The ProShares UltraPro Russell 2000 ETF (NYSE Arca: URTY) has seen a sharp decline in value following a 23.12% plunge in the prior week.

Driving the bearish momentum was the risk of contagion from the stress in the Banking Sector and panic selling. Following the second and third largest bank failures since the 2008 Financial Crisis, Silicon Valley Bank (SVB) and Signature Bank, traders and investors moved cautiously as fears of more failures arose amid loss-making fixed-income portfolios.

Traders will have their eyes glued to the U.S. CPI, PPI and Retail Sales for signs of inflation’s progress in February. Probabilities of no rate hike rose to 44.6% as the banking sector’s stresses have led to traders assuming the likelihood of the Federal Reserve protecting the sector.

Technical

URTY’s uptrend, represented by an ascending channel, was concluded following a breakout below the dynamic support level. Support and resistance currently stand at the $35.31 and $43.83 levels, respectively.

With the pre-market trading below support, a breakout below the level on high volume is likely to drag the ETF lower. If bears continue to run riot, the price will likely be directed towards the $32.73 level based on the Fibonacci Extension. A rejection is likely if bulls are attracted to the $32.73 level as a support zone. Investors will likely look to the $43.83 level with interest as a take-profit level.

Fundamentals

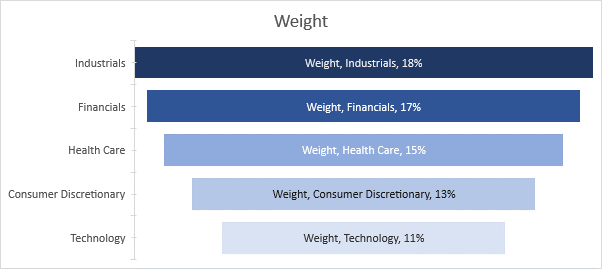

The top 3 sectors within the Russell 2000 are the Industrials, Financials and Health Care sectors constituting 18%, 17% and 15% of the index, respectively. With the financial sector making up almost a fifth of the index, the recent selloff in the sector has seen the URTY find little friction towards the downside, leaving minimal buying opportunities.

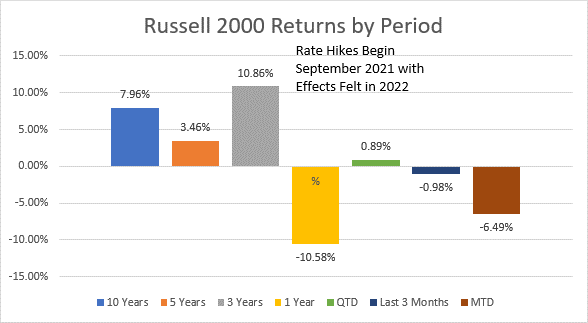

The Russell 2000 struggled to gain upside traction from the beginning of the rate hike cycle. Russell 2000 company valuations were dampened as borrowing costs rose, while the high borrowing costs subdued growth prospects. The overall performance began to decline from the impressive three-year return, with most of the decline coming from 2022 as rate hikes became prominent.

Summary

Traders will look to the U.S. CPI tomorrow to gauge the Federal Reserve’s next interest rate move. If the CPI comes in much higher than anticipated, the Federal Reserve will likely be inclined to raise rates by a jumbo-sized 50 basis points. If interest rates are raised significantly, the URTY ETF will likely experience further downside price action before buying opportunities are presented. However, if the rate hike is minimal (25 basis points), investors will probably look to buy into the ETF at present levels.

Sources: FTSE Russell, CME FedWatch Tool, Reuters, TradingView