PayPal Holdings’ Inc (ISIN: US70450Y1038) peak share price is a long distant memory, not by time but by how far the price has come down from it. Once a darling of Wall Street, peaking at $310 per share in 2021, the stock has lost just over three-quarters of its value since and now trades at $71.29 per share.

The fastest interest rate hike since the 1980s played a massive role in intimidating the stock’s share price, as the Federal Reserve was stuck with high inflation it had to fend off. 2022 saw the stock’s value decline 62%. But what’s next? Is there more doom to come, or will PayPal find a bottom?

Technical

PayPal’s stock price has been in a sharp downturn which kept it subdued in a downtrend, as the price traded well below the 100-day moving average while forming a descending triangle pattern. Support and resistance were established at the $66.44 and $88.41 per share levels, respectively.

Downside volumes have declined as the price action consolidated within the descending channel pattern. The stock shows signs of having established a bottom, as the price established a flat base level within the pattern, while downside price action is losing steam. If bullish investors plan on buying the stock at a sharp discount, a high volume breakout above the descending triangle pattern could validate a leg-up imminent. Bullish investors will likely earmark the $88.41 per share level as a point of interest.

Alternatively, if bearish pressure continues to weigh on PayPal’s stock price, a breakdown below the descending triangle pattern could play out, with the price likely headed towards the next support level at $57.89 per share. Bullish investors could look for long opportunities at the level, given that downside volumes accompany the price’s approach to the level, signalling the wearing out of bearish momentum.

Fundamental

Despite experiencing a subdued share price performance, PayPal’s first quarter of the year was relatively upbeat. Revenues surged by 9% year over year to $7B, while the Earnings per share was up 33% on a Non-GAAP basis to $1.17 per share. The stock beat Wall Street’s earnings and revenue expectations by 6.40% and 0.84%, respectively, pointing out the company’s healthier foundation.

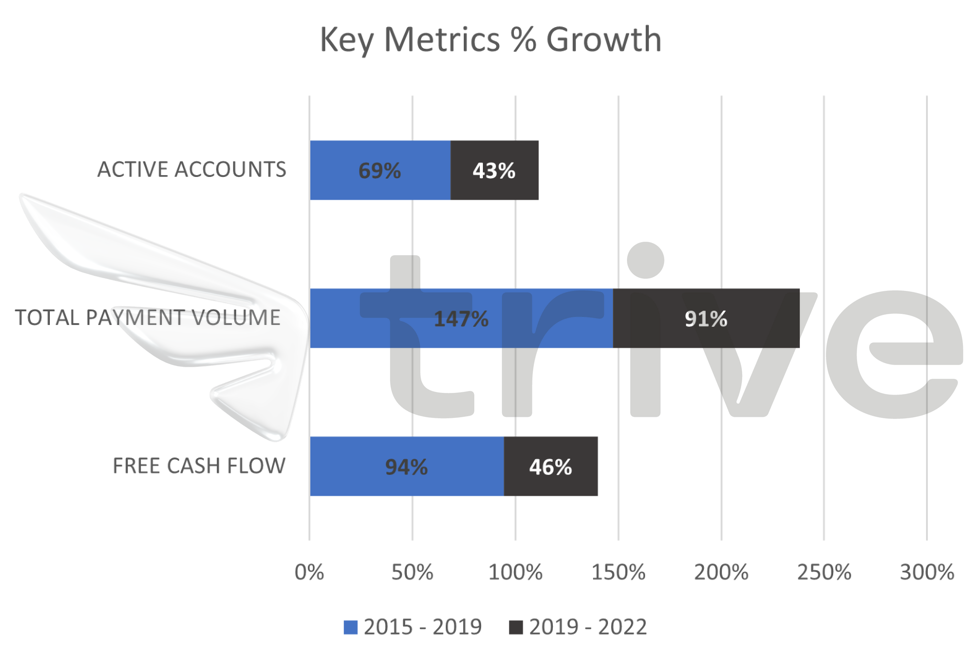

PayPal has experienced significant growth in active accounts, which filtered through the positive performance in total payment volume and free cash flows. In the depiction above, periodic growth is measured from 2015 to 2019 and 2019 to 2022. Despite growth in all three metrics almost halving for the latter four years, it still represents an upward trajectory which could filter through to PayPal’s bottom line, producing healthier earnings while guaranteeing its going concern status with more cash to meet obligations or fund expansion.

