Apple Inc (ISIN: US0378331005) posted an upbeat quarter, despite several headwinds presenting themselves in the period. Faced with a tougher consumer environment and a slowing U.S. economy, Apple’s earnings and revenues were able to edge above Wall Street expectations by 6.36% and 2.08%, respectively. Earnings per share landed on the $1.52 per share mark, while revenues reached the $94.84B level, just shy of $95B.

Helping boost the top and bottom line above consensus was improved sales in Apple’s iPhones. Investors will closely monitor macroeconomic developments to determine whether the expected mild recession in the year’s second half materialises.

A mild recession could weigh on consumer demand and sales as consumers tighten budgets to spend more on necessities. However, with the market pricing in a 95% chance of rates easing by the end of the year, Apple’s stock price could be in for a pleasant surprise as borrowing costs potentially take a route southward. Will Apple’s share price take the route north?

Technical

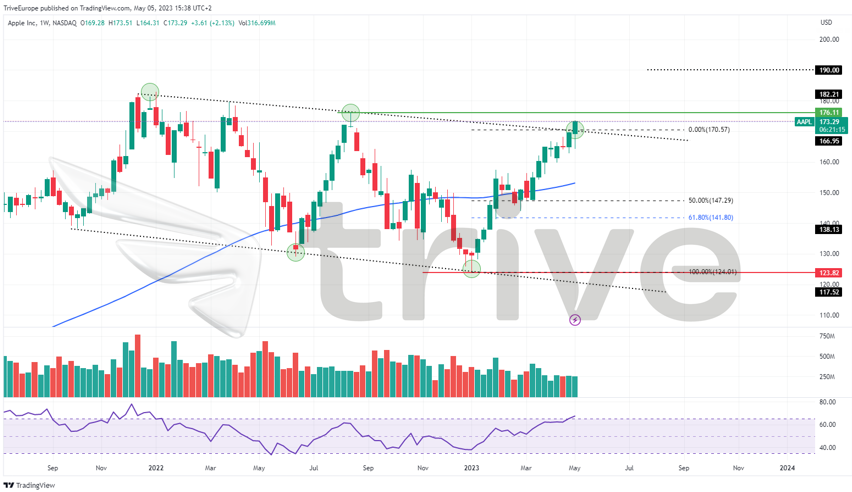

Apple’s share price has been subdued mainly by the high-interest rate environment imposed by the Federal Reserve in its fight against inflation. Higher borrowing costs weighed down the stock, while growth prospects and valuations were limited by higher interest rates and discount rates, respectively, sending the stock into a downtrend. Apple’s share price produced a descending channel pattern in its move lower. However, prices were supported near the mid-2021 lows.

Support and resistance were established at the $123.82 and $176.11 per share levels, respectively. A surge from support supported by bullish volumes sent the price to the descending channel’s resistance, nearer to the horizontal resistance level. With RSI conditions pointing to overbought levels, a reversal from resistance is likely and could send Apple’s share price lower.

Bullish investors could be better positioned to buy the stock at a slightly discounted price. If a reversal from the pattern’s resistance ensues, bullish investors could look to either the 61.80% Fibonacci Retracement Golden Ratio or support at the $123.82 per share level for long opportunities. A long position could be validated by declining volumes to the downside, suggesting bearish momentum is phasing out, with the market finding less interest in a lower price. The $176.11 per share level will likely be earmarked as a point of interest for a bullish case.

Alternatively, a high volume breakout above the pattern’s resistance could signal the presence of bullish participants. Bullish investors could look to take a long position on the retracement if a breakout sustains above the pattern. The $190.00 per share fair value could be of interest if the share price moves higher.

Fundamental

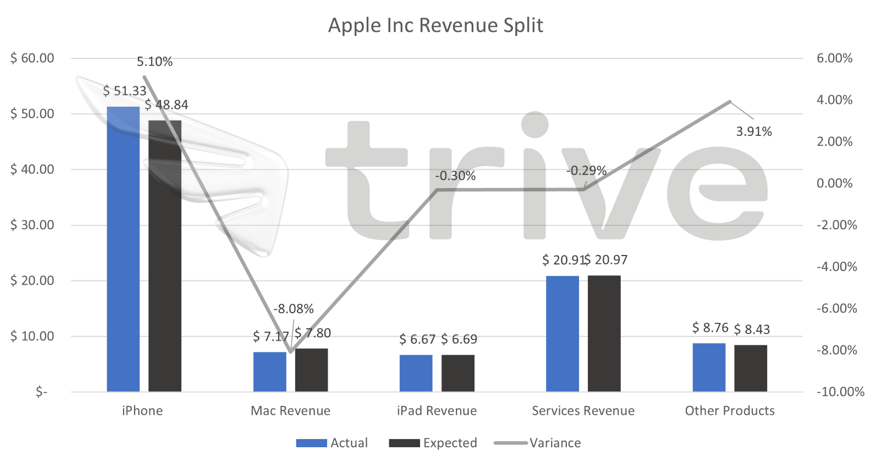

Revenues came in higher than expected, buoyed by stronger-than-anticipated sales in the iPhone segment. However, overall sales fell for a second quarter in a row, with some business segments suffering a continued downtrend from the prior quarter. Revenues fell 3% below 2022’s second quarter. Apple’s China business reported $17.81 billion in sales, down from last year’s $18.34 billion, despite hopes of the economic reopening supporting sales.

iPhone sales grew 5% quarter-on-quarter, suggesting that the parts shortages and supply chain issues, compounded by a factory shutdown in China, which had haunted the company in the past few years, are seemingly ending. Growth was achieved, despite a 13% drop in Global smartphone shipments, according to research firm Canalys.

