Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Microsoft Corporation (ISIN: US5949181045) had a successful fiscal year, largely due to the combined $30.3B in quarterly revenues for Microsoft Cloud services, up 21% from the previous year. Wall Street projections for the earnings of the second-most valuable firm in the world were exceeded as a result. On revenue of $56.19B, which topped estimates by 1.27%, the business reported earnings of $2.69 per share, 5.46% more than expected.

Microsoft spent heavily in the quarter on Artificial Intelligence (AI) to ramp up its product and service dependency on it as it stakes its future on the up-and-coming technology. One of the most prominent moves the tech giant took was its investment in OpenAI, the owner of the well-known ChatGPT service, at the onset of the hype surrounding AI. Wall Street is examining how Microsoft, which took the lead early on with investments in OpenAI, may profit from generative AI services.

Trive Financial Services Malta – TradingView, Nkosilathi Dube

Microsoft has slightly outperformed the heavily tech-weighted NASDAQ100 (NDX) year-to-date, with a gain of 46.50% that exceeds the NDX by more than 300 basis points. It now accounts for about one-tenth of the index due to the recent rebalancing of the NDX, which underscores the strong positive correlation between the two.

Technical

At the close of January 2023, Microsoft’s share price exited a downtrend characterised by the price trading below the 100-day moving average within a descending channel. The market’s arousal by the developments in AI led to a strong buy-in, which led the company’s share price above the aforementioned downtrend characteristics. Optimistic investors have been at the forefront of the tech sector ever since, and with positive earnings on the books, Microsoft’s share price was driven up to an all-time high at $359.49 per share on 18 July 2023.

Resistance was established at the peak price at the 366.78 per share level after retreating from the level for four consecutive days, while support was formed at the $247.49 per share level after originating the move higher midway through March 2023. Given the positive earnings and the likelihood of an interest rate peak, the share price could find its way higher to form a new all-time high if the 23.60% Fibonacci Retracement level holds as support, following the reversal from the all-time high. The 366.78 per share level will most likely act as a point of interest to the upside if momentum continues to favour a move higher. In contrast, if upside momentum falters, the reversal from the all-time high could persist, leaving lower Fibonacci Retracement levels as likely points of interest for optimistic investors if downside volumes contract.

Fundamental

In the final quarter of 2023, total revenue reached $56.2 billion, reflecting an 8% increase. Within the Productivity and Business Processes segment, revenue amounted to $18.3B, growing by 10% year-on-year. The growth was propelled by a 19% increase in Dynamics products and cloud services revenue, primarily driven by a remarkable 26% surge in Dynamics 365 revenue. Additionally, Office Commercial products and cloud services revenue increased by 12%, with Office 365 Commercial revenue showing a substantial growth of 15%.

Revenue in the Intelligent Cloud segment amounted to $24.0B, witnessing a significant increase of 15%. The growth was primarily led by a 17% surge in server products and cloud services revenue, driven by a remarkable 26% increase in Azure and other cloud services revenue.

The More Personal Computing segment revenue totalled $13.9B, experiencing a decline of 4%. This decrease was mainly driven by a 20% drop in device revenue and a 12% decrease in Windows OEM revenue. The company’s overall product sales, including its Windows operating system, have been affected by the ongoing weakness in the PC market.

The positive top-line performance filtered through the income statement, leading to an 18% increase in operating income to $24.3B year-on-year. Furthermore, net income increased by a fifth year-over-year to $20.1B.

Trive Financial Services Malta – Microsoft Corporation, Nkosilathi Dube

The cloud services segment mostly housed revenue growth exceeding 10% for the various services under this section, which contained Microsoft’s best-performing services. With a 26% increase year over year, Dynamic 365 also experienced noteworthy growth.

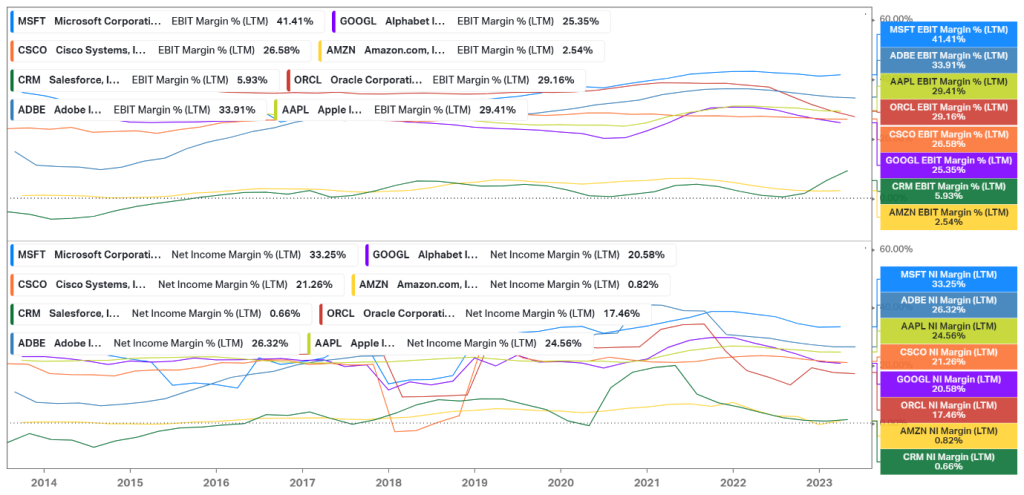

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

With margins that may make its rivals envious, Microsoft stands out as the most lucrative company among its main rivals. With earnings before interest and tax margin of 41.41%, which is 750 basis points more than its closest rival, Adobe Systems Inc. (ISIN: US00724F1012), it is more operationally effective at turning every dollar of sales into a profit before interest and tax. Additionally, it has an industry-leading Net Income margin (33.25%), which makes it an appealing earnings prospect for investors in the tech sector.

