Shocks from the Banking Sector crisis were almost nowhere in sight as Wells Fargo & Company (ISIN: US9497461015) brushed off the crisis with upbeat earnings for the first quarter of 2023. The fourth biggest bank in America and its three biggest competitors beat earnings estimates resoundingly.

Wells Fargo recorded earnings of $1.23 per share against a consensus of $1.13, beating Wall Street’s expectations by 9%, while revenues went north of expectations by 3%, to $20.73B, against the $20.09B estimated. The high-interest rate environment supported the financial services sector’s top lines and fuelled Wells Fargo’s quarterly positive performance.

Technical

Wells Fargo temporarily exited a downtrend to trade in a minor uptrend. Midway through 2022, price action broke above its 100-day moving average and descending channel pattern to commence a light uptrend. Support and resistance were formed at the $36.43 and $48.41 levels, respectively.

Panic selling caused by the banking sector six weeks ago led to the stock giving up almost a quarter of its value before finding support and reversing. The latest week saw Wells Fargo & Company recording positive earnings, sending the share price surging 5% for the week.

With the worst of the banking sector over and bullish investors seemingly finding their feet, a reversal from the $36.43 level is probable. Bullish investors will likely be enticed to hold with the $46.00 or $48.41 levels likely in sight.

Fundamentals

Higher interest rate payments in the first quarter blanketed all negative expectations as the high-interest rate environment continued to feed into tailwinds for Wells Fargo. Net interest income was up 45% in the same quarter a year ago, landing on the $13.34B mark from $9.2B. All in all, revenue was up 17% in the same period, weighed down by a slight decline in noninterest income driven by weaker results in mortgage banking income, venture capital, and private equity businesses.

Despite Wells Fargo experiencing a decline in noninterest income, growth in net interest income offset the downfall and filtered through to the bottom line, where net income grew 30% to nearly $5B from the year-ago period.

However, the upbeat quarter did come with flaws, with Wells Fargo raising concerns over a possible mild recession ahead. In addition, due to the elevated rates, the business set aside $1.21B to cover potential loan losses, compared to $787M in the prior year. This potentially raises fears of headwinds arising from likely defaults to come, weighing down on the company’s top line.

In addition, analysts warned of weakness in the commercial real estate market due to the prevalence of remote working across major cities, emptying up valuable real estate. Wells Fargo’s outstanding loans in CRE stand at $154.7B, exposing 16% of its total loans to the market.

After discounting for future cash flows, Wells Fargo’s share price landed at $46 per share, leaving 16.06% room for the upside from the current share price. The $46 per share fair value aligns with a critical technical level forming resistance. Investors bullish on the stock could look to aim for the level.

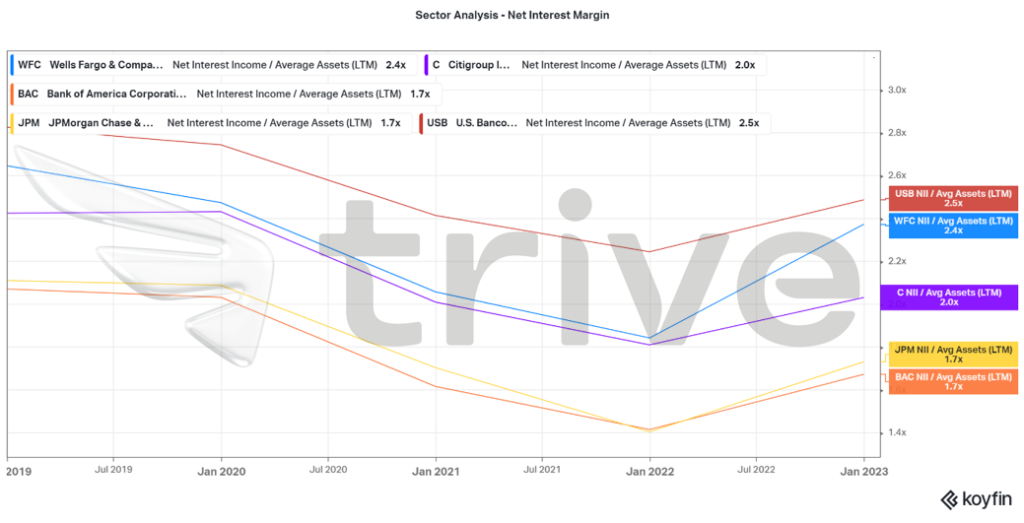

The above graph analyses the Net Interest Margin for Wells Fargo and its competitors. Net interest margin measures a bank’s profitability or what it earns on its loan interest against what it pays out in interest on deposits. Among some of the sector’s biggest banks, Wells Fargo is second in class after UBS, with a net interest margin of 2.4×. The bank is among the most efficient in generating interest income on its asset base, making it one of the better banks to invest in regarding earnings efficiency.

