Target Corporation (ISIN: US87612E1064) made it through a cloudy quarter characterised by high-interest rates, increasingly thrifty consumers and growing fears of an imminent recession. Earnings and revenues beat Wall Street’s expectations, with earnings surprising remarkably. Earnings landed on $2.05 per share, beating estimates by a staggering 16.06%, while revenues marginally beat estimates by 24 basis points, reaching $25.3B.

Discretionary Retailers have felt the pinch of high-interest rates eating into consumers’ purchasing power as retail sales fell off their pandemic peak to move sideways. Consumers are now focusing more on non-discretionary spending, with a potential recession imminent. Retailers, including Target Corporation, could be under pressure for the remainder of the year as consumers turn to financial prudence.

Technical

Target Corporation’s share price plunged at the onset of the second quarter of 2022 as U.S. retailers missed earnings estimates due to weak earnings on the back of rising inflation. The share price broke below its 100-day moving average, instantly putting it in a downtrend. The stock has since found some stability and traded within a sideway range as volumes declined while the price consolidated. Support and resistance formed at the $139.65 and $181.68 per share levels, respectively.

After rejecting its resistance level, the share price lowered and found support at the 61.80% Fibonacci Retracement Golden Ratio level. Since earnings were positive, bullish investors could be tempted to buy into the stock and take it higher. The share price could be driven higher if the market respects the Golden ratio at large as a support level. The $181.68 level will likely be the next point of interest should the share price move higher.

Alternatively, a high volume breakout below the Golden Ratio could indicate that the market is still in bearish mode. Bullish investors could then look to the support level for long opportunities if the share price approaches the level on declining volumes.

Fundamental

Sales were up slightly by 0.6% to $25.3B, boosted by higher retail prices. Target’s first-quarter gross margin was improved, coming in at 26.3% versus 25.7% a year earlier. Improvement in margins resulted from better inventory turnover, lower freight costs and slightly higher retail prices.

However, the slight growth in the top line was not enough to offset the bottom line decline as a 5.5% growth in operating expenses and the 31.2% surge in net interest expense weighed. Therefore, The bottom line was left reeling as it landed on $950M, down 5.8% from the quarter a year ago.

Weakness in consumer demand progressed in the quarter as Target’s shoppers spent less, with the strongest expenditure recorded in February. Sales began to taper off, weakening in March and softening yet again to close off April.

After discounting for future cash flows, Target’s fair value came in at $175 per share, leaving room for an 8.87% gain if the share price rebounds.

Over five years, Target’s year-on-year revenue growth peaked in 2021 and began tapering off as the world returned to its normal state. At present, Target has one of the weaker revenue growths among its major competitors, reflecting weakness in the company’s competitiveness.

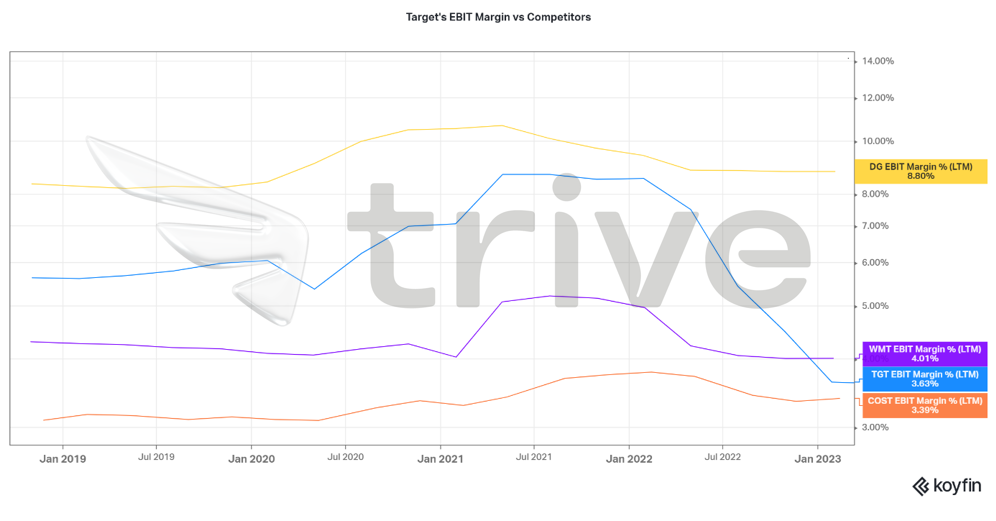

The company’s profitability has also been questioned as it produces less operating income per unit of sale compared to the pandemic period. However, compared to its competitors, Target remains in the midrange with a 3.63% EBIT Margin. This could indicate that its operations are still relatively healthy and aligned with industry standards, as its competitors are not too far off.

Summary

Target’s forecast for the remainder of the year was slightly downbeat as consumers will likely face more pressure from high inflation and interest rates that eat into their pockets. The share price will probably reach its fair value in the medium to long term if the U.S. market avoids a recession and consumption is supported by a less restrictive policy.

Sources: Target Corporation, CNBC, Reuters, U.S. Census Bureau, TradingView, Koyfin