Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

As the Federal Reserve delivered its latest interest rate decision, the United States Oil Fund (NYSE Arca: USO) is threatened by a pullback atop the stellar uptrend as demand concerns start lingering again. However, a tug-of-war has been initiated with supply tailwinds supporting the buyers, which could halt the current momentum.

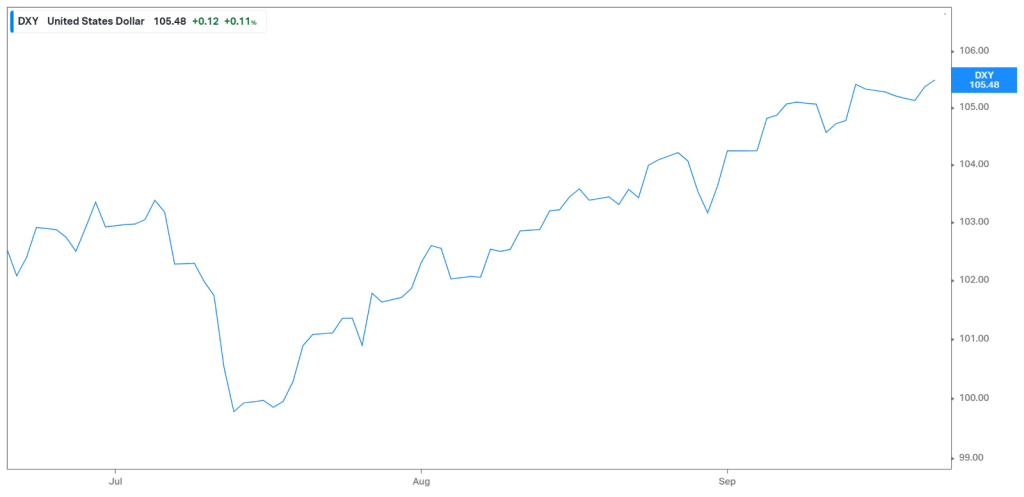

On Wednesday, the Federal Reserve opted to leave the federal funds rate unchanged but hinted at another rate hike before the end of the year. According to the dot plot, there could be another hike either in November or December, as inflation remains elevated above the target rate. As a result, the US dollar strengthened, reaching multi-month highs. The graph below shows the sharp appreciation in the greenback over the last three months, making oil more expensive to overseas buyers, which could be detrimental to the demand environment.

However, the EIA on Wednesday reported a 2.14M barrel inventory drop for last week, coming in near consensus as demand continues to outweigh supply. In addition, Russia temporarily banned gasoline exports outside of a circle of limited ex-Soviet states to stabilize the domestic fuel market, which could further strain the supply environment. These supply concerns offset the recent shift in demand sentiment, putting oil firmly in the balance between buyers and sellers.

Technical

On the 1D chart, the fund trades in a rising wedge, with a breakdown at the $80.62 pivot point suggesting bearish intraday momentum. With the dynamic support of the rising wedge being vulnerable, there could be a breakdown in the upcoming sessions, resulting in a longer-term pullback.

If the support fails, the rising wedge could break down toward support at $79.16 (S2), at which point there could be a retest of the breakdown level if the market finds buyers. With the 25-SMA trading above the 50-SMA, the momentum still favours the bulls, which could trigger a retest from S2 to the daily pivot point. However, if S2 fails, a longer-term pullback could lead the price toward $77.53 and $75.40.

If the rising wedge support holds, the price could rebound to continue its uptrend. In that case, resistance at $82.08 (R2) could come into play before higher resistance at $83.56 comes within reach. If this uptrend continues, higher resistance at $86.14 could become pivotal in the upcoming week.

Summary

While supply tailwinds continue to support the bulls, the United States Oil fund could suffer a temporary pullback at the rising wedge due to the strengthening dollar after the Federal Reserve’s hawkish pause. In this case, the market might look for support at $79.16 to trigger a potential retest at the breakdown point.

Sources: Koyfin, Tradingview