Volkswagen AG ST O.N. (XETR: VOW) has stepped up in its pursuit to become a leading figure in the Electric Vehicle space by closing in on BYD and Tesla (NASDAQ: TSLA).

VOW announced plans to invest €180 billion over a five-year period in battery production and sourcing of raw materials to cut costs and at least defend its current market share in the increasingly competitive space. Over two-thirds of VOW’s five-year investment coffers have been allocated to the electrification and digitisation of the company as it tries to secure its stake in the future of automotives. According to a study by The S&P Global Mobility, electric vehicle sales in the U.S. are forecasted to potentially account for 40% of total passenger car sales by 2030, leaving fruitful opportunities for VOW to expand into the EV market.

VOW beat earnings and revenues consensus for the final quarter of 2022 by 2.84% and 2.46%, respectively. Fresh off a well rounde year of performance, VOW projects an upbeat 2023, with revenues and deliveries both forecast to grow significantly.

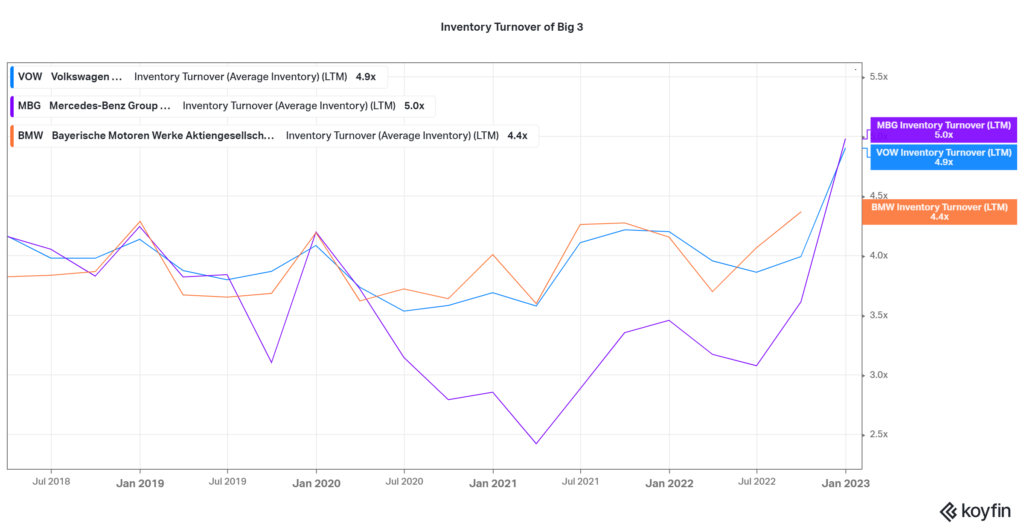

Inventory turnover, which measures the rate at which a company’s inventory is sold and replaced, is a crucial metric within the automotive industry. VOW’s inventory turnover has stayed in line with Mercedes Benz Group and BMW, the two biggest competitors to VOW. This signals stability in the automotive industry’s sales and a recovery from the low turnovers in 2021.

Technical

VOW has been in an ongoing downtrend following price crossing below the 100-day moving average to form a descending channel pattern. Support and resistance are currently located at the €143.45 and €183.20 per share levels, respectively.

Following a rejection of the descending channel pattern’s resistance, bears will likely lead the share price further down. Price is approaching the 61.80% Fibonacci Golden Ratio and will likely reject the level if market participants play into its dynamic support.

A breakout below the Golden Ratio could signal the market’s intention to lower the share price towards support at the €143.45 per share level. If the share price approaches support on declining volumes, it could signal the dissipation of bearish investors and infer a higher chance of the share price reversing.

