The EURUSD currency pair gained 0.87% in the prior week, taking the gains over the past four weeks to a delightful 3.07% for traders long on the pair since.

Driving the bullish sentiment were signs of weakness in the U.S. economy and bets of a 77.41% chance of a Fed Pivot by the end of 2023. U.S. inflation slowed, with the U.S. PPI declining 0.5% from the prior month, the steepest drop since the start of the pandemic. The weakening PPI followed the downtrend in year-on-year U.S. inflation rates, down 1% in March, sending the greenback to a one-year low, while the Euro reached its one-year high.

Technical

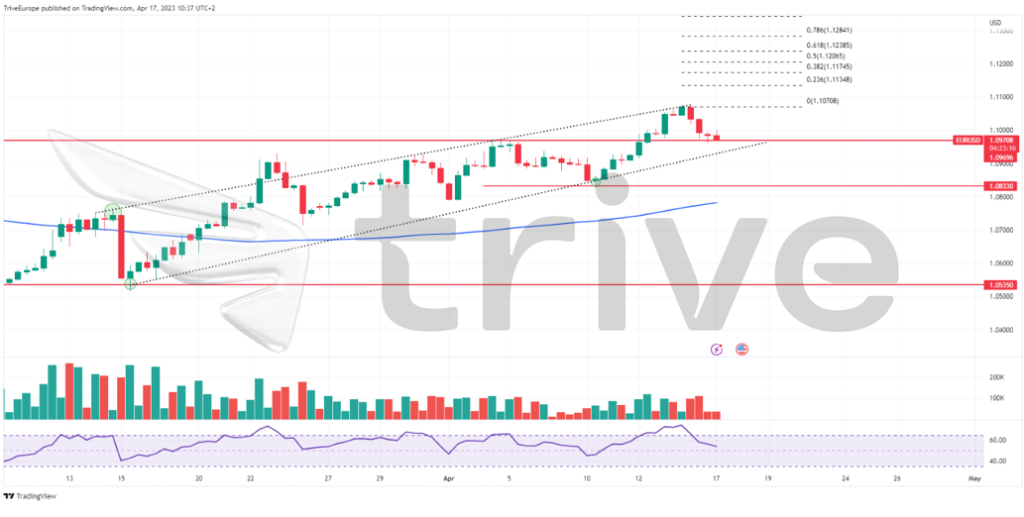

The EURUSD currency pair has traded in a strong uptrend, with price action trading comfortably above its 100-day moving average. Support was established at the 1.09696 level after the price broke out above the month’s high, while resistance was formed at the 1.10708 level after a bearish rejection of the price level.

The consistent breakouts above prior highs suggest bullish traders have a firm grip on the market’s direction. If bulls stay the course, the pair could be redirected towards resistance at the 1.10708 level, with a strong probability of the market finding higher Fibonacci Extension levels if the trend unfolds.

Alternatively, if bearish traders exterminate bullish sentiment, the pair could remain subdued, with support at the 1.09696 level likely to be tested further. A high volume breakout below support could validate an extended move lower, with bears likely looking to the 1.08330 level with interest.

Summary

The week ahead has Euro Area, and U.S. PMIs lined up, along with German Producer Inflation, Euro Area Consumer confidence and U.S. Labour market reports. Traders will likely navigate the week cautiously as they determine the interest rate policy outlook for the U.S. and European Central Bank. If U.S. economic activity edges lower with worse-than-expected PMIs, the EURUSD could be magnetised toward the upside, making the 1.10708 level probable.

Sources: Reuters, TradingView