Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Deutsche Bank showcased resilience in the second quarter of 2023 amid its ongoing restructuring efforts. With a steadfast focus on cost reduction and bolstering profitability, the bank posted a net profit of €763 million, slightly surpassing expectations by 4%. This achievement marked the 12th consecutive quarterly profit since their comprehensive restructuring strategy took flight in 2019.

However, despite this impressive feat, there was a notable 27% decline in the bottom line compared to the previous year, highlighting the headwinds faced. The bank grappled with higher non-interest expenses stemming from increased litigation and severance charges, coupled with the challenges of surging inflation exerting pressure on their cost structure.

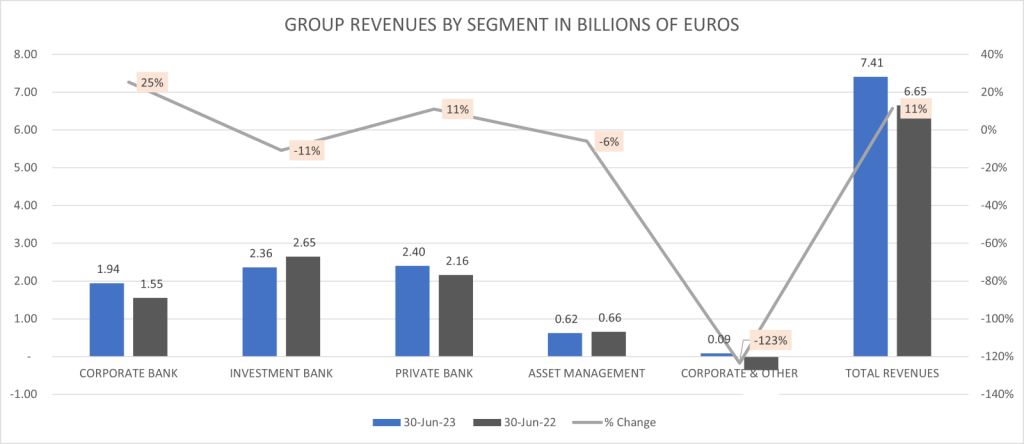

Notwithstanding these obstacles, Deutsche Bank displayed its ability to surpass revenue expectations, with net revenue amounting to €7.4 billion, exceeding last year’s second quarter by an impressive 11%.

As market observers keenly dissect Deutsche Bank’s performance, the outlook remains unpredictable. The bank’s determination to achieve long-term sustainability through cost management and profitability enhancement amidst the complexities of an evolving economic landscape sparks interest. What’s next for the ninth-largest European bank?

Technical

After enduring a tumultuous 2022 with a drastic market value drop of nearly 50%, Deutsche Bank has shown signs of a remarkable turnaround in its price action. The establishment of a low at €7.49 per share in September 2022 has since served as a strong support level, attracting bullish investors to the stock. Their optimism was fuelled by improved earnings, driven by higher net interest income amid steep interest rates.

A significant bullish signal was triggered when the share price crossed above the 100-day moving average and sustained the upward momentum for five weeks, producing a year-to-date high at €12.48 per share. However, the banking sector crisis caused a selloff, pushing the share price below the 100-day moving average, albeit finding intermediate support at the 61.80% Fibonacci Golden Ratio. The market’s respect for the Golden Ratio as a support level led to a sideways consolidation forming a rectangle pattern characterized by low trading volumes.

A surge in trading volumes accompanied by a breakout above the consolidation pattern could prompt a sustained move in the direction of the breakout. For optimistic investors, the €12.48 per share level could serve as a significant level of upside interest if a sharp breakout above the 50% Fibonacci level transpires.

Fundamental

Deutsche Bank’s quarterly performance offers a tale of two worlds, with its corporate and private banking divisions basking in success while its investment banking and asset management units grapple with market headwinds. Benefiting from rising interest rates, the corporate and private banking divisions soared, registering impressive revenue growth of 25% and 11% year over year, respectively. The interest-earning division’s net interest income doubled to €10.7 billion, a testament to the impact of higher interest rates.

Despite these triumphs, the bank faced challenges in its investment banking and asset management segments, as revenues dipped 11% and 6% due to the prevailing financial market environment. Additionally, a 15% surge in non-interest costs to €5.6 billion, coupled with a 4% increase in adjusted costs to €4.9 billion, dampened the bottom line for the second quarter.

