Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Oracle Corporation (ISIN: US68389X1054) has unveiled a promising start to the fiscal year, with its first-quarter earnings report bearing testament to its prowess in the tech industry. The company’s earnings per share (EPS) of $1.19 exceeded Wall Street estimates with a 3.45% margin. However, the revenue figure, though robust at $12.45 billion, fell just shy of expectations by $22 million, landing at $12.45 billion, compared to the projected $12.46 billion.

What’s truly fascinating about Oracle’s Q1 performance is its strategic positioning amidst the rapidly evolving technological landscape. Embracing the AI revolution, Oracle’s cloud business has emerged as a key driver of revenue growth. Notably, AI development companies have shown tremendous confidence in Oracle, with contracts worth over $4 billion signed for capacity in Oracle’s Gen2 Cloud – a twofold increase from the previous quarter.

This surge is underpinned by Oracle’s exceptional cloud services, seamlessly integrated with Nvidia Corporation’s (ISIN: US67066G1040) cutting-edge technology. This collaboration has resulted in cloud services that boast twice the speed while costing less than half of what competitors offer.

As a result of its alignment with AI technology, Oracle has outpaced the broader market, surpassing the S&P500 with a remarkable year-to-date gain of 51.35%. This stellar performance underscores Oracle’s resilience and adaptability in the ever-evolving tech sector, making it a standout player to watch in the coming quarters.

Source: Trive – TradingView, Nkosilathi Dube

Technical

Oracle’s stock has made a remarkable turnaround, surging by an impressive 51% year-to-date after a modest 6.27% dip last year. The upward trajectory is evident in its trading pattern, firmly established within an ascending channel and comfortably above its 100-day moving average. The pivotal point at $82.07 per share witnessed a surge in demand, propelling the stock towards an all-time high.

Despite this milestone, momentum stalled at $127.54, prompting a pullback to the 38.20% Fibonacci Retracement level. However, the subsequent resurgence in upward momentum signalled renewed strength. Prior to the earnings release, the stock retested the resistance level, but a slight miss in the top-line estimate and guidance led to a premarket dip below the 23.60% level.

If this level holds as support, a retest of the all-time high could be on the horizon. Nonetheless, should downward momentum persist, lower Fibonacci Retracement levels may come into play, with the pivotal $82.07 per share level likely to draw the attention of astute bargain hunters.

Fundamental

Oracle Corporation has unveiled a robust performance in its fiscal 2024 Q1 results, showcasing significant growth across key segments. The company’s total revenue for the quarter surged to an impressive $12.5 billion, representing a substantial 9% increase compared to the preceding year. This upswing in revenue is a testament to Oracle’s resilient business strategies in an ever-evolving market.

Oracle’s Cloud Infrastructure (IaaS) segment was a standout performer in this quarterly report, which experienced an astonishing 66% surge, reaching a revenue milestone of $1.5 billion. This growth demonstrates Oracle’s competitive edge and solidifies its position as a formidable player in the cloud services arena. Furthermore, Cloud Application (SaaS) revenue demonstrated significant progress, rising by 17% to $3.1 billion, affirming the company’s proficiency in delivering cloud-based solutions.

Fusion Cloud ERP (SaaS) revenue witnessed a notable 21% increase, reflecting Oracle’s success in providing cutting-edge Enterprise Resource Planning solutions. NetSuite Cloud ERP (SaaS) followed suit, achieving a similar 21% growth, showcasing Oracle’s continued dedication to excellence in cloud-based services.

The commendable top-line performance translated into impressive bottom-line results. Oracle’s operating income saw an encouraging 26% rise, totalling $3.30 billion compared to last year’s first quarter. Meanwhile, net income surged by an impressive 56%, reaching $2.42 billion. This demonstrates the company’s ability to manage costs and improve profitability efficiently.

Oracle’s cloud services have emerged as the cornerstone of its success, constituting a substantial 77% of the company’s total revenue. CEO Safra Catz rightly emphasized the exceptional performance in cloud infrastructure, outpacing competitors and reaffirming Oracle’s strength in this pivotal sector.

Chairman and CTO Larry Ellison’s emphasis on Generative AI is particularly significant. This technological advancement positions Oracle at the forefront of the artificial intelligence revolution, as it can train AI models at remarkable speeds and a fraction of the cost compared to other cloud providers. Such technological prowess is instrumental in solidifying Oracle’s competitive edge in the dynamic tech landscape.

Looking ahead, Oracle’s guidance for the fiscal second quarter paints an optimistic picture. The company anticipates adjusted net income ranging from $1.30 to $1.34 per share, coupled with a projected 5% to 7% growth in revenue. While these projections slightly fall short of some analysts’ estimates, they signal Oracle’s confidence in sustaining its growth trajectory and maintaining its position as a leading force in the tech industry.

