels deteriorate consumers’ ability to spend due to higher prices while limiting their ability to borrow due to higher interest rates. If inflation fails to back down in 2023, ANF’s share price will likely take a knock in 2023.

Sources: Abercrombie & Fitch, S&P Global Market Intelligence, TradingView, Nasdaq, Koyfin