Source: Trive Financial Services Malta – Deutsche Bank, Nkosilathi Dube

To combat the effects of inflation and rising non-interest costs, Deutsche Bank accelerated its cost-cutting measures and set a revised cost-saving goal of €2.5 billion from €2.0 billion. Operational efficiencies worth around €1 billion were realized or anticipated by the end of the first half of 2023 through various strategic actions, such as branch closures, standardizing processes, and streamlining technological infrastructure.

Looking ahead, the bank plans to eliminate up to 10% of its 17,000 retail workforce in Germany and invest significantly in technology and controls enhancements to foster future revenue growth. Meanwhile, economists warn of potential headwinds, including a softening German economy, steep inflation, and lingering regulatory issues that have plagued the bank for years.

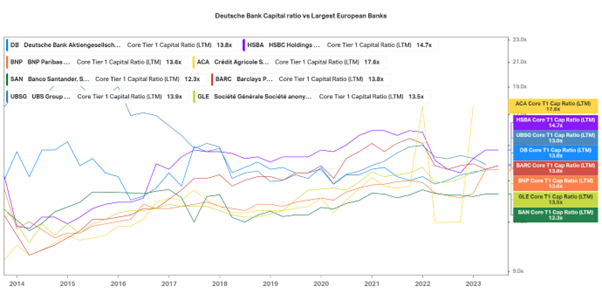

Despite the challenges, Deutsche Bank exhibited commendable liquidity, with its common equity tier one capital ratio (CET1) rising to 13.8%—surpassing its 2025 capital objective of around 13%. This indicates a healthy financial position and the bank’s ability to withstand adverse economic conditions.

As the German economy treads uncertain waters, the bank must balance its growth aspirations with prudent risk management practices. A nimble approach to adapting to market dynamics and a relentless focus on capital preservation and cost optimization will be crucial for Deutsche Bank to thrive in the evolving financial landscape. Amidst an ever-changing environment, only time will reveal the efficacy of the bank’s strategies in realizing its growth ambitions and overcoming the challenges ahead.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Deutsche Bank’s Core Tier 1 Capital Ratio shines at 13.8x, placing it confidently among Europe’s top banks. Its financial strength surpasses half of its larger peers, providing a robust buffer against losses and bolstering resilience in the face of economic uncertainties. With a solid foundation, the bank stands ready to weather potential storms with confidence.

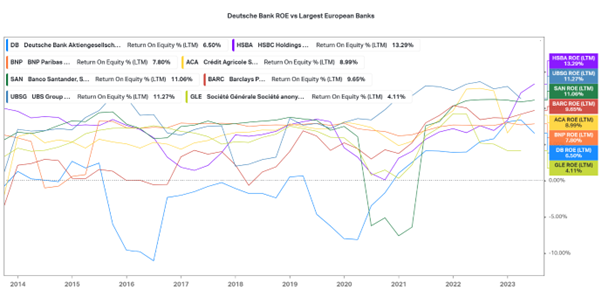

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Deutsche Bank’s Return on Equity (ROE) disappoints at 6.50%, lagging behind its major competitors. As the least efficient in generating returns for shareholders’ equity, it faces a challenge in delivering sustainable profitability. Past fluctuations add to the urgency for the bank to improve operational effectiveness and optimize capital utilization for long-term success.

Source: Trive Financial Services Malta – Deutsche Bank, Nkosilathi Dube

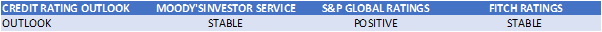

Deutsche Bank has received a series of credit rating upgrades from major agencies, reflecting the bank’s successful transformation efforts. With ratings in ‘A’ territory (A-), Fitch highlights the bank’s stable and diversified business model, improved earnings quality, resilient asset quality, strong capitalization, and robust funding and liquidity base. These upgrades underscore Deutsche Bank’s strengthened financial position and potential for sustainable growth as the major credit rating agencies rate the bank’s outlook between stable and positive.

After discounting for future cash flows, a fair value of €11.39 per share was derived.

Summary

Deutsche Bank showcased resilience in its second quarter 2023 fiscal year, with its 12th consecutive profitable quarter, despite the headwinds faced. The bank strives for sustainable growth through cost-cutting and further income generation, which could propel its share price towards the fair value of €11.39 per share in the medium to long term.

Sources: S&P Global Market Intelligence, Fitch, CNBC, Reuters, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.