Adding onto the quarter’s upbeat performance, the adjusted operating margin in the first quarter landed at 22.7% compared with 20.7% last year. However, PayPal announced a downbeat forecast in operating margin expansion for the remainder of the year, with a 25 basis point revision to 100 basis points, compared to a 125 basis point expansion previously forecast.

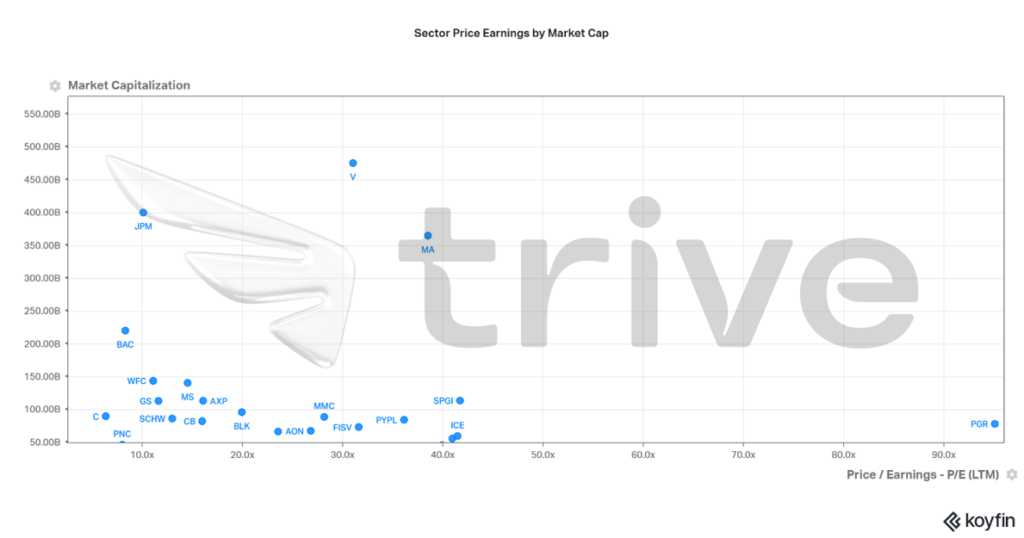

Among the $50B market capitalisation class, PayPal falls within the top Price Earnings (P/E) companies in the financial services sector with a P/E of 36.1×. This could indicate that investors expect PayPal to have higher earnings growth in the future than most of its competitors or that it is overvalued. However, given its strong baseline performance, it is probable that PayPal could experience further growth in the future, thereby boosting its valuation.

