Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

After advancing over 30% since June, the oil price has stabilized as traders weigh the balance between supply and demand. With the prospect of major central banks holding rates higher for longer clouding the demand environment, the United States Oil Fund (NYSE Arca: USO) is holding on at a critical technical level, with the potential of a pullback keeping volumes low.

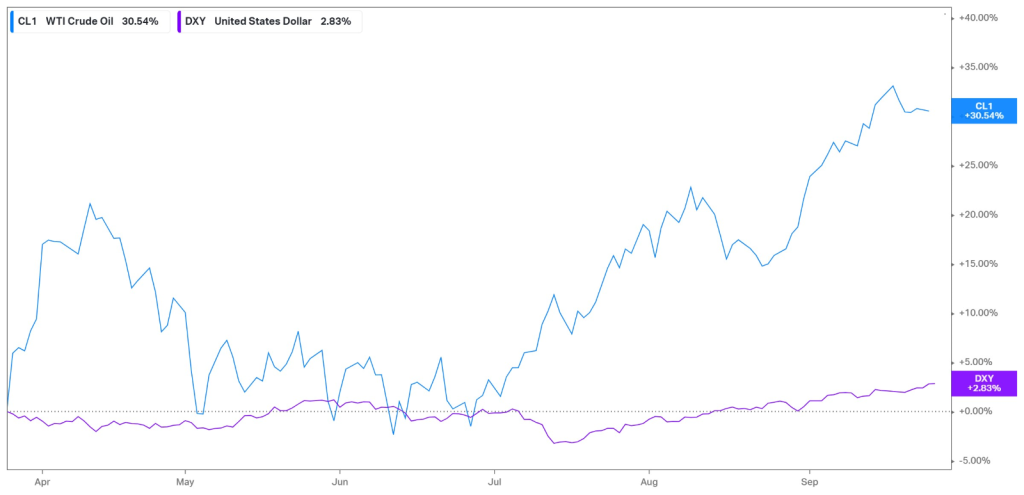

After the Federal Reserve spoke in a hawkish tone, recessionary fears have crept back into traders’ minds as sentiment tilts toward another rate hike before the end of the year. Treasury yields surged as the US dollar found strength on these expectations. The CME FedWatch Tool now predicts an 81.5% chance of a pause in November, but the probability of a hike in December has advanced to 34.4%. The graph below shows how the oil futures (NYMEX: CL) have strengthened over the last three months, with the US dollar mainly unchanged. While a strengthening dollar now pressures the upside, the prospects of higher travel demand from China’s golden week holiday, which starts on Sunday, could provide another tailwind along with the tightening supply environment.

Technical

On the 1D chart, the rising wedge remains in play, with the price moving below the dynamic support, potentially triggering a sustainable breakdown below $79.13 (S2). However, with volumes declining, the buyers could prevent the downside damage and retest the daily pivot point at $80.74 in an attempt to continue on its prior uptrend.

If the price breaks below S2, the downtrend could meet support at $77.15, converging with the 25-SMA (green line). This could prove a challenging level for the sellers to move below, but lower support at $75.17 and $73.49 is not far out of reach if volumes pick up.

However, while the 25-SMA trades above the 50-SMA, the momentum still favours the upside, potentially resulting in a pivot off the support at $77.15. In order to reverse the potential pullback, the price faces tough resistance from the daily pivot at $80.74 and $82.35 (R2), but a sustainable run above these levels could quickly see the price move toward $83.56.

Summary

While the supply environment remains tight in the oil market, demand concerns are lingering on the prospects of major central banks keeping interest rates higher for longer. The United States Oil Fund is threatened by a breakdown at the rising wedge toward $79.13 and $77.15, where a potential pivot could see the price returning to its prior uptrend.

Sources: Koyfin, Tradingview, CME Group