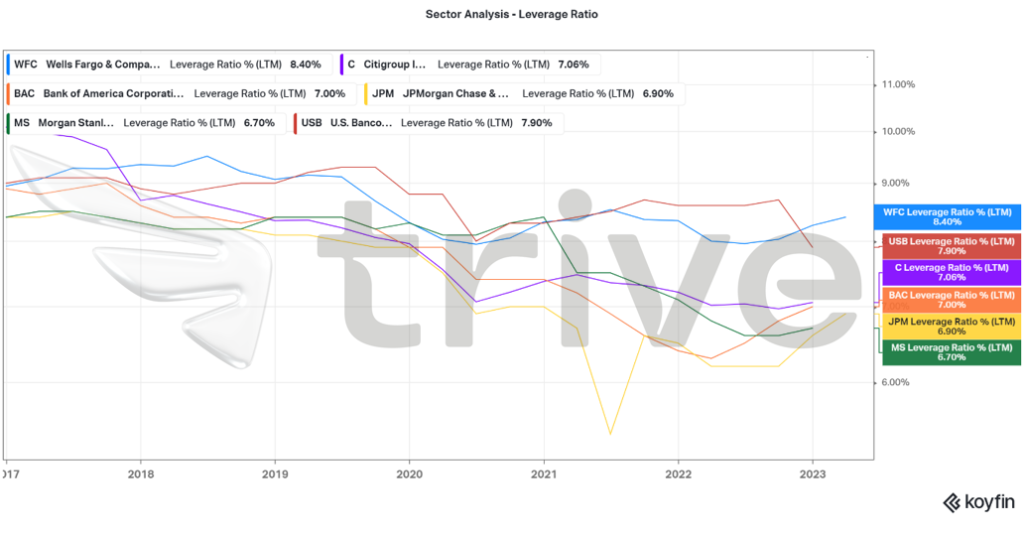

The Leverage Ratio depicted above measures a bank’s exposure, or how leveraged it is compared to its assets. A higher leverage ratio indicates that a bank has a low level of debt in relation to its capital. A ratio above 5% is generally considered a strong footing for banks. Once again, Wells Fargo is a leader in this aspect, among some of the top banks in America, with a leverage ratio of 8.40%. In a nutshell, Wells Fargo has the best near-term financial health among its immediate competitors and can withstand a negative shock to its balance sheet better than its competitors, leaving it as a safer investment option from a risk management perspective.

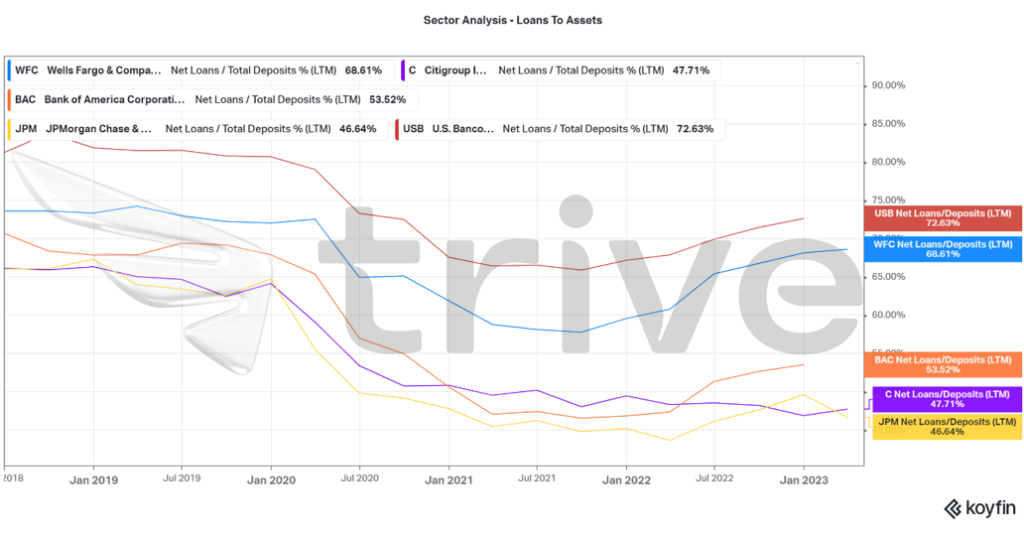

Since Wells Fargo is among the leaders in its ability to produce net interest income on its asset base, a higher loan to deposits ratio would favour its operations as it allocates more assets to generate an income. Wells Fargo’s loans to deposits are only second to UBS, making it one of the class leaders in this regard. With its higher income-generating efficiency, its top line and earnings could be more attractive than its competitors, given its higher allocation of loans to assets.

Summary

Given the high-interest rate environment, banking sector stocks will likely milk the global economy of more interest income. Positive growth in net interest incomes will likely translate into healthier earnings and superior valuations, leaving Wells Fargo’s fair value of $46.00 per share probable. In addition, from an efficiency, profitability and risk management perspective, Wells Fargo is far superior to its counterparts, making it a high-quality investment grade within the Financial Services sector. Prominent U.S. Bank executives foresee a shallow recession this year due to high-interest rates stalling consumers and businesses alike. However, a mild recession will likely weigh on Wells Fargo’s share price softly.

Sources: Wells Fargo & Company, Koyfin, CNBC, Reuters, Insider Intelligence, TradingView