Piece written by Alexa Smith, Trive Financial Market Analyst

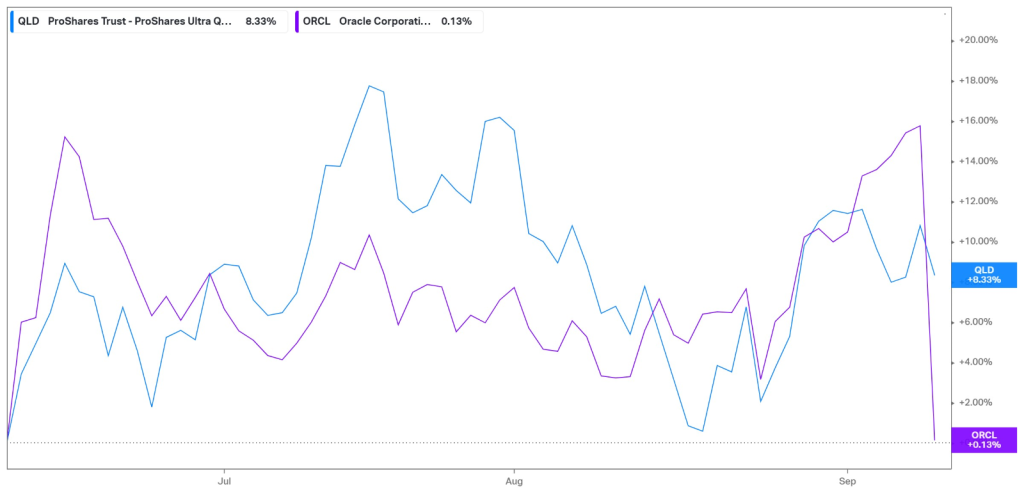

The ProShares Ultra QQQ ETF (ISIN: US74347R2067) tracks the performance of the Nasdaq 100. Stocks ended lower on Tuesday after Oracle Corporation’s (ISIN: US68389X1054) disappointing financial forecast and rising oil prices exacerbated concerns about sustained price pressures ahead of inflation data expected this week.

Oracle’s share price tumbled by more than 13% after narrowly missing first-quarter projections, spurring stocks of other major players in the cloud computing arena, such as Amazon (ISIN: US0231351067) and Microsoft (ISIN: US5949181045) to decline by more than 1%. Simultaneously, oil prices surged by more than 1%, building upon a recent upward trajectory and fuelling concerns that persistent inflationary pressures could lead to a prolonged period of elevated US interest rates.

The market is on tenterhooks in anticipation of the release of the August Consumer Price Index (CPI) data scheduled for today and the Producer Prices report expected on Thursday. These reports will play a pivotal role in shaping the outlook for US interest rates in the lead-up to the Federal Reserve’s meeting on September 20.

Technical

The $33.31 major support marked a pivot point for an uptrend, forming an ascending channel pattern. The ProShares Ultra QQQ ETF edged higher and established major resistance at $70.39 before a swing low took the price action within reach of the channel’s lower boundary at the 100-day moving average line.

The ETF gained upside momentum after falling short of the channel’s lower boundary, spurring the price action to establish resistance at $67.15. Since the ETF has fallen below the 50-day moving average line, the $61.64 support at the 23.60% Fibonacci Retracement could be a point of interest for the continuation of the broader uptrend as this level intersects with the channel’s lower boundary.

If the ETF meets with the $61.64 support, the price action could leg up towards the $67.15 resistance, bolstering the price action towards the $70.39 major resistance.

Summary

The ProShares Ultra QQQ ETF edged lower due to Oracle’s sharp decline, worries over rising oil prices, and a general sense of caution in anticipation of crucial inflation data. Since Oracle’s financial forecast paints a woeful picture of rising interest rates, the price action may attempt to retest the $61.64 support at the channel’s lower boundary. However, the price pressures could soothe and edge the ETF towards the $67.15 resistance.

Sources: TradingView, Reuters