The Nasdaq 100 futures (CME: NQ) are currently experiencing a thrilling rally, initially fuelled by the rise of AI stocks. Now, the recent tie-up between Tesla and General Motors may further propel the index to new heights.

However, the Nasdaq 100’s remarkable growth over the past few months may face a potential setback with the upcoming interest rate decision from the Federal Reserve, expected between Wednesday and Thursday this week. With a hoist of US economic data being released this week, the Tech-heavy index could see a further boost in investor sentiment, and the US Core Inflation release tomorrow could generate insight into whether or not further rate hikes are imminent.

Technical

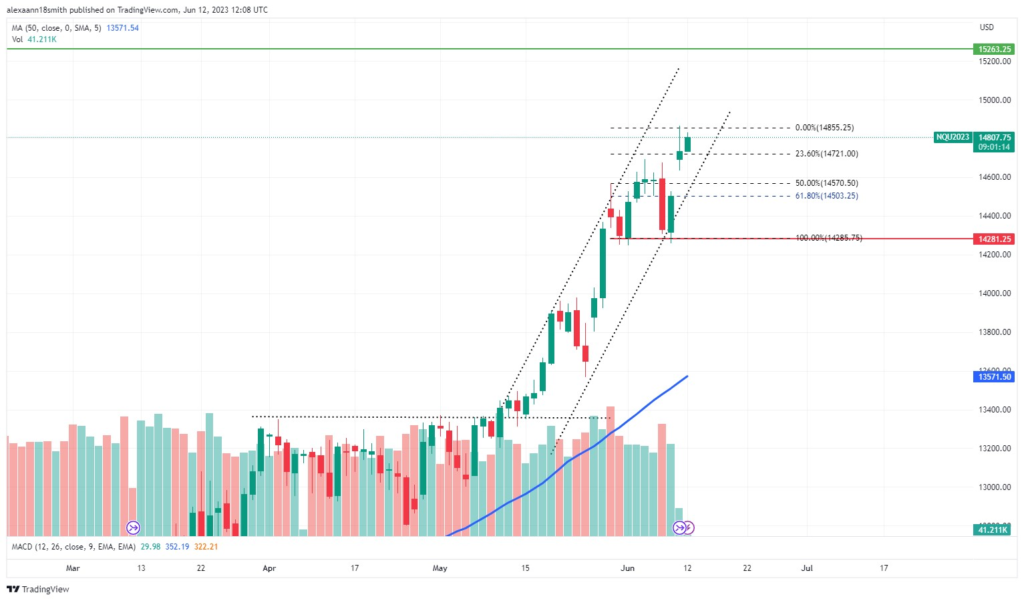

The Nasdaq 100 Futures have seemingly recovered following the bear’s break out of the ascending channel pattern, with the bulls establishing support at 14281.25. The bulls then gained momentum and shattered the 14503.25 resistance, establishing support at this point before edging the index level towards 14570.5.50, the 50% Fibonacci Level.

If AI stocks continue to rally, the bulls could see further upside possibilities towards the 15263.25 resistance level. However, recessionary woes could see bearish sentiment take over and edge the index back towards 14285.75 and out of the channel.

Summary

The rally of the Nasdaq 100 Futures could come crashing down following the release of the Fed’s interest rate decision which might see the bears challenge the 14281.25 support. However, AI shows no signs of giving up momentum, which could see the bulls drive the index towards the 15263.25 resistance level.

Sources: TradingView, Reuters