The world’s largest chemicals company, BASF SE NA O.N (XETR: BAS), plunged 8% last week, primarily due to weak final quarter earnings. Earnings and revenues missed consensus by 83.19% and 2.19%, respectively, striking fear among the company’s investors.

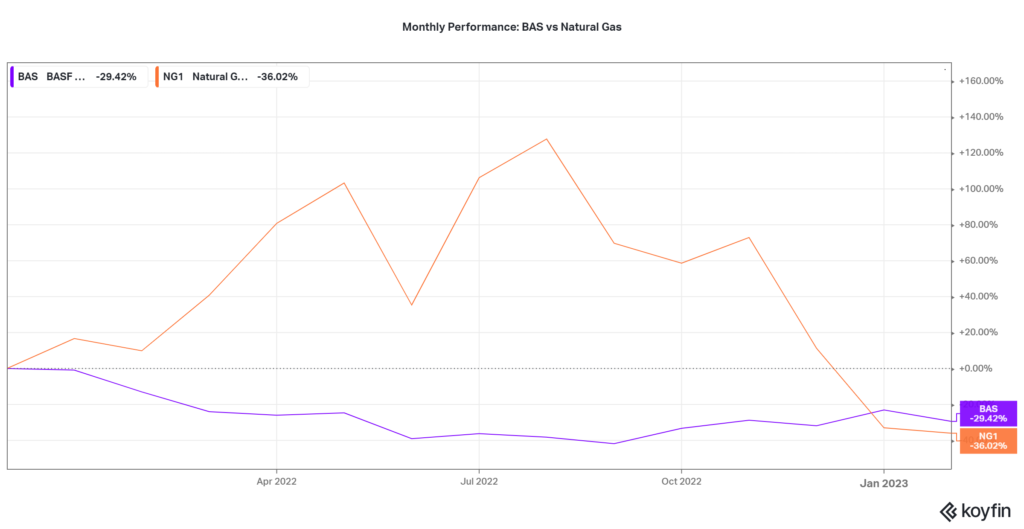

BASF relies heavily on Natural gas in its production processes, and below is an illustration of the correlation between BASF’s share price and the price of Natural Gas. The two have an inverse relationship as higher natural gas prices result in higher production costs, the share price becomes depressed. During natural gas price spikes, BASF’s share price declined and vice versa when the gas price went down.

Source: Koyfin

Technical

BASF bulls shook out bearish investors in the latter part of 2022 to commence an uptrend. Support and resistance were formed at the €45.530 and €54.110 per share levels, respectively. Following a rejection of resistance, price was driven lower towards the 61.80% Fibonacci Retracement Golden Ratio at the €48.565 per share level.

If bearish investors take weak earnings to heart, price will likely be lowered towards support at the €45.530, following a high volume breakdown below the €48.565 per share level.

If bullish investors take the earnings with a pinch of salt, it is probable that price will be redirected towards resistance at the €54.110 per share level. A high volume reversal from the €48.565 per share level could validate upside price action.

Fundamental

BASF’s top line improved year-on-year, surging 11.1% to €87.3B. The quarterly performance did, however, offset the year-on-year as sales declined 2.3% to €19.3B due to lower volumes in the final quarter of the year, which fell 15.4%.

Weighing down on the upbeat revenues was higher energy costs globally and more so in Europe, where BASF operations are predominantly based. Energy costs soared in 2022 following Russia’s invasion of Ukraine. BASF’s high natural gas dependence (69% of total energy bill) resulted in the company’s energy bill rising by a staggering €3.2B for the year after natural gas futures prices peaked at USD10 MMBtu in the second half of 2022.

Higher energy costs filtered through the income statement and left an adverse effect on the Earnings before Interest, Tax, Depreciation and Amortisation (EBITDA) and Earnings Before Interest and Taxes (EBIT), which both declined 5.3% to €10.7B and 14.7% to €6.5B, respectively.

In a drive to cut costs, BASF’s senior management decided to cut 2600 jobs or 2.3% of its global workforce. In addition, they have targeted a €200m yearly decline in fixed costs to bring the overall cost-cutting measure to approximately €700m annually, including the job cuts. If implemented successfully, this will likely prop up the bottom line and make earnings more attractive to investors.

However, 2023’s guidance is lacklustre to negative, with revenue forecasted to be between €84B and €87B for the full year, much in line with 2022’s performance, while EBIT is projected to fall between €4.8B to €5.4B, lower than 2022. BASF warned of a further decline in earnings due to rising costs, further dampening its 2023 outlook.

After discounting for future cash flows, a fair value of €49.17 per share was derived. The current share price trades at a 1.30% discount to fair value, leaving little room for upside price action.

Summary

The chemical giant will likely experience a subdued year as interest rates rise and raise chances of a slowdown in economic activity. The materials sector is cyclical, and its stocks generally align with global growth prospects. With the global economy forecast to grow by 1.7% in 2023, according to the World Bank, BASF’s share price will probably have very little room to manoeuvre to the upside, leaving the €49.17 per share price as a hold recommendation.

Sources: BASF SE NA O.N, Reuters, CNBC, Nasdaq, WorldBank, TradingView, Koyfin