Despite the top line being somewhat in line with expectations, the chipmaker Micron Technology Inc’s (NASDAQ: MU) second-quarter earnings were downright gloomy, missing the mark by 186.26%. As expected, the share price shed 2.82% before finding the support of the bullish investors who rode on the back of a positive outlook, primarily with the promising future of Artificial Intelligence (AI).

Technical

Following the tapering off of volumes, Micron’s share price consolidated sideways to trade in a rangebound zone forming a rectangle pattern. Support and resistance were established at the $48.60 and $64.02 per share levels, respectively. A six-week downtrend within the range led the share price to reject the $53.00 per share level, forming a valid support level within the consolidation range within the weekly chart.

On the daily chart, Micron’s share price concluded the six-week downtrend following the breakout above the descending channel pattern’s resistance. The share price surged before bearish investors flocked to sell, leading to descending price action. The share price rejected the downside after bouncing from the 50% Fibonacci Retracement level at the $57.39 per share level, forming a pivot point. The rejection formed a long daily wick to the downside following the release of earnings, signifying the lack of investor interest in the downside.

Bullish investors will likely be at the forefront of price action following the rejection of the $57.39 per share level. The next probable level of interest is the $64.02 per share level if bulls commit to the upside. Alternatively, support at the $53.00 or $48.60 per share levels will probably entice bulls to commit to the stock if price action moves towards either level on declining volume, signalling bearish pressure wearing off.

Fundamental

Revenues for the second quarter plunged by a revolting 53% to $3.69B on a year-on-year basis. The steep drop in revenue left a bad taste in the bottom line performance, down 202% due to a $2.3B loss. Low demand for PCs and smartphones drove the negative performance in Micron’s income statement, which continues to weigh on its performance.

According to Gartner, 2022 posted the most significant decline in PC shipments of 28.5% since tracking of the PC market commenced in the 1990s. Micron anticipates a 60% decline in revenue for the next quarter, year-on-year, to continue the downward trend in the top-line performance. It doesn’t end there. Micron expects a full-year decline in revenues, deeper than the deepest drop it experienced in 2001.

To quell the adverse effects of declining revenues on its bottom line, Micron plans to reduce its headcount by 15% as part of its cost-cutting program.

However, despite the gloominess of Micron’s present and near past, the long-term outlook remains positive, giving hope to its investors. The company’s executives anticipate a rosy outlook for 2025, with sales boosted by growing demand for Artificial Intelligence.

After discounting for cash flows, a fair value of $83.28 was derived, leaving room for a 37% surge in Micron’s share price if it lives up to its outlook.

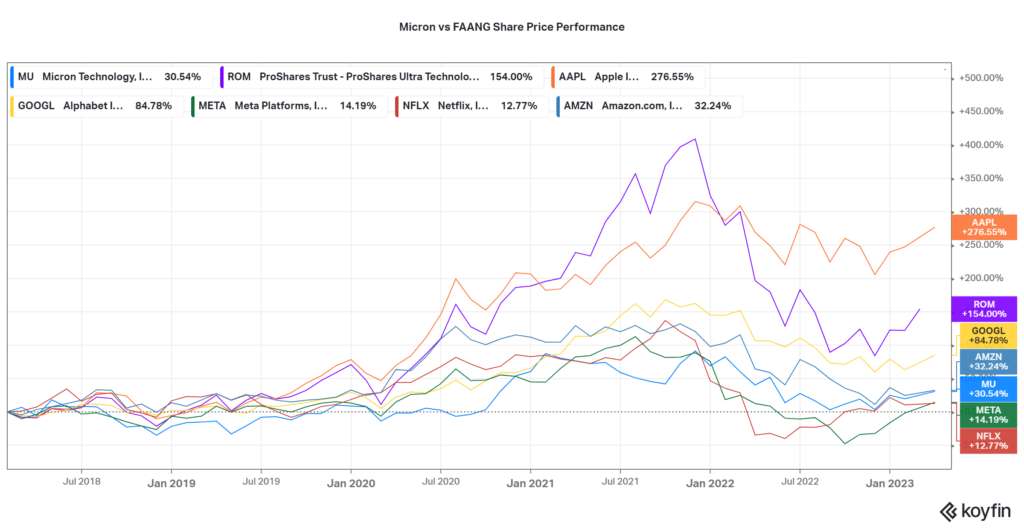

The above graph depicts Micron’s five-year share price versus Meta, Amazon, Apple, Netflix and Google, also referred to as the FAANG Stocks. There is a strong correlation in the share price movement between Micron and FAANG. Overall, tech stocks took a knock in 2022 as the Federal Reserve hiked interest rates in its fight against inflation. Micron’s share price will likely be subdued, as interest rates remain highly elevated, with higher borrowing costs weighing down on the bottom line.

Summary

With Artificial Intelligence maturing and becoming a hot topic, Micron is well-positioned with its technology and product development plans to take advantage of the growing opportunities. If Micron cuts costs and establishes a firm footing in the AI industry, the share price will likely experience minor friction to the upside, making the $83.28 level probable.

Sources: Micron Technology Inc, CNBC, Reuters, Gartner, TradingView, Koyfin