The Global Healthcare iShares ETF – IXJ (ISIN: US4642873255) is an ETF that tracks the global healthcare sector and is benchmarked by the S&P Global 1200 Healthcare Sector Index.

Stocks that fall under the Healthcare sector are considered defensive stocks due to the necessity of healthcare in all economic cycles, including recessions. The IXJ has found some favour in recent weeks as recessionary fears induced a risk-off sentiment within the market, leading to investors restructuring portfolios to play into safer bets.

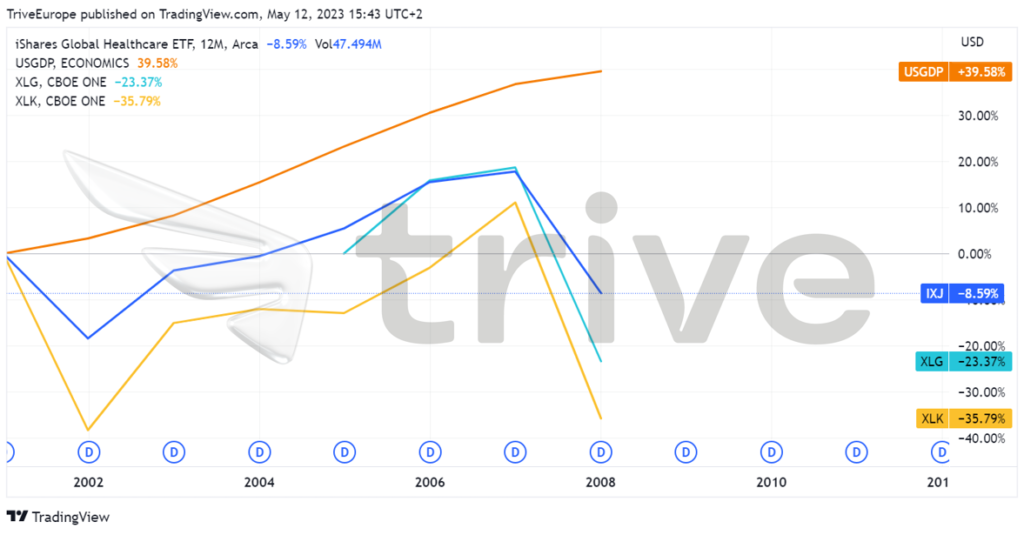

As depicted below, the onset of the 2008 Global Financial Crisis was a nightmare for global stocks. The Guggenheim S&P 500 Top 50 ETF – XLG (ISIN: US46137V2337) and Technology Sector SPDR – XLK (ISIN: US81369Y8030), which track the Top 50 companies in the S&P500 and Tech Stocks, respectively, all plummeted, along with the IXJ. However, the IXJ declined only 8.59% in the period. In contrast, the aforementioned ETFs declined in the double digits, signifying the healthcare sector’s ability to withstand economic pressures better than other sectors.

The Healthcare sector, although still a risk asset, could be considered a safer risk investment among various stocks due to its defensive stature. The IXJ has gained 9.36% from the bottom it formed in March as a result. Is there more room for growth?

Technical

The IXJ has been trending lower since 2022 as interest rates went up globally, with central banks raising rates to fight off stubborn inflation. Borrowing costs surged, while the higher cost of borrowing hindered growth prospects and increased equity valuation discount rates. However, the IXJ has recovered from its losses imposed by a sell-off in the latter part of 2022 and is on track to recover all of the losses incurred in the year.

A symmetric triangle was established, characterised by lower highs and higher lows. This could indicate that the price is moving into consolidation as neither bulls nor bears have taken control for a clear direction. Support and resistance were established at the $78.65 and $87.88 levels, respectively.

With bullish investors having established traction in an upward direction, the IXJ’s price has come face to face with its resistance level at $87.88 and the upper trendline of the symmetric triangle. A reversal is probable if supply outweighs demand at the level. If the market rejects the resistance level, bullish investors could look to the 50% or 61% Fibonacci Retracement level for entry points. A reversal from either level could be validated by declining volumes to the downside, signalling the weakening of bearish momentum, with a reversal imminent. The $91.91 level will likely entice bulls if the market accepts a higher value for the ETF above its current resistance level.

Fundamental

After experiencing a torrid 2022, the IXJ has officially recovered all of its losses incurred from the final quarter of the year, which saw the ETF plunge 10.51% off the period’s peak. Covid-19 vaccine sales which had become a driving force for healthcare stock’s sales, plunged in the second half of 2022 as the pandemic seized to infect as it did at its peak, leading to lower vaccine sales. Large pharmaceutical businesses, in turn, revised their vaccine sales forecasts lower to fit in with the new dynamics. Investors momentarily wondered where healthcare stocks could go next, but Covid-19 is one of many diseases.

