CVS Health Corporation (ISIN: US1266501006) grabbed the first quarter of 2023 by the throat, leading to an upbeat earnings result. Earnings and revenues beat Wall Street Expectations by 4.59% and 5.69%, respectively, with $2.20 earnings per share and $84.28B revenue reported.

However, the upbeat earnings were not enough to boost CVS’s share price, which declined 3.60% on the back of a weaker outlook. Recent expansion efforts by CVS have left a hole in its cash balances and will likely pull down earnings as the cost of acquisitions filters through the income statement.

CVS falls under the defensive stocks category due to the necessity of the company’s healthcare services. With a recession potentially looming in the second half of 2023, CVS’s share price will likely stand its ground as earnings hold steady, regardless of the overall stock market and economic state.

Technical

CVS’s share price gave into bearish investors for most of 2022 as interest rate hikes devalued equities and higher borrowing costs subdued earnings while limiting growth prospects. The downtrend was validated by the share price crossing below the 100-day moving average while forming a descending channel pattern. Support and resistance were established at the $68.22 and $104.02 per share levels, respectively.

With bearish investors in the driver’s seat, CVS’s share price could see further downside price action. Support at the $68.22 per share level could be of interest to bullish investors looking to long the stock. A reversal is probable if the support level is respected. If they commit to the upside, bullish investors will likely look to the $104.02 per share level with interest as an exit point.

Alternatively, if the share price breaks through the support level on high volumes, it could signal the market’s intention to take the share price even lower. The next probable point of interest for long opportunities will be support at the $54.72 per share level.

If the share price approaches the $68.22 or $54.72 per share level with volumes tapering off, it could signal the dying out of bearish momentum and the likelihood of a reversal.

Fundamental

CVS enjoyed a healthy quarter, with all business segments reporting growth in the top-line income, from health insurance to drugstores. Sales jumped 11% to $85.3B from $76.8B a year ago.

The revenue growth was primarily boosted by CVS’s expansion in health plan membership, which increased by 1.1M, reaching 25.5M as of March 31 2023. The result was a 12% surge in revenue to $25.8B in the first quarter for the segment.

The growth in its health plan members maintained CVS’s bottom line above the $2B mark but came in lower than last year’s first quarter by 9% to $2.14B. Total operating expenses grew 12% as the cost of production took a turn higher in line with the more robust sales performance.

However, the upbeat quarter has not been forecasted to extend into further quarters as CVS’s expansion efforts have been accounted to increase costs and weigh on future quarterly bottom lines. The company’s big spending of almost $18B to acquire Signify Health and Oak Street Health is expected to weigh on future earnings.

After discounting for future cash flows, CVS’s fair value is expected to be $75.55 per share, which leaves room for a 7.54% upside gain if bullish investors begin piling into the stock.

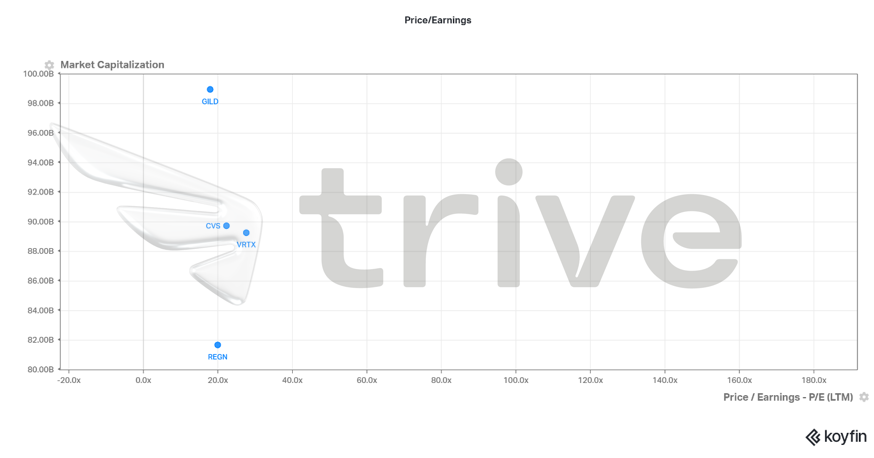

Within the $50B to $100B market capitalisation range, CVS is among the more highly valued healthcare stocks. The share trades at over 20 times its current earnings level, indicating its high perceived value by investors. However, the share price is aligned with its peers’ valuations, representing the sector’s health.

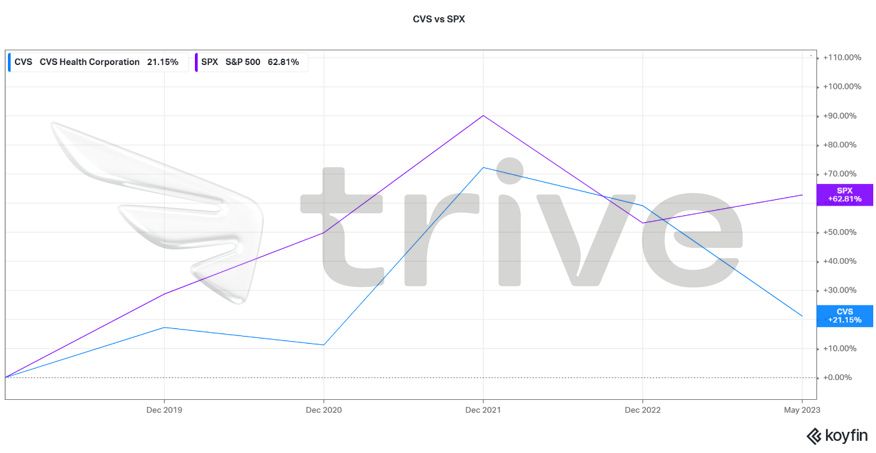

Compared to the S&P500, CVS has underperformed over the past five years, despite gaining a fifth of its value in the period. However, its lower performance can be attributed to the outperformance of tech and other growth stocks compared to healthcare stocks. The company still represents a healthy investment, given its expansionary progress and the expected improved outlook over the longer term.

Summary

Despite announcing a downbeat outlook for the remainder of 2023, CVS Health Corporation’s share price will likely bounce back in the medium to long term as the effects of its recent quality acquisitions filter through into higher revenues and earnings while adding onto the company’s synergies.

Sources: CVS Health Corporation, Nasdaq, Reuters, CNBC, Forbes, TradingView, Koyfin