Supported by the Banking Sector crisis, which saw investors fret over risk assets, safe-haven demand surged and drove the ProShares Ultra Gold ETF (NYSE Arca: UGL) just short of its 2022 highs. Investors piled into the yellow metal’s futures contracts to safeguard their investments from the selloff in risk assets such as equities and commodities.

With the banking sector mainly in the rear-view mirror now, investors will focus on the broader economic environment to determine whether demand for Gold Futures, which the UGL tracks, will continue its stern upside momentum.

Technical

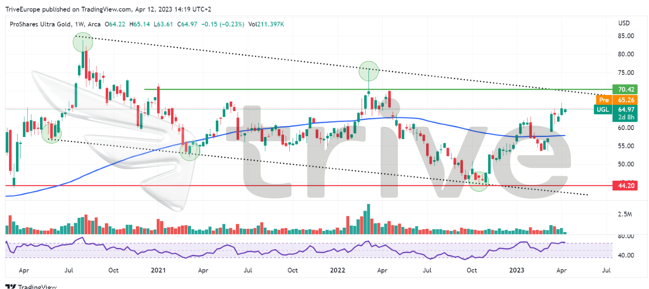

The ProShares Ultra Gold ETF had been in a broader downtrend since the second quarter of 2020, trading within a descending channel pattern. Support and resistance were established at the $44.20 and $70.42 levels, respectively.

On the daily chart, below, the ProShares Ultra Gold ETF, shifted into an uptrend after price broke above its 100-day moving average. Following the rejection of the level, the $53.59 level forms an intermediate support level, which coincides with the 100-day moving average and 50% Fibonacci Retracement level, adding confluence to the zone.

If bullish investors commit to the upside, the UGL could extend its uptrend with the $70.42 level likely designated as a level of interest in a bull case. This move could be validated by upside price action matched with high volumes, signalling the presence of bullish momentum.

Alternatively, price action could reverse if bearish investors participate in the market to increase upside friction. If the UGL reverses, bullish investors could buy into the ETF if the price approaches the 100-day moving average or support at the $53.59 level. Buying could be validated by the price approaching the aforementioned levels on declining volume, signalling bearish momentum dying out.

Fundamental

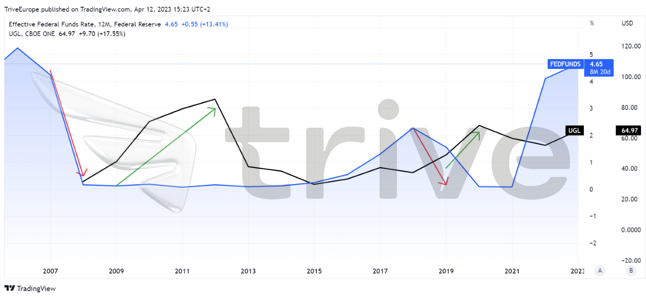

The primary fundamental factors to consider when looking to buy into assets with gold as its underlying value are inflation, interest rates, and the strength of the greenback. When inflation rises, particularly in the monetary hegemony of the U.S., the Federal Reserve fights rising prices by raising interest rates to slow the economy and consumer spending. The result is investors look to place their funds in higher-yielding assets, such as the U.S. Treasury Bonds and the greenback, at the expense of other assets, including gold.

Therefore, gold prices and interest rates have an inverse relationship. Gold shines during periods of lower interest rates or recessionary periods as investors look to the precious metal as a safe-haven investment, which can preserve the value of their wealth. As depicted below, when interest rates are on the downturn, the UGL picks up steam and vice versa.

The 2006 to 2008 and 2018 to 2019 periods saw Fed funds decline significantly, leading to the UGL gaining 174% and 80%, respectively, as a result. Of late, the UGL has been slightly depressed due to the high inflation and interest rate environment, which has seen the greenback shine.

Summary

With interest rates globally elevated to fight off stubborn inflation, the UGL will likely remain subdued in the short to medium term. However, the UGL could be boosted by a tapering off of interest rates or safe-haven demand bred by risk contagion. Bullish investors will probably be better placed to buy into the ETF at a discounted price, making the $53.59 level a feasible price for long entries.

Sources: Federal Reserve, Bloomberg, World Gold Council, TradingView