SPDR S&P Regional Banking ETF (NYSE ARCA: KRE) was overtaken by stress and panic from the global banking sector, which sent bank stocks plunging worldwide. The KRE shed 32.32% from its Year-to-Date high as risk-off sentiments imploded the market.

At the forefront of the banking sector crisis was Silicon Valley Bank (SVB) which announced a $3B loss on a $21B Fixed Income portfolio. The loss sent shockwaves into the banking sector as depositors sought to withdraw their cash to protect themselves from loss. Deposits at small banks dropped by $119 billion to $5.46 trillion in the week ended March 15. The drop in deposits accounts for over two times the previous record drop. Besides a rout on deposits, bank shares plunged as investors sold off to prevent themselves from loss too.

Technical

On the weekly chart, the KRE entered into a downtrend which saw price action cross below the 100-day moving average. Before the selloff, Support and Resistance were established at the $56.69 and $78.83 levels, respectively. A nosedive in price action led the KRE to a sharp breakout below support at the $56.69 level, now functioning as a resistance level, while the next support level sits at the $30.38 level.

Investors looking to buy low will likely be enticed to buy into the ETF at the current price level, which coincides with the 61.80% Fibonacci Retracement Golden Ratio. If bulls commit in numbers, a rejection of the Golden Ratio could play out, with bulls looking to the $56.69 level as a probable exit point. Alternatively, bullish investors will look to the $30.38 level as a probable entry point if the KRE continues its downward trend.

Below is the KRE’s daily chart, which shows price consolidating sideway in a rectangle pattern with support and resistance at the $42.34 and $46.94 levels, respectively. Following the steep selloff, bulls and bears are repricing and gauging their favourable price levels. As a result, a high volume breakout to either side of the consolidation pattern could lead price action further in the direction of the breakout.

Bulls will likely aim for the $56.69 level if a breakout above the $46.94 level occurs, while they will stay out of the market if the price breaks below the $42.34 level on high volumes.

Fundamental

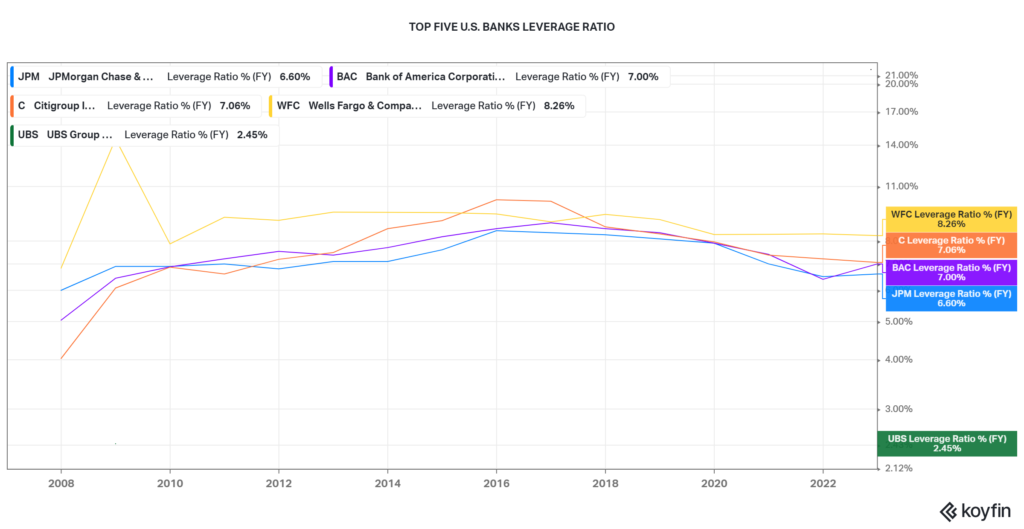

According to Refinitiv, the KRE’s top five holdings make up 10.27% of the entire ETF value. Below is a list of the top five holdings’ Leverage ratios, compared to the big five U.S. Commercial Bank’s leverage ratio between 2008 and to date. The Leverage ratio measures a bank’s core capital relative to the total assets on its balance sheet, thus a measure of near-term financial health.

A low leverage ratio indicates that a bank holds significant debt levels compared to its capital. It evaluates the bank’s capability to meet its financial obligation. A higher leverage ratio signals a bank’s likelihood to withstand adverse shocks to its balance sheet.

Since 2008, the KRE’s top five have seen flat to declining leverage ratios. SVB was among the top KRE holdings whose leverage ratio declined over the same period. This could signal a snag for regional banks in dealing with shocks to their balance sheet, like SVB, whose shareholder equity took a knock.

However, declining leverage ratios have not been the case across the board, with the big five U.S. Commercial Banks’ leverage ratios flat to positive between 2008 and 2022.

Regional banks outside of the mega U.S. Commercial Banks will likely face a higher risk of defaulting on a run on their balance sheets if the banking sector crisis continues to unfold. The KRE will probably be weighed down further, but it is not all doom and gloom for regional banks as the Federal Reserve stepped up with hefty coffers allocated to shore up liquidity in the sector. During the unfolding of the banking crisis, banks borrowed nearly $153B from the Fed as part of rescue efforts, smashing the previous record of $112 set during the global financial crisis.

Summary

Despite U.S. Banks sitting on $620B worth of unrealised profits, the KRE’s underlying assets will likely be supported by the Federal Reserve’s commitment to shoring up liquidity within the sector. If market panic dissipates, the KRE will probably head north towards the $56.69 level.

Sources: NYSE Arca, Reuters, CNBC, Refinitiv, Federal Reserve, TradingView, Koyfin