Apple’s Mac and iPad businesses didn’t do too well, with sales declining 8% and 30 basis points, respectively. However, this did not come as a surprise after the company warned of declining sales in both segments last quarter, primarily due to parts shortages, although incomes fell much further than expected. According to Canalys, PC unit shipments in the first quarter fell 33%, signalling weakness in the market.

Services revenues remained resilient while the company added 150 million subscribers to its platforms from the quarter a year ago, representing strong growth in the segment’s business.

Improved sales for the quarter filtered through to the bottom line beating consensus, but remained 3.4% below the same period last year. The company expects its June quarter year-over-year revenue to stay in line with the current quarter, given that no significant macroeconomic worsening occurs from now.

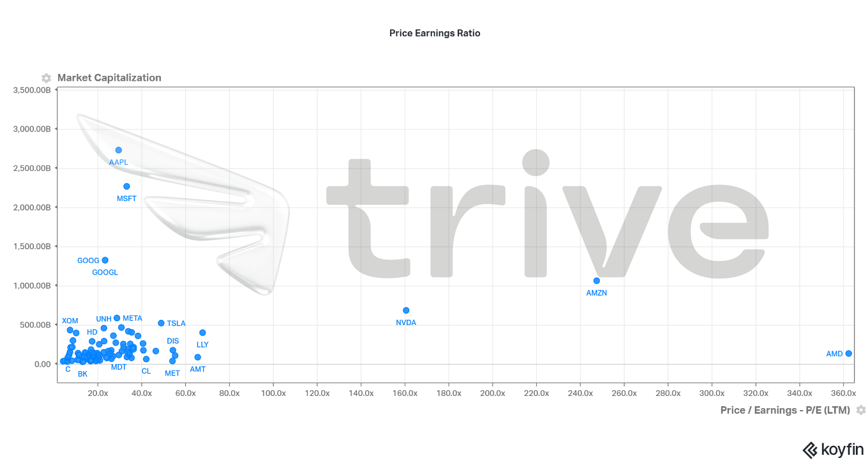

Apple is the highest-valued company in the world and has a Price Earnings multiple (PE) of 29.5. The high PE, relative to the S&P 100 (mega-cap stocks), suggest that investors perceive a high value of the company with more room to grow potentially.

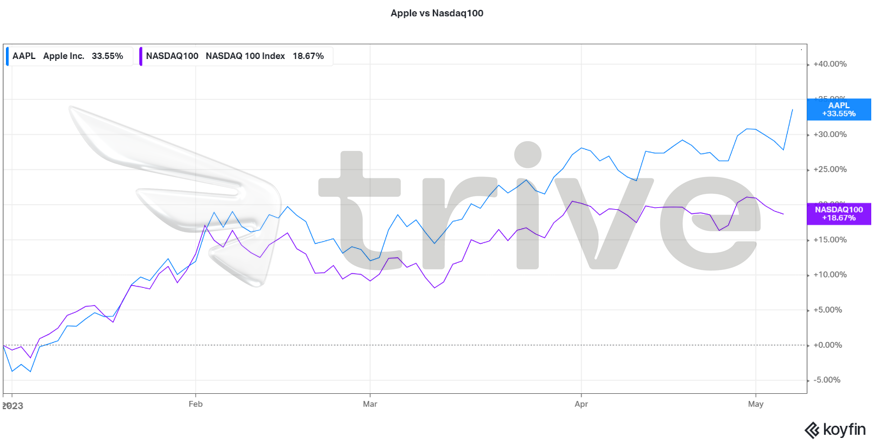

Apple’s highly perceived value relative to the mega-cap stocks is depicted in the above illustration. Compared to the tech-heavy NASDAQ100, Apple’s share price has outperformed the index almost two-fold. Therefore, investors generally favour the stock as it exhibits high growth and earnings potential as it retains a large customer base with many services on offer, along with strong growth potential.

After discounting for future cash flows, a fair value of $190 per share was derived, leaving room for a 9.74% gain to the upside, if the market moves higher.

Summary

Apple has been able to stand tall in the face of fairly moderate headwinds. Its business operations remain healthy, with gross margins moving 20 basis points higher than expected. The share price will likely benefit from a possible pause in interest rate hikes in the near future, making the $190.00 oer share level probable.

Sources: Apple Inc, Reuters, CNBC, CME FedWatch Tool, TradingView, Koyfin