The second largest pharmacy chain in the U.S., Walgreens Boots Alliance Inc (Nasdaq: WBA), has its investors making merry of the better-than-expected earnings results for the second quarter of its fiscal year. The share price trades 4.22% above its pre-earnings share price as investors buy on optimism.

Despite the past few quarters seeing a significant decline in demand for Covid-19 vaccines, WBA was able to offset the decline in sales with a stronger performance in its retail pharmacy business. WBA beat its earnings and revenue expectations by 5.16% and 3.98%, respectively, highlighting its operational health and sales efficiency.

Technical

The WBA share price has been in freefall since 2019, trading below the 100-day moving average for most of the period. A descending channel pattern formed in the process, with support and resistance forming at the $32.59 and $55.30 levels, respectively.

With price action currently trading near support with oversold RSI conditions at the $32.59 level, bullish investors might be enticed to enter the market. If they commit to the upside, bullish traders will likely look to the $55.30 level with interest. Alternatively, a high volume breakout below the $32.59 level could signal the bull’s weak hands in the market. The share price will likely be lowered further before bullish investors find interest at the next support at the $26.84 per share level.

Fundamental

Second quarter sales increased by 3.3% year-on-year to $34.9B, boosted by improved sales in the Non-Covid-19 category. WBA’s core operations, the U.S. retail pharmacy, recorded $27.6B in revenues, exceeding expectations by 3%. Growth in volumes of prescription drugs offset the decline in Covid-19-related products to the relief of WBA’s stakeholders. Comparable prescriptions filled increased by 3.5%, while same-store pharmacy sales rose 4.9% from last year, driving sales north.

WBA’s outlook is positive following its acquisition of VillageMD and CareCentrix for nearly $5.5B, along with the acquisition of urgent care provider Summit Health in January. Through the acquisitions, WBA induced organic growth, with the Walgreens Health segment revenues rising sharply to $1.6 billion. VillageMD grew pro forma sales by 30%, adding to the clinic’s growth and footprint expansion. The closing of VillageMD’s acquisition of Summit Health makes WBA one of the largest players in primary care, with the best-in-house assets across the care continuum, mainly putting the business and its core operations at an advantage.

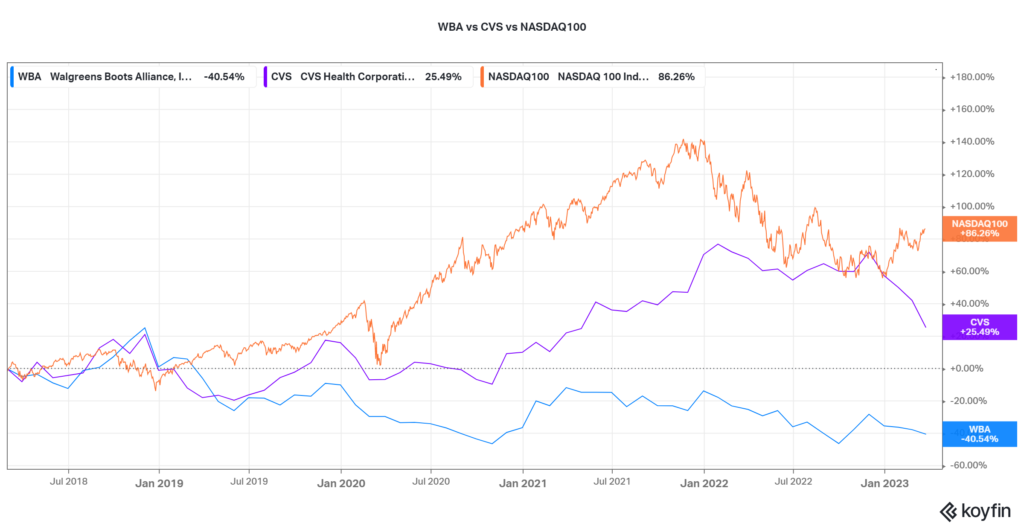

Below is the total return of WBA, NASDAQ100 and CVS Health Corporation (CVS), which is WBA’s biggest competitor. The WBA’s share price performance is highly correlated with the NASDAQ100 and CVS as they move in similar directions. However, WBA’s performance has been negative over five years compared to CVS and the broader stock index, NASDAQ100. Driving WBA’s share price lower was a cocktail of operational challenges, which led to its EBITDA depleting, along with a negative outlook by Fitch Ratings in 2021 compounding the issues.

After discounting for future cash flows, a fair value of $49.48 per share was derived, leaving room for a 48% gain to the upside if bullish investors see the value.

Summary

Walgreens Boots Alliance Inc will likely find its share price magnetised to the upside. Following the improved performance on a year-over-year basis and its strategic acquisitions, which add to its synergies, the revenues are likely to move north and filter into improved earnings performance, making the $49.48 per share level probable.

Sources: Walgreens Boots Alliance, Reuters, FitchRatings, TradingView, Koyfin