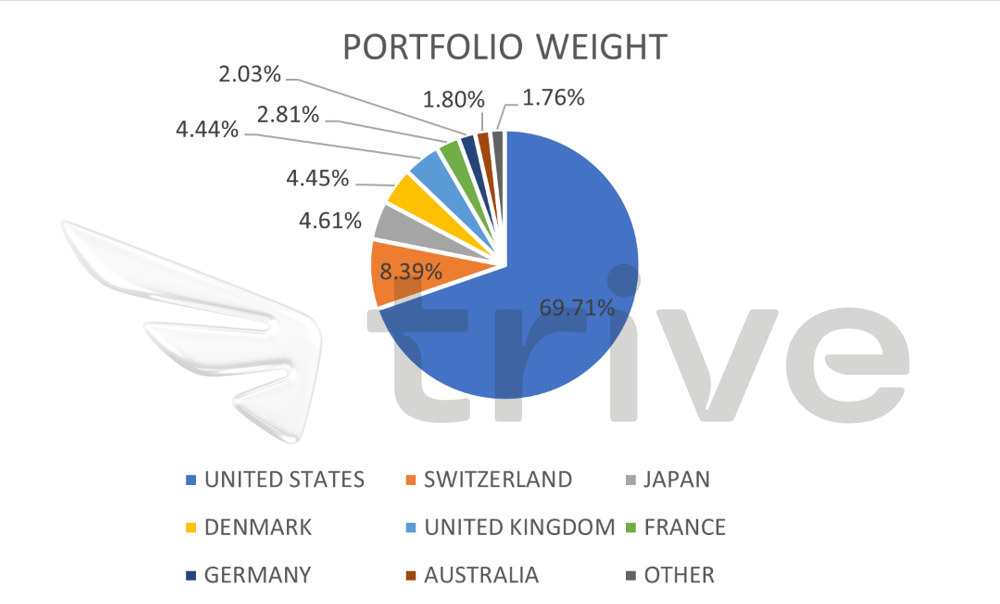

Most of the IXJ’s exposure is towards U.S. healthcare stocks, followed by European Stocks. The U.S. makes up 69.71% of the entire exposure, and thus the ETF is heavily dependent on the macroeconomic conditions of the U.S. for a direction. Of late, the U.S. economy has been showing signs of weakness, leaving the investment community fretting over a likely recession. However, this should not be of much concern to healthcare investors due to the sector’s defensive stature.

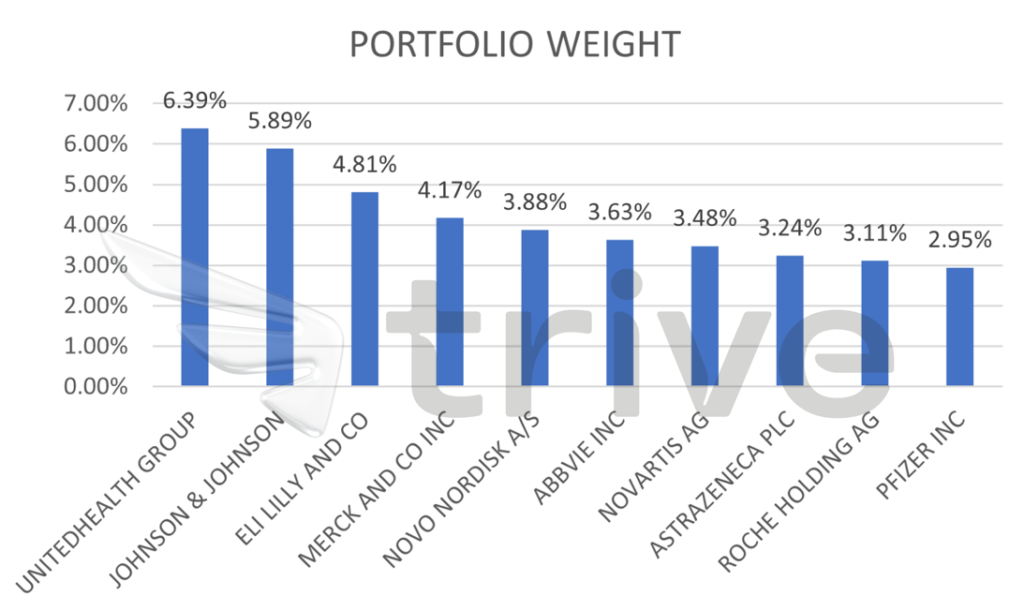

The top ten holdings of the IXJ make up 41.55% of the entire portfolio. Most stocks are healthy Blue-chip stocks with a rich history of operations within the sector. Due to its extensive exposure to a high-quality list of companies, the IXJ will likely represent a relatively stable ETF with fluctuations primarily arising from macroeconomic shock.

Summary

Healthcare stocks will likely remain defensive indefinitely for as long as humans exist and require medical attention. With the IXJ trading at a prior premium level, the market could be repricing to prepare for a move higher. The $87.88 level will be a crucial level to monitor to define the market’s sentiment.

Sources: Ishares, Blackrock, FinancialTimes, Pharmaceutical Technology