Chevron Corporation (ISIN: US1667641005) weaved through a quarter of softer energy prices and lower production to end the period with earnings and revenues beating Wall Street Expectations against all odds.

Earnings landed on $3.55 per share, while total revenues landed on $50.79B, with both metrics beating expectations by 4.43% and 4.55%, respectively. Chevron’s refinery business came to the rescue as higher margins offset the decline in energy prices and production, leading to upbeat earnings results.

The second biggest U.S. oil company followed in the footsteps of its biggest rival and will likely face headwinds in the form of a potential mild recession projected for the year’s second half. However, Chevron’s share price still has room to manoeuvre to the upside, given its aggressive expansion efforts, especially in the U.S. If a mild recession does not turn into a full-blown recession, the upside could be more likely.

Technical

Chevron’s share price has been in a strong uptrend, supported by price trading above its 100-day moving average and forming an ascending channel pattern. Support and resistance were established at the $141.82 and $188.47 per share levels, respectively.

Given that bearish investors are in the driver’s seat at present, Chevron’s share price is moving lower, with the support level looking more feasible for long opportunities. If the share price declines towards support on lower volumes, it could signal the lack of interest in downside price action and validate a probable reversal. Bullish investors could look to enter the market at the ascending channel pattern’s support level or support at the $141.82 per share level.

Bullish investors will likely earmark the $188.47 per share level as a point of interest if they enter the market and commit to driving the share price higher in large numbers.

Fundamental

Sales and other operating revenues in the first quarter of 2023 were lower after landing on the $48.8B mark, 7% lower than the prior year’s first quarter, which recorded revenues of $52.3B. The revenue decline was primarily driven by lower commodity prices, with crude oil prices down 12.37% year-to-date, and a decline in total output, down 3% from a year ago to 2.98 million barrels of oil and gas per day.

However, despite Chevron’s top line sliding, its bottom line gave an upbeat performance as adjusted earnings were reported at $6.57B, up 5% from $6.26B a year ago. Driving the upbeat bottom line was the standout performance in Chevron’s refinery business. Margins were higher for Chevron’s refined petroleum products, leading to a five-fold increase in the unit’s income to $1.8B.

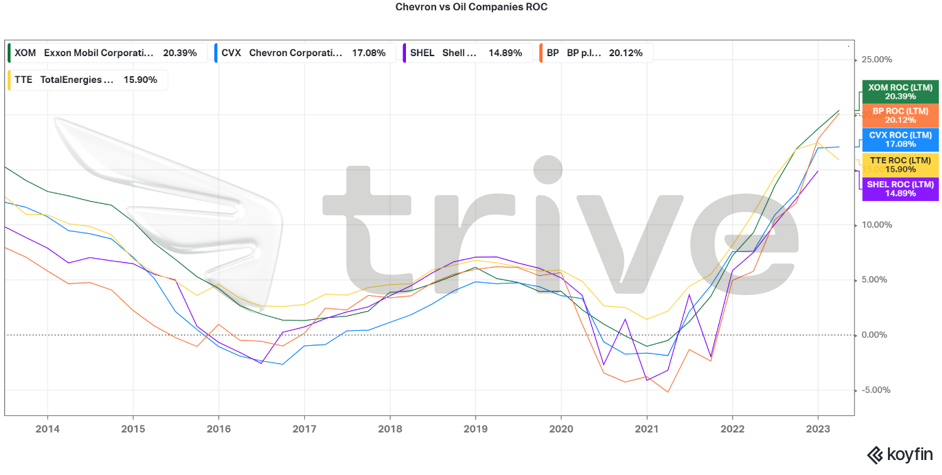

Chevron’s cash holdings were down 11% from a year ago to $15.7B but remain $10B above what the company needs to run the business, reflecting health in its balance sheet and a strong capability to meet short to long-term obligations. In addition, Chevron’s Return On Capital employed has been in reasonably good shape as double-digit returns have been maintained at over 12% for the past seven consecutive quarters. Chevron has also exhibited strong intent in its operations after Capex in the first three months of 2023 grew 55% from a year ago, primarily due to higher investment activity in the United States.

After discounting for future cash flows, Chevron’s share price came in at $180.80 per share. This leaves room for a 14.25% gain if the share price begins moving positively from current levels.

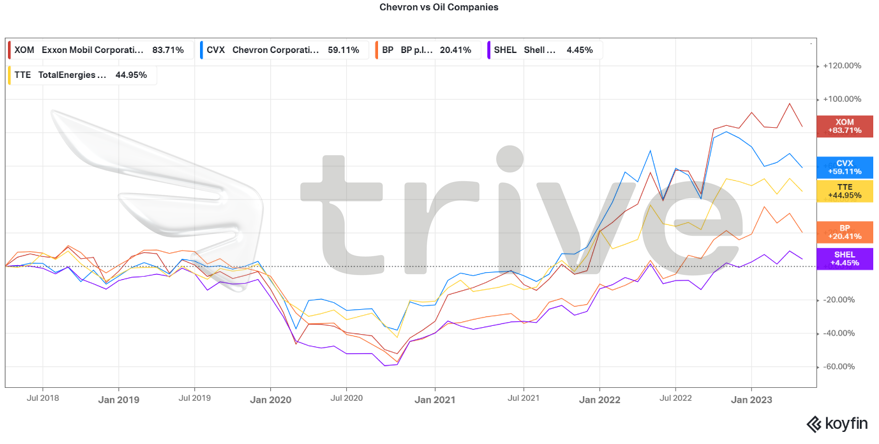

Chevron’s share price return over the past five years has only been second to its biggest U.S. rival. Over five years, Chevron’s share price achieved growth of 59.11%, above and beyond its next closest European rivals. The strong performance relative to its European counterparts represents investors’ confidence in the company’s operations and profitability, making it one of the more attractive oil companies to invest in.

Chevron’s return on capital has also been relatively healthy and falls in the mid-tier among its larger U.S. and European competitors. With the Latest Twelve Months returning 17.08% on top of consistent double-digit returns over the past seven quarters, the company represents a healthy investment prospect from a returns perspective.

Summary

could weigh down on commodity demand on the back of an economic slowdown. Should Chevron avoid a recession, the $180.80 level will likely draw bullish investors into the market as they look to ride a wave of upbeat performance from oil companies.

Sources: Chevron Corporation, Reuters, CNBC, TradingView, Koyfin