Piece Written by Nkosilathi Dube and Tiaan van Aswegen, Trive Financial Market Analysts

The success of Barbie as the top movie internationally for two consecutive weekends is a significant achievement for Mattel Inc and its first-ever major theatrical film. According to Business Today, Barbie earned over $122 million outside of the United States and totalling $215 million in its second weekend demonstrating the film’s strong global appeal and audience reception. The movie’s performance has contributed substantially to its position as one of the year’s highest-grossing films. The film’s impressive worldwide box office earnings, reaching approximately $775 million in ten days from its release, signify that Barbie has resonated well with audiences worldwide.

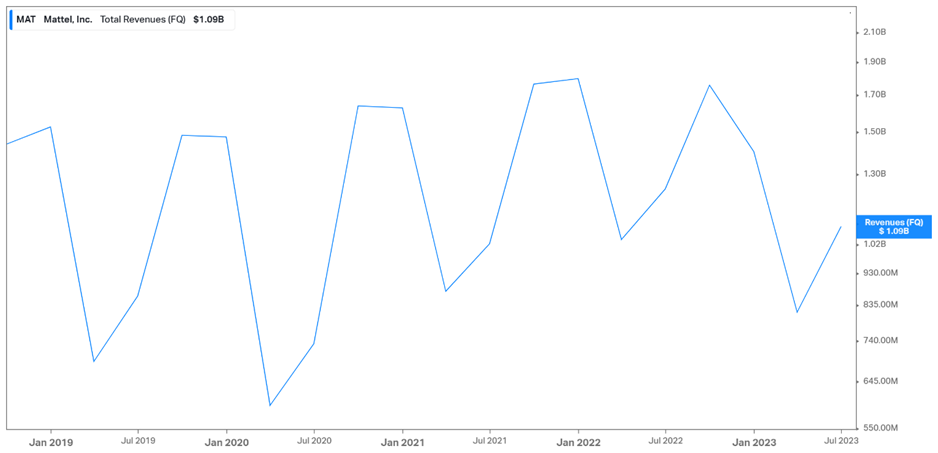

Mattel Inc’s revenue for Q2 2023 surged to $1.09 billion, a 34% increase from the previous quarter. However, compared to the same period last year, revenue declined by 12%, indicating challenges in maintaining previous growth. The North America segment faced an 18% decline, while the international segment saw a 3% decrease in net sales. Barbie segment sales dropped by 6% year-on-year, generating $282.7 million in revenue. Mattel’s revenue trends follow a seasonal pattern, with Q2 being a strong period, likely due to holiday shopping anticipation and new product releases. The company heavily relies on Q3 and Q4 for significant toy sales during the holiday season.

Source: Trive, Koyfin, Nkosilathi Dube and Tiaan van Aswegen

Share Price Performance

Before the announcement of the live-action adaption of Barbie, Mattel’s share price was under severe pressure, as the demand for their toys and dolls was diminishing. However, the advertising and hype around Barbie sparked some new life into the share price, which has advanced 16.20% over the last twelve months. However, the effect becomes more significant when analysing the price action over the last two months, during which the share price surged close to 20%. The share price underwent thirteen consecutive daily gains from the late-June period, reaching a high of $22.07 in the week leading up to the film’s worldwide release. However, since the film went public on the 21st of July, the share price has slightly retreated, taking back 4% of the gains as a downward channel is forming once again. The question now is whether this is a temporary correction from the hype of Barbie or whether the excitement around their business prospects as we advance are starting to wear off.

Source: Trive, TradingView, Nkosilathi Dube and Tiaan van Aswegen

Mattel Cinematic Universe

However, Barbie is just the start of Mattel’s strategic pivot, as the company took inspiration from Marvel to create its own cinematic universe, featuring a range of its other toys, games, and brands to take advantage of its extensive array of intellectual property (IP). It is believed that over 45 movies are being developed by Mattel, including Barney, Masters of the Universe, Hot Wheels, and American Girl. Mattel executives are also optimistic about creating an entire Barbie world of sequels following the success of their first film. With their new strategy focusing on IP, the company will benefit from the success of these films and the additional demand created for their iconic toys and dolls through the advertising and exposure that the community will get to their products.

Summary

In conclusion, the success of the Barbie movie as one of the highest-grossing films of the year bodes well for Mattel Inc. It presents an opportunity for increased brand visibility and revenue growth in the upcoming quarters.

Sources: Mattel Inc, Business Today, FitchRatings, Koyfin, TradingView

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.