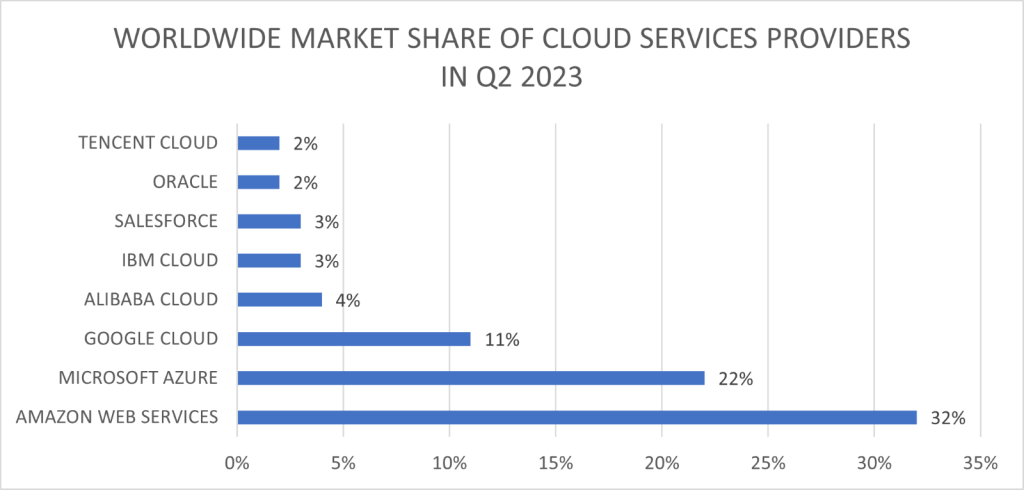

Source: Trive – Statista, Nkosilathi Dube

Oracle confronts formidable competition in the cloud services arena, contending with industry behemoths such as Amazon Web Services and Microsoft’s Azure. The post-pandemic landscape has prompted businesses to reassess their digitalization approaches, intensifying the competition.

While Oracle may trail behind the comprehensive cloud integration of market leaders like Amazon.com Inc (ISIN: US0231351067) and Microsoft Corporation (ISIN: US5949181045), it commands a respectable 2% market share in this rapidly evolving sector. Despite this share appearing modest in comparison, it is worth noting that Oracle secures a spot among the top ten cloud services companies based on revenue. This highlights the company’s tenacity and ability to hold its ground, even in the face of such formidable competition.

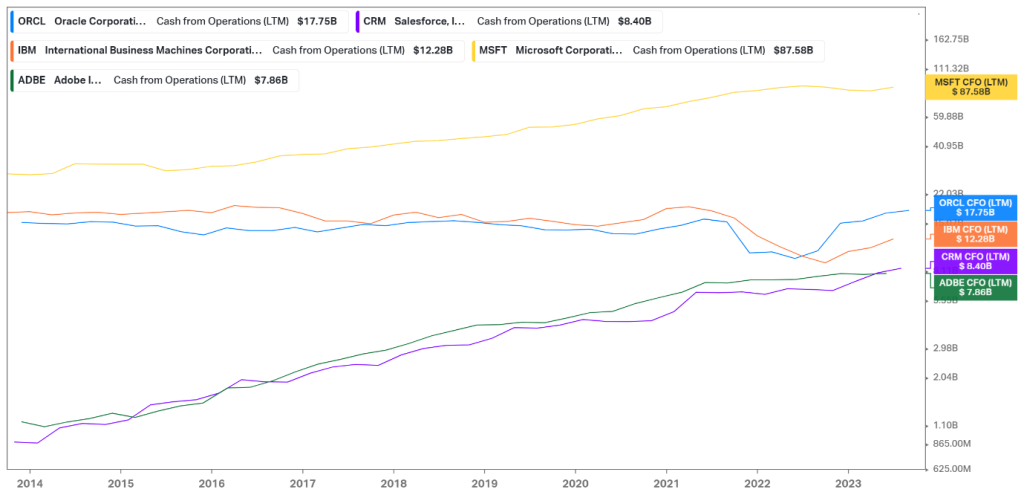

Source: Trive – Koyfin, Nkosilathi Dube

Oracle has exhibited a consistent upward trajectory in its revenues, with the sharpest surge occurring from the latter part of 2021. The introduction of Artificial Intelligence (AI) has propelled revenue growth to unprecedented heights, resulting in sales figures that outstrip previous records on a latest twelve-month basis.

In tandem with this surge in sales, Oracle’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has also experienced rapid expansion. On the latest twelve-month basis, Oracle achieved its highest EBITDA figure, reaching an impressive $19.64 billion. This remarkable financial performance underscores Oracle’s adeptness at capitalizing on emerging technologies and effectively translating them into substantial revenue and operational gains.

Source: Trive – Koyfin, Nkosilathi Dube

Oracle holds the second-highest operational income in the cloud services sector, trailing only behind Microsoft. This highlights Oracle’s significant influence and success in the tech industry. The company’s consistent cash flow from operations indicates a robust and adaptable business model, emphasizing its ability to manage financial resources effectively. While there was a slight dip in cash generation in 2021-2022 due to pandemic impacts, Oracle has swiftly rebounded, showcasing resilience and adaptability. These factors firmly establish Oracle as a key player in the competitive tech and cloud services landscape.

