Invesco S&P500 Top 50 ETF (ISIN: US46137V2337) experienced its worst year since its inception in 2005 after shedding just above a quarter of its value, a dismal 25.82%.

Driving the ETF lower was a surge in borrowing costs fuelled by the fastest rate hiking cycle by the Federal Reserve in decades. Borrowing costs surged while growth prospects were impounded, leaving the Top 50 S&P500 constituents bleeding.

The possibility of a Fed rate pause or pivot has restored hope in the prospects of the top 50 as the market led it to recover 13.24% year-to-date. Bullish investors will hope that the worst is over for the S&P500’s Top 50 valuations, but is this just the beginning, with a recession now a possibility?

Technical

The Invesco S&P500 Top 50 ETF found a path of least resistance that saw it trend lower in 2022, forming a descending channel pattern as the price crossed below the 100-day moving average. Support and resistance were formed at the $260.14 and $328.16 levels, respectively.

A higher low was established in December 2022 at the $271.07 level as bullish investors bought into the ETF above 2022’s lows at support. The higher low led price action into a high volume breakout of the ascending channel, with bulls supporting the move higher on strong conviction. Price action reversed at the $307.80 level to send the ETF lower before bulls found interest at the 61.80% Fibonacci Retracement Golden Ratio. The result was a surge above the $307.80 high, validating the beginning of a potential uptrend.

If bulls look to stay in control of the market, they could find the $328.16 level a likely target if they commit to the up move supported by strong buying volume.

Alternatively, a retracement is probable if bearish investors look to undo some of the bullish waves. Bulls will likely buy into the ETF at a discounted price at either the Golden Ratio of $285.10 or the higher low pivot at $271.07 if a retracement occurs.

Fundamental

The Invesco S&P500 Top 50 ETF is predominantly made up of companies in the Technology and Healthcare sectors. Both sectors have been under pressure in the past year due to the high inflation and interest rate environment. However, tech stocks, considered growth stocks for their high yielding and fast pace of growth, suffered more losses than healthcare stocks, which are generally more defensive, due to their necessity throughout economic cycles.

The depiction below shows that the Federal Reserve commenced its rate hiking cycle in the first quarter of 2022 with a 25 basis point rate hike. The Invesco S&P500 Top 50 ETF began taking a turn for the worst within the quarter, as investors feared that higher borrowing costs would weigh down on earnings. At the same time, valuations were discounted with a much heavier discount rate. The result was a 25% plunge in The Invesco S&P500 Top 50 ETF in the first quarter of 2022. On the other hand, the inverse relationship between the ETF’s price and interest rates is highlighted by the period of rates easing and the surge in the ETF value by 45% within the first quarter of 2020.

Tech stocks, highly sensitive to borrowing costs, suffered the most losses, with the top seven tech stocks in the Invesco S&P500 Top 50 all in the negative on a one-year historical basis. The average one-year performance was -14.13%.

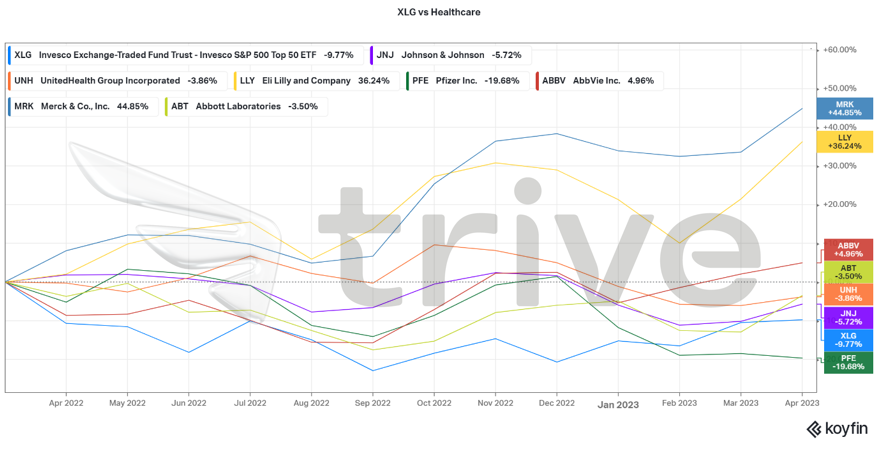

Healthcare stocks, on the other hand, suffered losses smaller than tech stocks, while some of the top healthcare stocks in the S&P500 Top 50 ETF gained massively over a one-year period. Of the top seven Invesco S&P500 Top 50 ETF healthcare stocks, an average growth of 7.61% was achieved since April 2022, further proving the resilience of Healthcare stocks as defensive in times of economic stress.

Within the Invesco S&P500 Top 50 ETF stocks, tech sector stocks have an interest coverage ratio of 18.69%, which is trumped by the 36.66% interest coverage ratio of Healthcare stocks. A higher interest coverage ratio is healthier as it reveals that a company can more than cover its debt obligations. With interest rates rising in 2022, tech stocks were highly exposed to debt obligations, weighing on the sector’s performance overall.

Summary

With the tech sector stocks making up the majority of the Invesco S&P500 Top 50 ETF, higher interest rates negatively impacted the ETF, despite the defensive stature of the second biggest sector the ETF is exposed to. The recovery could likely be in progress and continue through the medium to long term as the U.S. economy shows signs of cooling off, combined with expectations of rates nearing a peak. According to the CME FedWatch Tool, investors are now pricing in a 70.35% chance of the Federal Reserve easing rates by the end of 2023. If rates begin tapering off, the Invesco S&P500 Top 50 ETF will likely experience tailwinds, making the $328.16 level probable.

Sources: Invesco, S&P Global, Financial Times, Factset, Reuters, Federal Reserve