The world is evolving rapidly, with new technological advancements progressing faster than ever before. The internet has played a crucial part in technological evolution, and with Web3, we could be witnessing the birth of a new era. Web3 is a term used to characterize the next generation of the internet, built on a decentralized infrastructure owned and controlled by those who use it. Web3 is built on top of blockchain technology and has the potential to play a significant role in the investment and trading industry by providing a more substantial level of transparency and efficiency in transactions.

Traditionally, the investment industry has operated under a centralised structure, with financial intermediaries like brokers and banks playing an essential role in facilitating transactions between buyers and sellers. With the development of Web3 technology, these intermediaries are no longer needed. The decentralised system verifies transactions through a network of Web3 providers called nodes, eliminating the possibility of manipulation by any single entity.

There are several ways to take advantage of the growth of Web3 and its implications for the industry. Cryptocurrencies are the backbone of Web3, as they provide a medium of exchange that is not under the control of a central authority. Cryptocurrencies also offer investors a way to invest and take advantage of the growth of Web3. Many Web3-based applications are built on blockchain networks and funded through Initial Coin Offerings (ICOs), which investors can buy to benefit from the project’s growth. The graph below demonstrates the growth of cryptocurrencies in recent years, with Bitcoin generating a 10,943.33% return over the last seven years, with the S&P 500 returning a measly 103.31% over the same period, highlighting the growing popularity of these alternative investments.

Within the cryptocurrency industry, decentralised finance (DeFi) allows investors to lend, borrow and trade cryptocurrencies without the need for a traditional intermediary. DeFi alludes to a set of financial applications built on top of blockchain networks that aim to provide permissionless financial services to users. This has created an inclusive financial system that is accessible to investors who were previously excluded or did not have access to traditional financial services. In 2020, the total value locked up in decentralised finance projects spiked to roughly $21Bn.

This democratisation of investment removes the barriers to entry and provides greater access to financial services. For example, decentralised exchanges (DEXs) allow individuals with a stable internet connection to trade cryptocurrencies without needing a bank account or brokerage firm. These exchanges provide increased security and transparency, making it more and more challenging to manipulate the market.

Another critical component of Web3 is smart contracts. These are self-executing contracts where the parties involved write the terms and conditions of the agreement directly into code. These contracts are executed on blockchain networks and operate on predefined conditions and rules. Once the conditions in the smart contract are met, the contract will be automatically executed, and the agreed-upon transaction will be processed, ensuring a trustless transaction. Since the terms of the contract are written into code, there is no need for a financial intermediary, which reduces the cost of the transaction. Automatic execution ensures increased efficiency and speed in processing the transaction, with the decentralised network providing increased security and transparency for the parties involved.

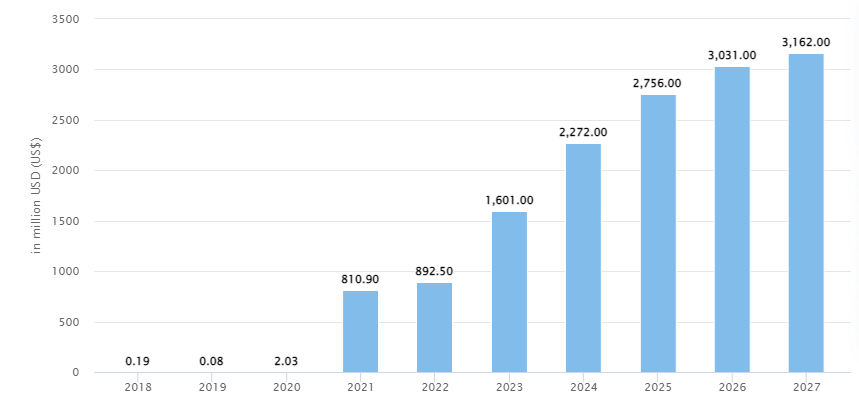

An example of the implications of Web3 technology on the investment industry can be perfectly demonstrated with the emergence of Non-Fungible Tokens (NFTs). These unique digital assets, such as an artwork, represent a particular asset’s ownership. Since they are created on a blockchain, NFTs provide a tamper-proof and transparent record of ownership. Investors interested in investing in rare and collectable assets that have only been accessible by a few individuals are now presented with new and alternative investment opportunities. According to Statista, the number of users in the NFT segment is expected to reach 19.31M in 2027, showcasing rapid growth from its inception in 2014. The graph below shows the expected revenue growth from this segment going forward.

While Web3 technology presents many opportunities for the investment industry, several risks are also involved. Cryptocurrencies are incredibly volatile and fluctuate rapidly, creating risk and uncertainty for potential investors. Secondly, security risks are real, despite the blockchain network being secure. Hacking and cyberattacks could lead to the loss of assets. Finally, since the regulatory environment of Web3 technology is still evolving, there is little clarity about how the existing regulations will be applied to transactions and Web3 platforms.

The impact and development of Web3 on the investment and trading industry are still in their early stages, leaving an immense opportunity for growth and innovation. While there are risks present, the benefits of decentralised systems could lead to broader adoption of Web3 technologies and a shift toward a more efficient and transparent investment and trading landscape.