The Total International Bond Index Vanguard ETF (ISIN: US92203J4076) tracks the investment performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index.

The index provides a broad measure of global investment-grade fixed-income debt markets. It incorporates government, corporate, and securitised non-U.S. investment-grade fixed-income investments issued in currencies other than the U.S. with maturities above a year.

The BNDX ETF has broad exposure across major bond markets outside of the United States. The fund invests in a broadly diversified sample of bonds within the index that mimics the index’s key risk factors and characteristics.

The BNDX suffered its worst year on record in 2022 after shedding 13.96% as interest rates across Europe and the globe were raised by central banks in their fight against aggressive inflation. The BNDX is seemingly on track to recover after clawing back 3.45% year-to-date on the back of a possible interest rate pivot, taking the Total Net Assets to $84.34B as of Mar 31 2023.

Technical

The BNDX’s price has decreased since 2022 as a downtrend was validated by price trading well below its 100-day moving average. Support and resistance were established at the $47.48 and $49.38 levels, respectively.

Despite the market giving off bearish signs through its descending structure, 2022’s lows have been avoided in the new year as the $47.48 level formed a higher low and established the latest support level. Bearish momentum is probably losing steam, given the failure of the market to establish a new low beyond 2022’s bottom.

If bullish investors lean toward a Fed pivot in the near term, the BNDX could be supported. A breakout above the 50% Fibonacci Retracement level on high volumes could validate the presence of bullish participants preparing for a leg up as the resistance level is cleared with strong conviction. Bullish investors will likely earmark the $51.13 level as a point of interest.

Fundamental

According to Refinitiv, the BNDX has moderate sensitivity to Interest-Rate changes. This is demonstrated by the loss-making year it experienced in the prior year due to interest rate hikes by several central banks within the ETF’s exposure. The BNDX suffered as it lost out to the growing attractiveness of newer bonds with higher interest-earning capability, leading to lower demand.

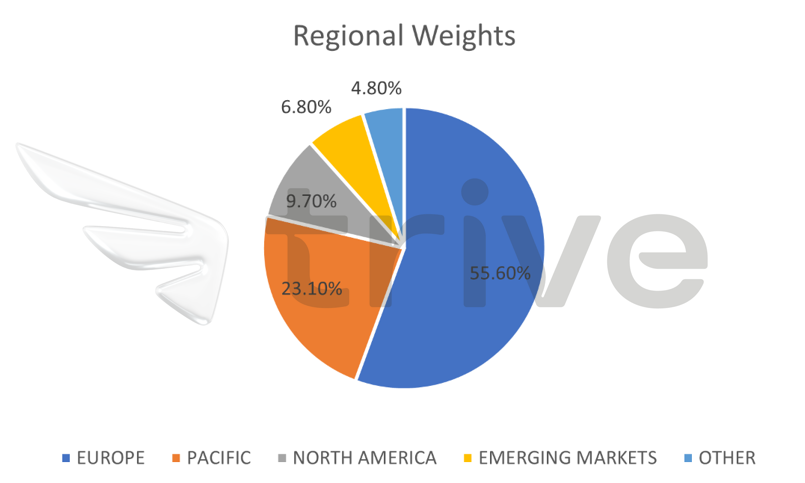

The BNDX’s most significant exposure is to the European fixed-income markets, followed by the Pacifics and North America. Given the European Central Banks’ aggressive tightening cycle, the BNDX was largely under pressure as new fixed-income securities with higher rates attracted investors. The Euro 10-Year Government Bond Yield surged to 2.575% in 2022, from negative rates in the year prior.

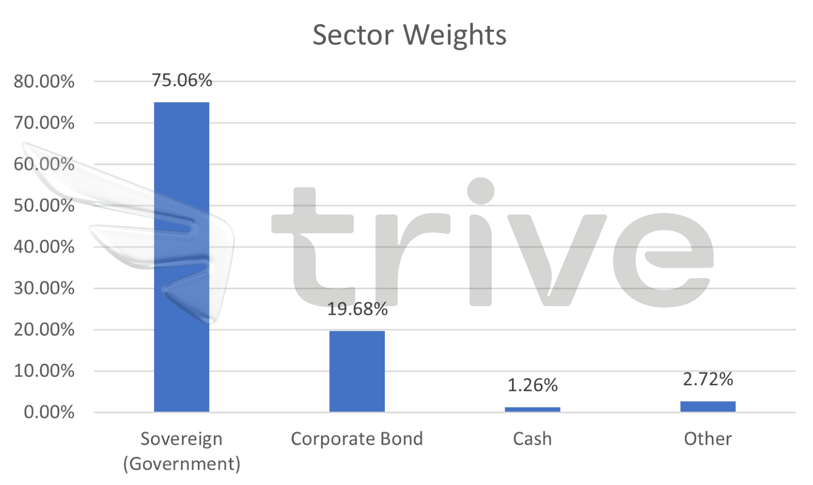

The BNDX is mainly exposed to government and government agency bonds, making up 75.06% of the total assets, followed by corporate bonds. Cash and other holdings remain minuscule as the primary purpose of the ETF is to track the Bond market’s performance.

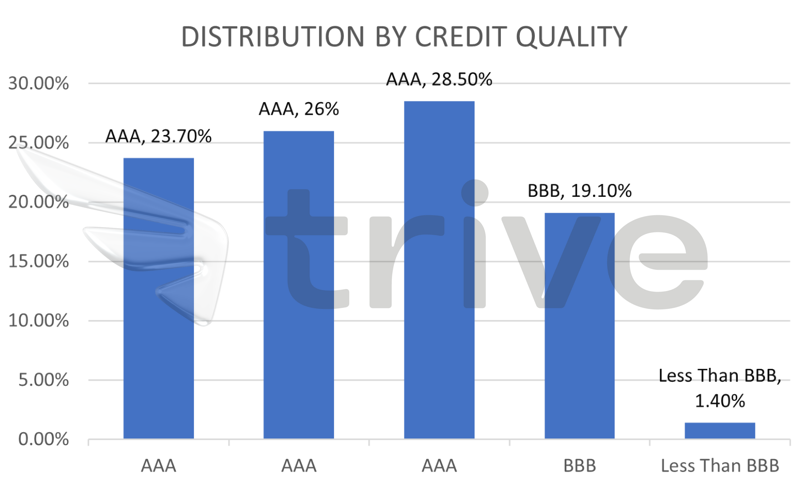

The BNDX comprises a reasonably healthy investment-grade portfolio, with most holdings rated above BBB. The probability of receiving back the principal on investment-grade instruments is considered high, making the BNDX an attractive investment option over the long-term.

Summary

With inflation now off its peak and ticking lower in the Euro Area and the U.S., further rate hikes will likely become less predominant. If global Central Banks pause or ease rates in the medium term, the BNDX could see upside price action pick up steam as the tightening cycle nears an end. The $49.38 level will determine whether the appetite for the Non-US Bonds is growing in the short to medium term.

Sources: Vanguard, FinancialTimes, Refinitiv, Nasdaq, TradingView