Piece written by Tiaan van Aswegen, Trive Financial Market Analyst

As deadline day approaches for the interest rate decisions of multiple central banks, the SPDR Gold Trust (NYSE Arca: GLD) lies uncertain. On the one hand, resilient US data generated a cautionary tilt, while the safe-haven properties of the yellow metal underpin its bullish potential as the market turns risk-averse ahead of the interest rate decisions. Which side of the coin will ultimately prevail as we advance into the week?

The CME FedWatch Tool predicts a 99% probability of a pause in the Federal Reserve’s rate hike cycle, leaving the market vulnerable to a severe downside surprise if the central bank decides to react on the resilient data seen last week. Inflation ticked up higher than consensus at 3.7%, followed by upbeat retail sales and a year-on-year PPI figure of 1.6%, up from the prior 0.8% while exceeding the 1.2% consensus. However, despite this, the probability that interest rates will remain at current levels through November is currently at 73%, up significantly from the 58% probability just one week ago.

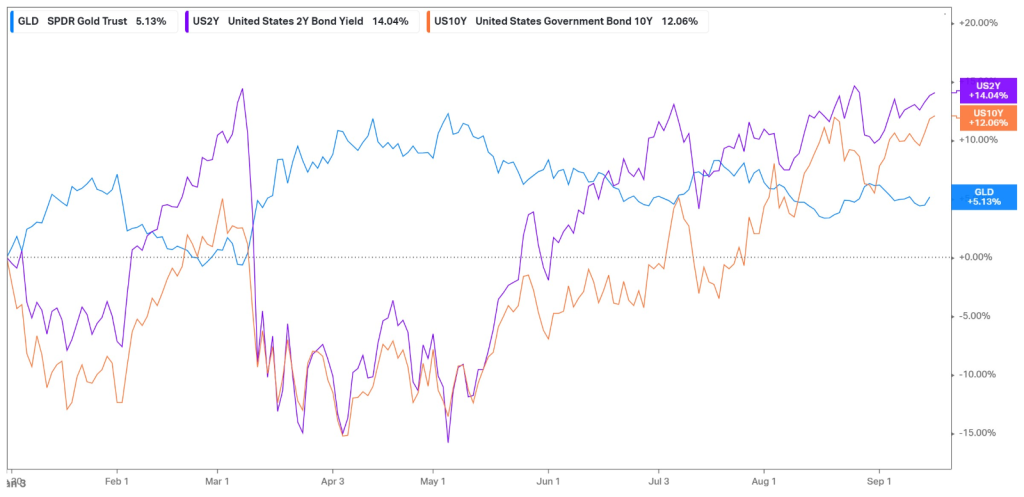

Year to date, the ETF appreciated 5.13%, benefitting significantly from the sharp drop in US treasury yields in March, when market sentiment changed on the potential path of the Federal Reserve’s interest rate stance due to the crisis in the banking sector. The safe-haven gold appreciated well until the sudden reversal and recovery in the US 2-year and US 10-year government bond yields in May, when the market returned to normality. Since then, the yields have appreciated significantly, pressuring the upside potential of the ETF. However, with the expectations of a potential end to the Federal Reserve’s interest rate path, the yields could soon reverse and aid the recovery of gold if the fundamental data in the market supports the view.

Source: Trive – Koyfin, Tiaan van Aswegen

Technical

On the 1D chart, a breakout from the descending channel looked to catch flight, but solid resistance ultimately halted the upside at $180.94. The presence of sellers then forced the price to retest the breakout level, and with the 25-SMA (green line) crossing below the 50-SMA (blue line), the bearish momentum could persist.

If the price can clear the 50-SMA at $179.27, the upside potential could kick in, which could entice the buyers to retest $180.94. A leg above this psychological resistance could confirm the upside momentum, with higher resistance established at $182.55 and $183.82.

However, if the price fails to clear the 50-SMA, support at $177.62 and the daily pivot point at $176.97 could come into play. From there, the price could continue trickling down, especially if the Federal Reserve surprises the market with a rate hike, which could result in the price moving toward $175.09 and $173.90.

Summary

With risk aversion kicking in ahead of the Federal Reserve and Bank of England interest rate decisions this week, the SPDR Gold Trust could benefit from its safe haven appeal in the week’s opening sessions. Clearing the $179.27 50-SMA could catalyze an uptrend, with resistance at $180.94 acting as a psychological level of resistance that needs clearing for a sustainable uptrend to form.

Sources: Koyfin, Tradingview