The Technology Sector SPDR ETF – XLK (ISIN: US81369Y8030) tracks the performance of tech stocks that fall under the S&P500 Index. The ETF exposes investors to companies in the technology hardware, software, IT services and semiconductor industries, amongst others.

Due to high-interest rates, which eroded earnings on higher borrowing costs and weakened valuations with higher discount rates, the XLK plummeted 28.43% in 2022. Major tech stock shares were largely under pressure during this period.

However, the narrative is changing. With the U.S. economy now giving off signs of moderating and interest rates seemingly nearing their peak, investors are more confident in a potential Federal Reserve pivot. The XLK has gained over a quarter of its value year-to-date and is on track to recover all of 2022’s losses if bullish investors do not take their foot off the gas. Will macroeconomic conditions give the XLK more room to manoeuvre the upside?

Technical

The XLK’s 2022 was characterised by a sharp turn lower, with the formation of a descending channel pattern and price crossing below the 100-day moving average to validate the steep downtrend. Support was established at the $122.71 level, while the $151.67 level formed resistance.

Bullish momentum kickstarted in 2023 and undid the resistance level as supply could not match the build-up of bullish appetite at the $151.67 level. A high volume breakout above the level ensued, indicating that bulls have surely been presiding over the market as their appetite for tech stocks scares away bears from taking part in the market. If upside momentum sustains, the $151.67 level will likely act as support, while the $163.75 level, which forms the high of 2022 prior to the selloff, forms the most immediate resistance level.

With bullish investors on the front foot, the $163.75 level will likely materialise as a destination for the XLK’s price. The ETF’s peak at $176.42 could come into play if bullish investors attempt to shoot for the moon with a convincing break above the $163.75 level.

However, bullish investors should proceed cautiously, given that the XLK’s Relative Strength Index points to overbought conditions. If bullish momentum begins to subside, a reversal could be imminent. Bullish investors looking to buy into the ETF could go long on a retracement, making the $151.67 level the most likely point of interest.

Fundamental

With markets returning to risk-on sentiment, tech stocks have been supported and nudged higher by the possibility of the Federal Reserve pausing rates. Traders are now wagering a three out of five chance of the Federal Reserve pausing rates in the upcoming June meeting, while an ease (reduction) in interest rates is expected to start as soon as November 2023.

Risk assets, especially tech stocks, which heavily depend on debt to fund research and development, and expansion, will likely benefit more as their bottom lines are not eaten away at by the predatory high-interest rates. Valuations will probably move north if interest rates taper off, giving tech stocks room to manoeuvre to the upside.

With the number of holdings at 64 different tech stocks, XLK’s top ten holdings comprise nearly 71% of the total holding. Of the top ten holdings, however, two companies, Microsoft and Apple, make up almost half the entire holding constituting 48%. Therefore, the XLK is heavily exposed to Microsoft (ISIN: US5949181045) and Apple (ISIN: US0378331005) and will likely move in the direction of one or the other or both. If Microsoft and Apple have a good day, so will the Technology Sector SPDR ETF!, as depicted below.

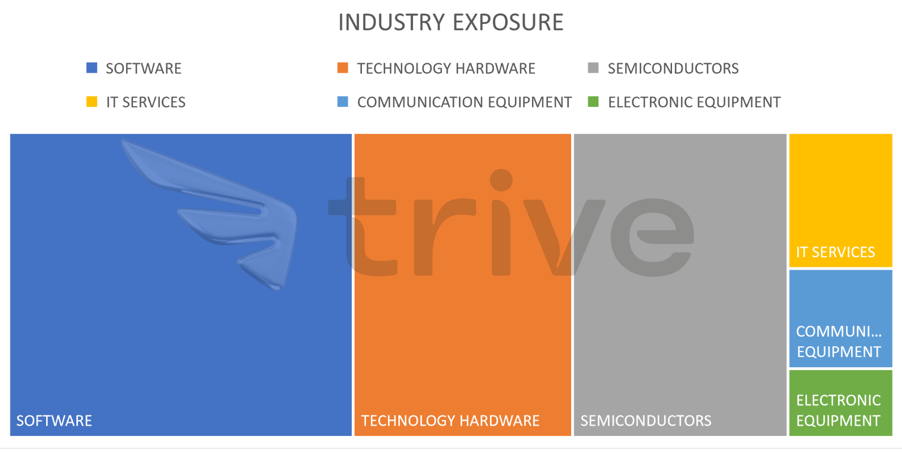

The software, technology hardware and semiconductor industries are the most prominent holdings within the ETF. According to McKinsey, the semiconductor industry is poised to become a trillion-dollar industry by 2030. Artificial Intelligence (AI) hype has further compounded the Tech Sector’s positive performance this year. With AI becoming integral in everyday life, from home to school, to the office, much growth could be expected for tech stocks as the technology matures.

Summary

If interest rates are indeed at their peak, they could cool off in the short to medium term. If so, the XLK could move to the upside, making the $163.75 level probable. Tech stocks will likely ride the wave higher on the back of the promising future of the Semiconductor industry and Artificial Intelligence.

Sources: SPDR, State Street Global Advisors, Financial Times, McKinsey, CME FedWatch Tool, CNBC