After delivering its best year on record in 2022, over and above that of 2008, ExxonMobil Corporation (ISIN: US30231G1022) has once again outdone itself, but now, on a quarterly basis.

From a year ago, ExxonMobil’s bottom line doubled, primarily driven by robust demand despite energy prices falling well off 2022’s peak. ExxonMobil exhibits a company with healthy operations and sound financial statements as production and profitability peak, while its end-of-period cash holdings sit at the $32.7B mark.

The U.S. economy has recently started to show cracks, with manufacturing activity pointing lower. For ExxonMobil’s investors, a likely recession could take away from the shine as oil demand takes a knock while energy prices remain off the peaks. Will ExxonMobil make it through the year with a probable recession looming?

Technical

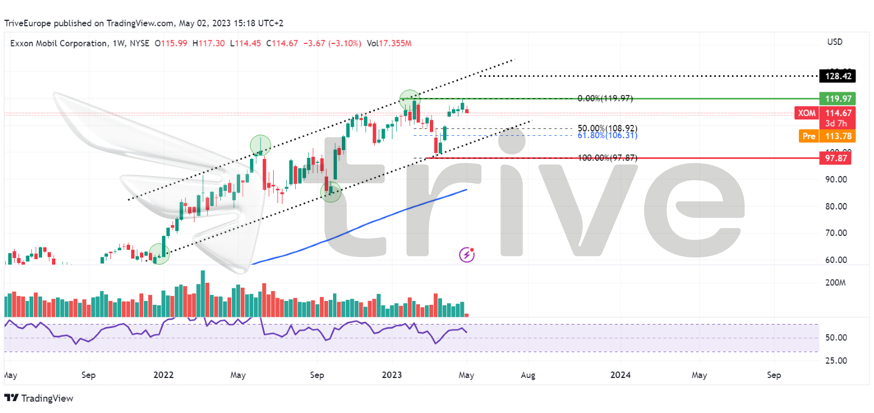

ExxonMobil’s share price has been northbound of late after supply-side constraints sent oil prices skyrocketing earlier in 2022, while demand picked up in 2023 following China’s economic reopening from Pandemic lockdowns. The share price has traded well above its 100-day moving average within an ascending channel pattern. Support and resistance are currently located at the $97.87 and $119.97 per share levels, respectively.

After approaching its resistance level, ExxonMobil’s share price is seemingly reversing, with the current week forming a red candle. A retracement is likely in progress, with the market looking to reprice lower before buyers are enticed to participate.

Bullish investors could look to the 50% or 61% Fibonacci Retracement Golden Ratio for long opportunities. If the share price approaches either level on declining volumes, it could signal a decline in bearish momentum, thereby increasing the chances of a reversal. Should they participate in an upside move, bullish investors will probably earmark the $119.97 per share level as a point of interest.

Fundamental

In 2022, ExxonMobil enjoyed an excellent year on the back of an energy price surge started by the Russia-Ukraine conflict due to supply-side constraints. In 2023, commodity prices, particularly crude oil, are far off their 2022 peak, and the theme has shifted to one of volumes rather than price for ExxonMobil.

ExxonMobil’s outputs increased vastly to offset the pullback in energy prices, primarily driven by robust demand, partially due to China’s economic reopening. This resulted in ExxonMobil beating Wall Street Estimates and doubling its earnings from the same period a year ago to $11.43B from $5.48B.

Oil and gas production increased by nearly 300,000 barrels per day (bpd) compared to a year ago, representing a 40% rise in output, primarily driven by increased production in Texas and Guyana. The output growth was enough to offset a 16% drop in oil prices from a year ago.

After discounting for future cash flows, ExxonMobil’s fair value was derived at $128.42 per share, leaving room for a 14% upside gain in the share price.

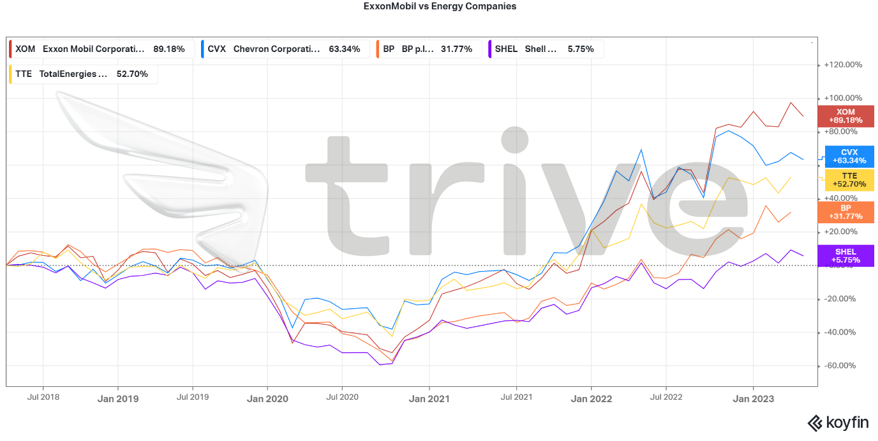

Compared to some of its notable peers, over five years, ExxonMobil’s share price is the top performer, with a growth of 89.18%, with the next closest competitor achieving a growth 25% behind that of ExxonMobil. ExxonMobil, the giant of them all, remains an investor’s top choice, as represented by its solid growth above its peers.

Summary

As a going concern, ExxonMobil has a firm footing, given its healthy cash balance, which it could use to weather the storm (potential recession), along with a growing asset base and incremental profitability. The share price is likely to move north so long the business holds its operations steady in the absence of a major recession. Investors will closely monitor how the share price unfolds after reacting to resistance at the $119.62 per share level.

Sources: ExxonMobil Corporation, Reuters, CNBC, TradingView, Koyfin