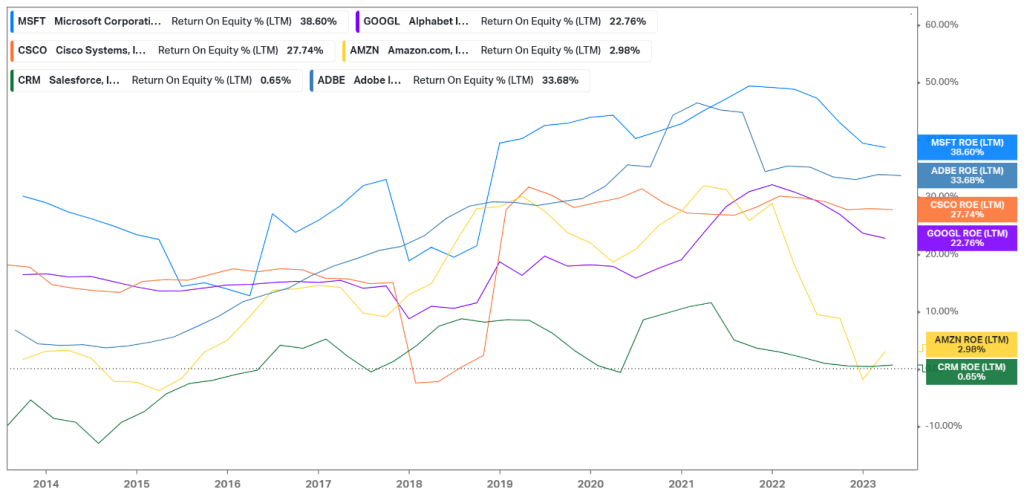

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Over the past ten years, Microsoft’s Return on Equity has led the way, at 38.60%, and has consistently outdone its competitors over the same period. Given the high levels of profitability, the ROE backs up the likelihood that Microsoft excels at generating a profit for investors more efficiently than its competition.

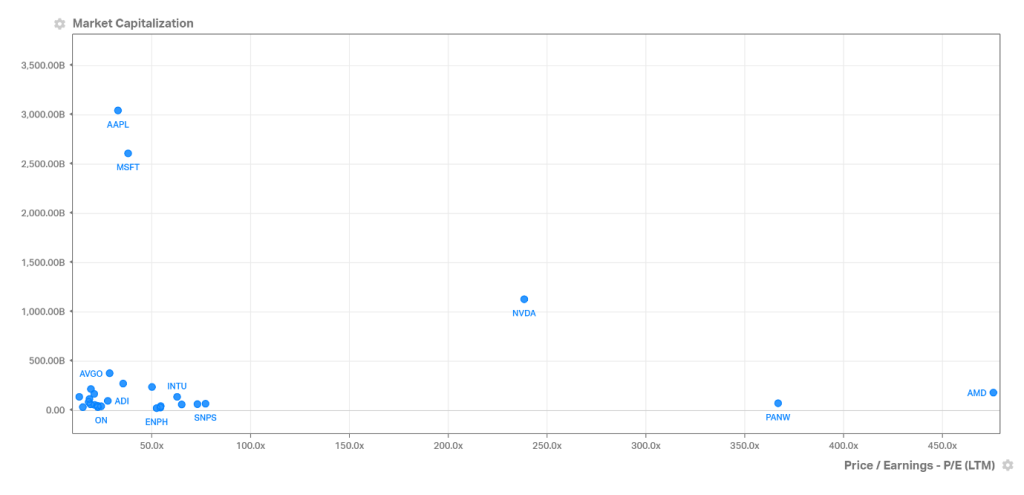

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Microsoft’s Price To Earnings Ratio is aligned with the NASDAQ100’s tech sector competition and represents growth prospects despite its high valuation, which puts it second to Apple (ISIN: US0378331005) on market capitalisation.

After the business warned investors that spending would increase as it equips data centres for AI capability, capital expenditures increased to $10.7 billion from $7.8 billion in the fiscal third quarter. The $30 a month “Copilot” assistant for its Microsoft 365 service, which can condense a day’s worth of emails into a brief update, is one example of how Microsoft is incorporating AI into its products. Additionally, it plans to sell cloud computing services that other businesses might use to develop AI products.

Microsoft anticipates a 25%–26% spike in constant currency Azure revenue growth for the first fiscal quarter 2024. It further forecasts a first-quarter revenue range with a midpoint of $23.45B for the segment that includes Azure. The midpoint of its first-quarter forecast for the Office segment was $18.15B, versus the $18.08B analyst’s consensus expectation. In contrast, due to the general decline in demand for electronic devices, Microsoft’s forecast for its Windows sector had a midpoint of $12.7B, below analysts’ estimates of $13.14B.

After discounting for future cash flows, Microsoft’s fair value was derived at $372.00 per share.

Summary

Given Microsoft’s firm footing in the AI space and solid brand awareness, its share price all-time high could be approached in the medium to long term. Microsoft continues to go from strength to strength, and with its continuous refinement of existing products and services and willingness to adopt new technologies in its offerings, the sky is the limit, even past the clouds. Its share price will likely converge with its fair value of $372.00 per share, given that positive future earnings performance takes shape.

Sources: Microsoft Corporation, CNBC, Reuters, Forbes, Refinitiv, Nasdaq, TradingView, Koyfin