Fundamental

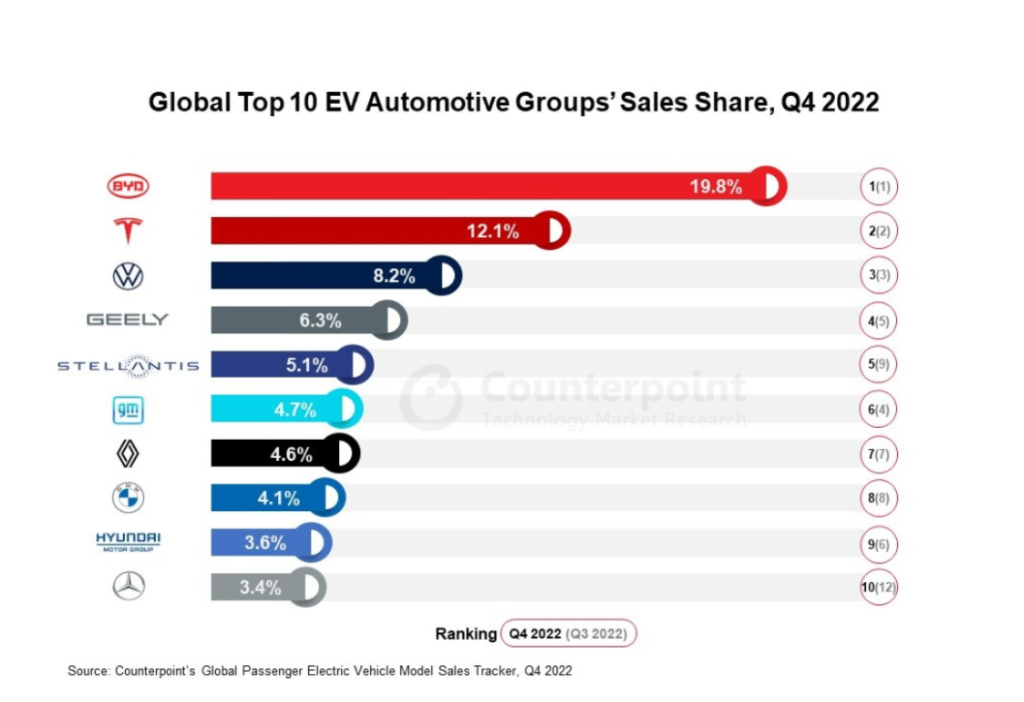

VOW’s focus is on transforming the automotive business towards electric, keeping up with the ongoing trend of a shift to green energies. This puts the organisation in an excellent position to take advantage of the rapidly growing market. According to the Counterpoint’s Global Passenger EV Model Sales Tracker, EV sales grew 53% to 10.2M units in 2022, year-on-year, and VOW services 8.2% of the market.

Source: Counterpoint

Deliveries to customers declined year on year by 6% to 8.3M units to end the year, still off pre-pandemic levels at 11m. Sales declined due to the high interest rate environment, which ate away at consumers’ spending capabilities.

Despite declining sales volumes, revenues stood tall with a 12% gain over last year to €279.2B, revealing VOW’s robust Business Model. Primarily driving revenue growth were improved margins and income from the financial services division.

Margins remained solid, with the passenger cars margin at 7.9%, in line with pre-pandemic levels at 8.0%, while commercial vehicle margins declined to 4.0% from 6.3%. Financial services margins struck gold in the high-interest rate environment as revenues surged from €3.2B in 2019 to €5.7B. Margins improved and are 4% higher over the same comparative period. The revenues were also kept elevated by significant growth in Premium brands, Sport & Luxury Brand Group and commercial vehicles with 4%, 6% and 12% sales growth in the respective divisions.

Improved revenue performance filtered through the financial statements with a 13% growth in operating results to €22.5B. Net liquidity grew a mouth-watering 61% to €43B, bolstered mainly by €16B worth of proceeds from the Porsche public offering

2023’s outlook is upbeat, with revenues projected to grow between €307 and €321B, while deliveries are expected to top €9.5M, up 14% from 8.3M. Therefore, net cash flows are projected to grow at least 25%, representing increased business activity. China, which makes up about 40% of the group’s sales, will likely continue growing its consumer base as the economy expands. VOW’s strong footing in the Asian market could be significant in increasing sales in the future.

After discounting for future cash flows, VOW’s fair value was derived at €208.56 per share, leaving room for a 46.25% gain in the share price from current levels.

Summary

VOW’s share price is likely to continue growing in an upward trajectory. With a firm footing in the EV industry, there is plenty more room for growth opportunities. If Volkswagen group can capitalise on the opportunities, its market share and share price will probably move north.

Sources: Volkswagen AG ST O.N., CNN, CNBC, Counterpoint, TradingView, Koyfin