The Euro has been unrelenting towards the Yen in 2023, as the interest rate differential between the European Central Bank (ECB) and Bank of Japan (BoJ) has seen traders flock to the Euro for higher yields. The ECB has further boosted the Euro with constant rate hikes and potentially more to come as inflation is still far off their 2% target. These conditions have left the EURJPY currency pair moving higher.

Japan’s Machinery Orders fell far lower than expected, indicating that the Asian giant’s economic activity is seemingly contracting. Weakness in the Euro Area has been magnified by the Manufacturing PMI coming in below expectations and ticking lower month on month, although the Services PMI was up against consensus but still below the prior month.

Technical

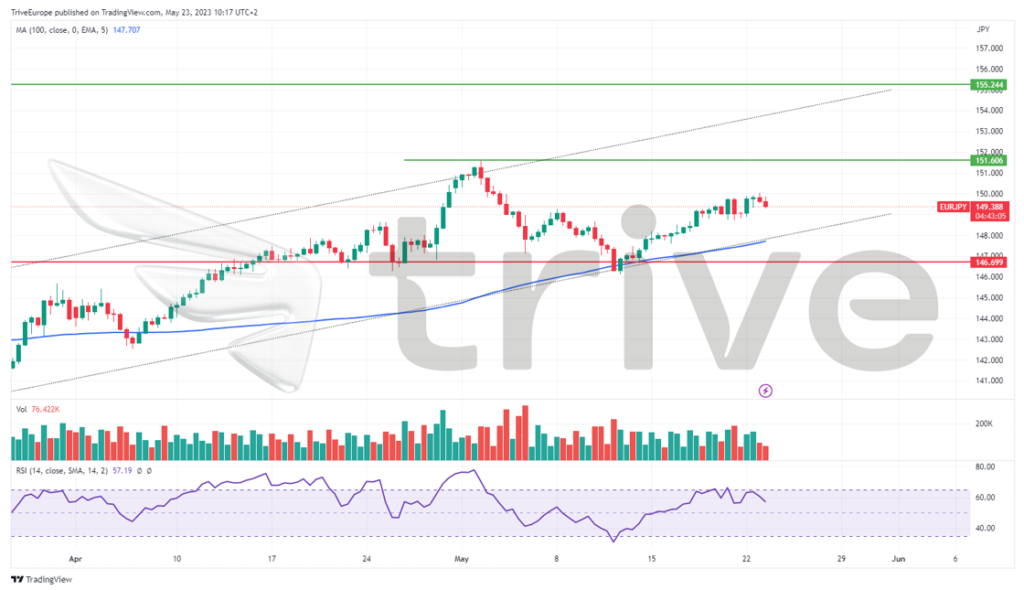

The EURJPY currency pair has been trending higher, with price action moving in an ascending channel pattern above the 100-day moving average. Support and resistance were established at the 146.699 and 151.606 levels, respectively.

Price action currently trades at the midpoint of the support and resistance range following a surge from the support level. If bullish traders do not back down from the upside potential, they could potentially aim to take the pair toward resistance at the 151.606 level.

Alternatively, a reversal is probable if bearish momentum builds up, backed by declining volumes to the upside. Bearish traders will likely be in contention to lower the pair in this scenario, with the 146.699 level the most likely point of interest.

Summary

Given that the BoJ has maintained an ultraloose monetary policy while the ECB is open to further rate hikes, the policy divergence could stretch in favour of the Euro. The 151.606 level will likely materialise if bullish traders remain in risk-on gear while chasing higher yields in the Euro Area.

Sources: Reuters, TradingView