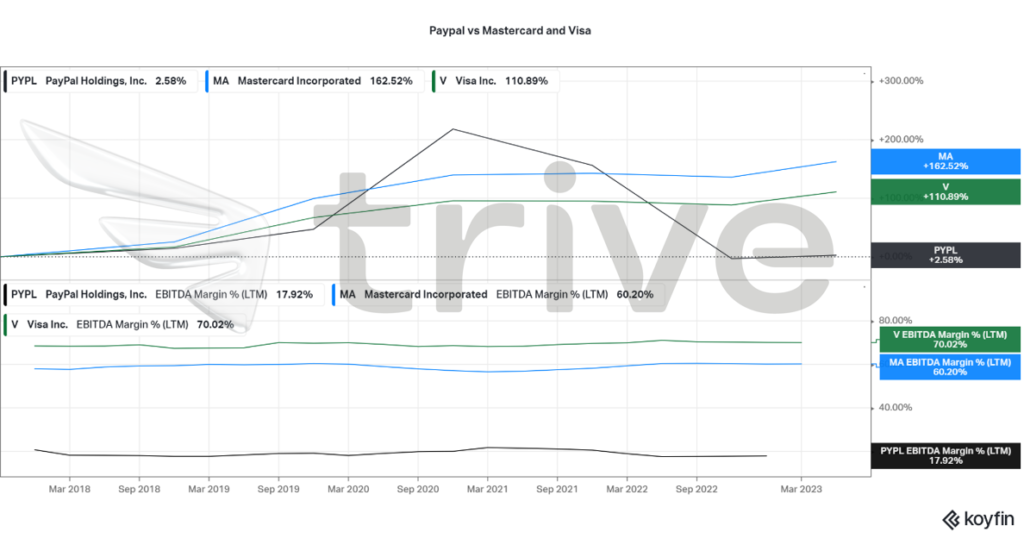

When put head to head with its two main competitors, Mastercard Incorporated (ISIN: US57636Q1040) and Visa Inc (ISIN: US92826C8394), Paypal is relatively an underperformer. On a five-year basis, the stock price has underperformed its biggest competitors significantly, suggesting that investors have greater confidence in the operations and future of Mastercard and Visa. In addition, Paypal produces less operating profit per dollar of sales than the two, indicating that it’s profitability and operational efficiency are falling behind its competitors by a wide margin.

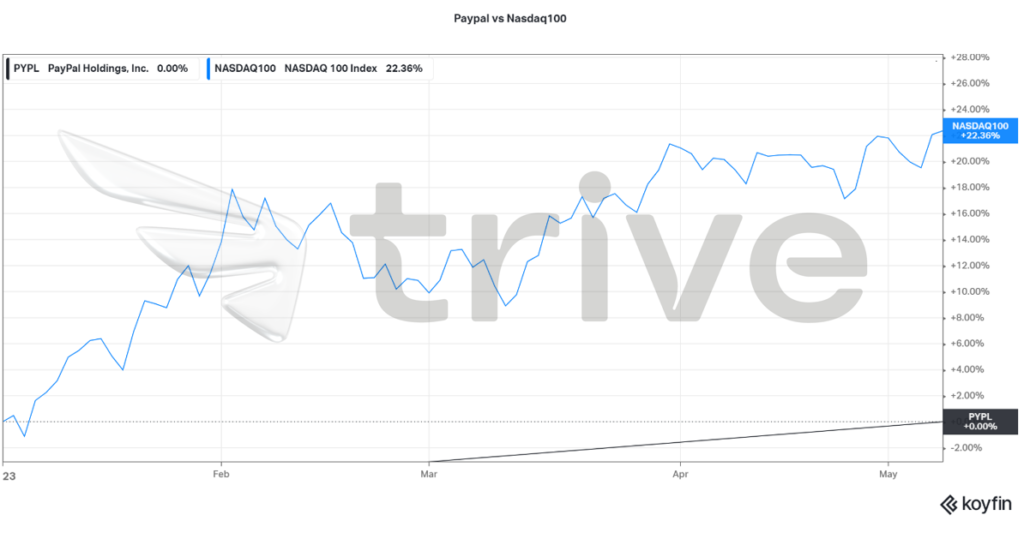

PayPal’s share price has fallen far behind the Nasdaq100’s performance on a year-to-date basis. Investors could still be finicky about the company’s operations within the current macroeconomic environment, which has seen its overall business activities subside from their peak during the pandemic, weighing on the stock price. Higher interest rates negatively impacted consumer discretionary spending as heavier borrowing costs took precedence. In addition, pandemic-induced e-commerce sales stood at 16.4% of total U.S. retail sales, but have remained under 15% in the past two years.

After discounting for future cash flows, $78.59 per share was derived as PayPal’s fair value. The stock trades at a 13.83% discount to fair value. The stock has some room for upside gains towards its fair value, given that bullish investors creep back into the market.

Summary

Despite reporting a relatively upbeat quarter, PayPal’s lower revision for the year’s operating margin put investors in sell mode. However, the business’ foundation has seemingly improved, with growth in total active accounts and payment volumes moving north, regardless of the intensified competition that has sprung into action. The fair value of $78.59 is within reach, given that no significant force majeure economic events weigh on the company’s operations or service demand.

Sources: PayPal Holdings Inc, Reuters, CNBC, TradingView, Koyfin