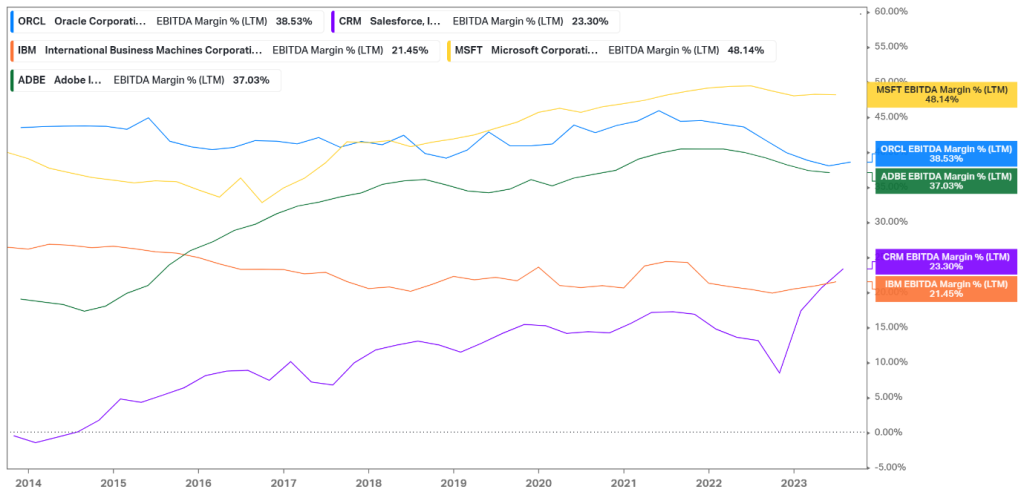

Source: Trive – Koyfin, Nkosilathi Dube

Oracle demonstrates robust profitability with an EBITDA margin of 38.53%, positioning it competitively among industry peers. While Microsoft leads the pack with 48.14%, Oracle outperforms Adobe Systems Inc (ISIN: US00724F1012) and Salesforce.com Inc (ISIN: US79466L3024) by a significant margin. This signifies Oracle’s efficient operational management and ability to convert revenue into earnings before interest, taxes, depreciation, and amortization. A higher EBITDA margin indicates a company’s potential to withstand economic downturns and invest in growth.

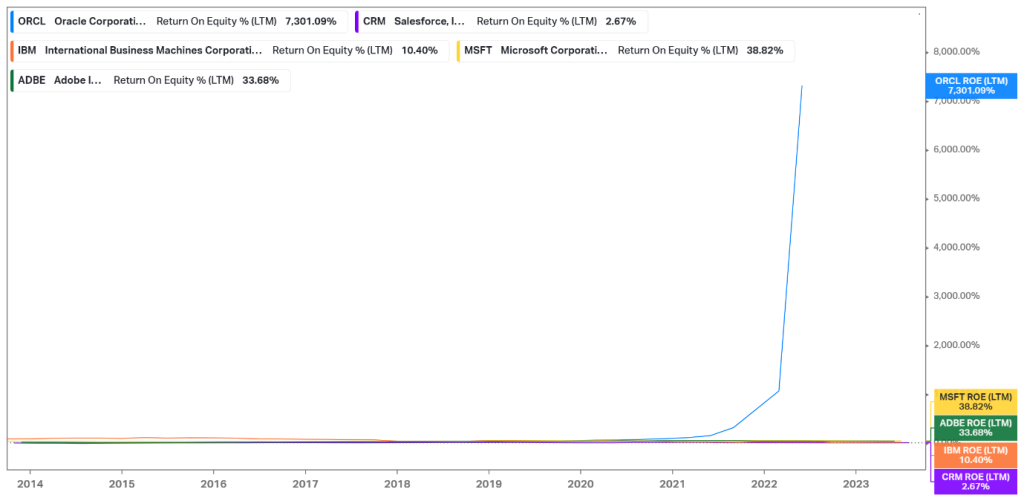

Source: Trive – Koyfin, Nkosilathi Dube

Oracle boasts an astonishing Return on Equity (ROE) at an impressive 7301.09%, showcasing an exceptional ability to generate profits relative to shareholder investments. This places Oracle head and shoulders above its industry peers, including Microsoft and Adobe, which, while still profitable, exhibit significantly lower ROEs. Such a high ROE indicates Oracle’s adeptness at efficiently utilizing equity to drive earnings growth, making it an attractive prospect for investors. This metric serves as a testament to Oracle’s financial prowess, solidifying its position as a standout performer in the tech industry, where return on equity is a critical measure of profitability and efficiency.

After discounting for future cash flows, a fair value of $144.00 per share was derived.

Summary

Oracle has demonstrated its prowess in the tech industry with a stellar Q1 performance, marked by robust earnings, impressive revenue growth, and a strong focus on AI technology. Its cloud services, EBITDA margin, and Return on Equity outshine industry peers. The company’s resilience, adaptability, and promising outlook make it a standout player with a fair value estimate of $144.00 per share. Oracle’s ability to thrive amidst fierce competition and leverage emerging technologies solidifies its position as a leading force in the tech sector, making it an intriguing prospect for investors.

Sources: Oracle Corporation, Reuters, CNBC, Statista, TradingView, Koyfin