The Dow Jones 30 Futures (CME: YM) swayed lower by 140 basis points in the prior week as bearish traders took centerstage. A much lower-than-expected U.S. Jolts Jobs Opening report sent shockwaves into the market as recession fears returned, compounded by jitters within the banking sector.

However, the index did make a mild recovery at the end of the week as risk-on sentiment flowed into the market following the release of above-expectation U.S. Non-Farm Payrolls. The robust labour market report undid fears from earlier in the week, leading to a minor rebound in the index.

Technical

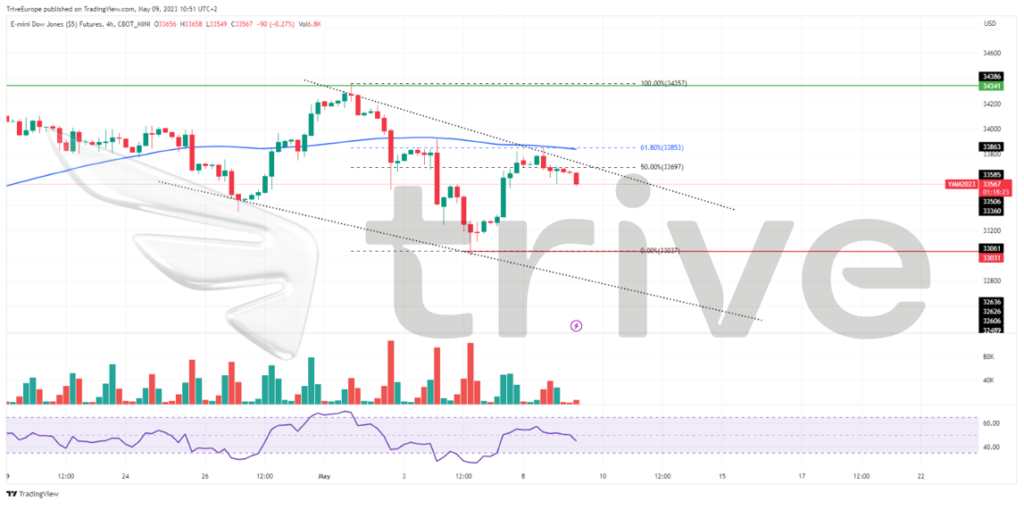

The Dow Jones 30 Futures entered a downtrend after the price moved below the 100-day moving average and broke below the last low at 33353. After forming a new low, the market made a retracement to the 61.80% Fibonacci Retracement Golden Ratio, and now volumes have subsided with minimal price movement as traders anticipate key economic events for the week. Support and resistance are currently located at the 33031 and 34341 levels, respectively.

Traders will likely be waiting for the release of critical economic data this week to determine the macroeconomic conditions and take a position. The 33031 level will probably be approached if the U.S. shows further signs of weakness or if another interest rate hike becomes plausible. Alternatively, traders will look to the 34341 level if further rate hikes become less likely.

Summary

Traders are now anticipating a pause in the upcoming Federal Reserve meeting and an ease as soon as July. The U.S. Inflation Data and Labour Market report will be widely observed to determine the Federal Reserve’s next interest rate move and whether a recession is beginning to show more signs of its imminence. Traders will closely monitor the 33031 and 34341 levels to determine the index’s next direction.

Sources: CME FedWatch Tool, Reuters, TradingView