The EURJPY currency pair has seen bulls take over after gaining 1.40% week-on-week. The risk-on sentiment has driven the pair higher from signs of a weakening U.S. economy and the European Central Bank’s firm focus on fighting inflation with further rate hikes.

The EURJPY interest rate differential has also been vital in strengthening the Euro as it has been bolstered by consistent rate hikes, while the Yen trades on negative interest rates. In addition, Japan recorded a lower-than-expected current account balance on Monday, driving further weakness in the Yen.

Technical

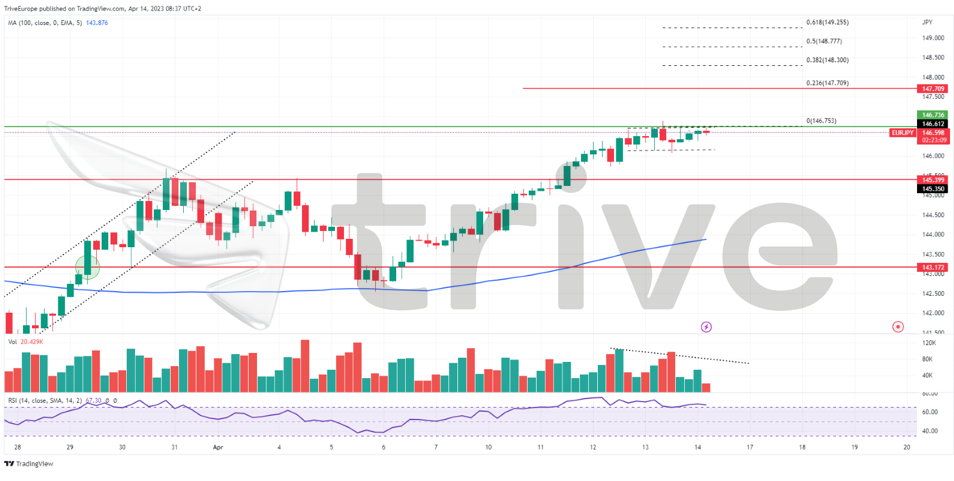

The EURJPY currency pair has traded firmly in an uptrend, with the price running away from its 100-day moving average. Support was established at the 145.399 level following a breakout above the level of significance, which acted as resistance before. Resistance was established at the 146.736 level after a downtrend began in December 2022.

Volumes have declined with price approaching the resistance level. A consolidation formed a rectangle pattern as bulls and bears fight for dominance at the significance level. A breakout to either side of the consolidation pattern on high volumes could validate an extended move in the breakout direction.

A breakout to the upside of the 146.736 level could give bulls reason to take the pair higher on bearish weakness, with the next probable level of interest set at the 23.6% Fibonacci Extension, at the 147.709 level. Alternatively, a breakdown below the consolidation pattern could validate a leg down, with bears likely aiming for support at the 145.399 level.

Summary

Traders will be looking to determine whether Euro strength will prevail over and beyond December’s highs. A breakout above the 146.736 level could signal undying bullish confidence and a stronger likelihood of the pair advancing beyond December’s highs.

Sources: Reuters, TradingView