The world’s seventh-biggest pharmaceutical company, Merck KgaA (XETR: MRK), assumes a challenging 2023. With pandemic-related sales sinking and the semiconductor industry’s supply challenges at hand, MRK’s share price performance will likely be dampened. Merck KgaA’s Chief Executive Belen Garijo expects pandemic-related sales to decline to €250M, down almost 70% from the prior year.

Despite 2023’s murky environment raising concerns for the company’s performance, sales are projected to reach €25B by 2025, driven by new product development and diversified business.

Technical

MRK’s share price has been in a downtrend for most of 2022, going into the year-to-date. A descending channel pattern was formed with support and resistance established at the €163.20 and €201.50 per share levels, respectively. The downtrend was fortified following the price crossing below the 100-day moving average within the descending channel pattern.

With bears in clear control, MRK’s share price will likely continue in its downward trajectory as 2023’s headwinds price into the share. Bullish investors will probably be enticed to buy the stock near support at the €163.20 per share level if downside price action is accompanied by weakening volumes.

Alternatively, bullish investors will likely view the €157.45 level as a potential entry point if price action lowers and breaks through support. The €157.45 per share level has held firm as a support level in the past, with the price rejecting the level on multiple occasions. The level represents a zone where demand clearly outweighs supply, with price action surging from the level.

Fundamental

MRK missed its earnings and revenue targets for the quarter by 6.50% and 1.04%, respectively, with bullish investors giving in to bearish pressure arising from a gloomy outlook for 2023. Despite the earnings miss, the company’s full-year performance was improved.

Double-digit growth was the theme of 2022 across various components of the income statement. Revenue for the year grew 12.93% to €22.2B. Strong growth was mainly due to healthy divisional performance. The Life science division was the source of the most growth, with a 15.44% surge in revenues, to €10.3B, followed by the Electronics and Healthcare divisions, which saw revenues grow 11.29% and 10.58%, respectively. The Life Sciences positive outcome was partly driven by acquisitions which added to the overall business revenue base. Merck invested in inorganic growth during 2022 after successfully acquiring the biopharmaceutical contract development and manufacturing organization, Exelead Inc., USA, along with the chemical business of Mecaro Co. Ltd., a Korea-based supplier to the semiconductor industry.

The bottom line was bolstered by higher sales filtering through the income statement, with profit after tax up 8.9% over the full year. MRK’s financial health and ability to generate income shined after EBITDA expanded by 9.4%.

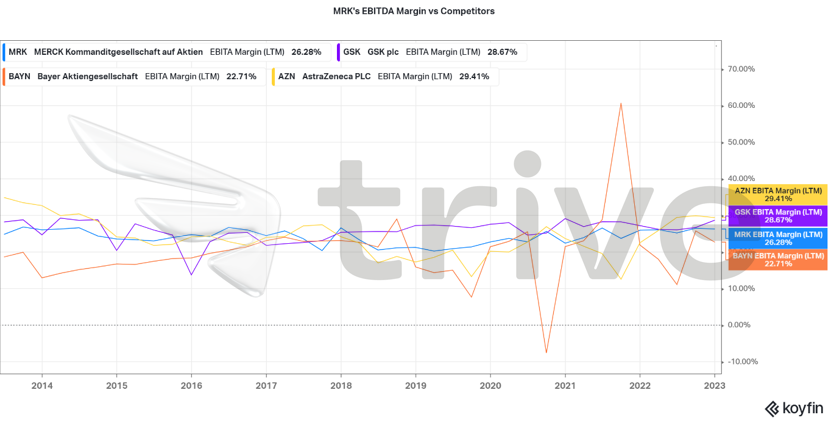

MRK’s EBITDA margin is within the average range compared to its counterparts. MRK’s stability in generating income is highlighted by its stable EBITDA margin, especially during the Covid-19 outbreak from 2020 through to the high inflation and high-interest environment in 2021 to the present times as illustrated below. MRK’s share price is not too sensitive to macroeconomic shocks due to the nature of the healthcare business being a staple.

After discounting for future cash flows, a fair value of €181.45 per share was derived. The current share price trades at a 7.29% discount to the fair value, leaving significant room for the upside.

Summary

MRK’s medicines were used to treat 94 million patients worldwide, which could be considered robust and likely to grow. The revenue loss from the Covid-19 business will likely be offset by growth in MRK’s main divisions, with the Life Science division in the lead. MRK’s share price outlook is stable to positive, with €181.45 per share probable in the medium to long term.

Sources: Merck KgaA, Visual Capitalist, TradingView, Koyfin