With earnings set to be released next Wednesday, investors will likely sit on their hands in anticipation of Salesforce Inc’s (NYSE: CRM) 2022 final quarter and Full year performance.

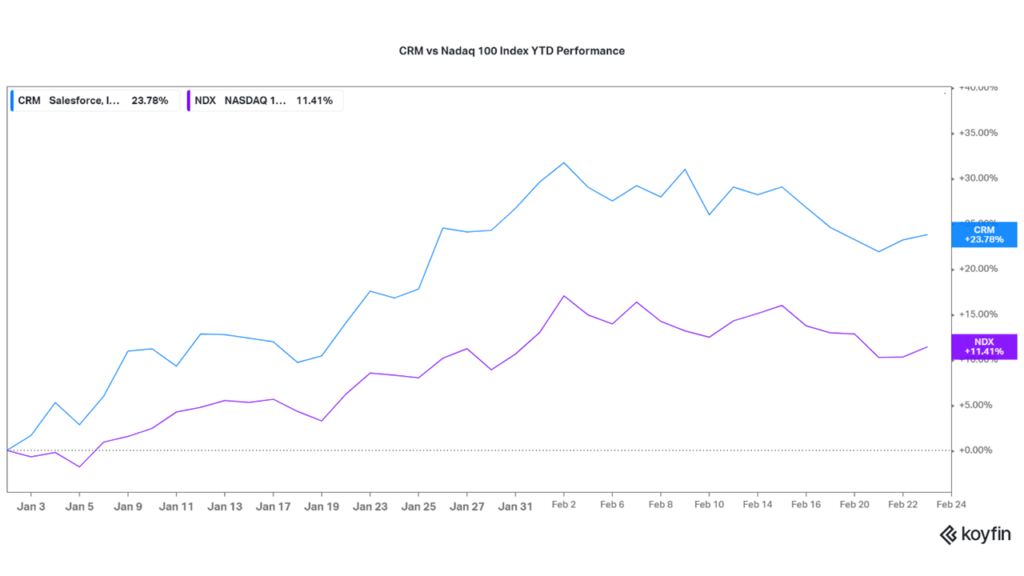

Salesforce, born out of the dot-com bubble, is a topical stock that has so far outperformed the tech-heavy Nasdaq 100 (NDX) by a large margin, gaining almost twice that compared to 11% of the NDX, as depicted below.

Source: Koyfin

Tech stocks have been increasingly sensitised to higher interest rates due to significant debt holdings that sit on most of their balance sheets. CRM is similar and highly sensitive to interest rate hikes by the Federal reserve. Beyond the company’s overall performance, further interest rate hikes by the Federal Reserve will likely dampen CRM’s valuation while hampering future growth as borrowing costs rise.

Technical

Salesforce’s bearish investors dragged the price lower in the final quarter of 2022 before bullish investors swept in at 2023’s opening to lead price into a breakout above a downward-sloping channel (dotted lines). The trend has been upward since the onset of 2023, with support and resistance established at the $126.89 and $175.62 per share levels.

Following a retracement from resistance, bulls and bears alike will look to the retracement levels for potential long and take profit areas. If bears, who currently dominate market sentiment, continue on their downward motion, the price will likely retrace to the $151.16 per share level at the 50% Retracement level while bulls look to enter.

Alternatively, if bulls repossess market sentiment, signalled by declining volumes on the down moves as price approaches key levels, a reversal is probable with resistance at the $175.62 per share level, a key level of interest for a bull case.

Fundamental

On a yearly basis, Q3 outperformed the prior year’s third quarter emphatically, with double-digit growth in the top and bottom line for the quarter. Revenues were up 14% year-over-year to $7.84B while operating margin was at a record high of 22.7% on a non-GAAP basis. Revenue growth was primarily driven by the improved performance in the subscription and support segment, which grew 13% year over year.

According to Q4’s guidance, CRM projects revenue of $7.9B to $8B, maintaining the upward trajectory. CRM’s share price will likely experience tailwinds if the revenue and earnings for the final quarter come in above consensus.

While interest rates remain elevated in the U.S. economy, CRM’s valuation has been able to move higher from last year’s lows, signalling the pricing in of high rates into its share price. After discounting for future cash flows, a fair value of $188 per share was derived, leaving room for a 14.40% gain from the current share price.

Summary

The main driver of CRM’s share price going forward will be next week’s earnings results and future interest rate expectations. If earnings come out better than expected, the upside will likely face minimal resistance, with the $188 per share level probable.

Sources: Salesforce Inc, Forbes, TradingView, Koyfin