Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Snap Inc’s (ISIN: US83304A1060) Q2 earnings unveiled a compelling surprise, with its financials charting a course that surpassed Wall Street’s projections. Despite a year-on-year backdrop of relative financial weakness, Snap managed to orchestrate significant advancements in its core operations.

Remarkably, revenue surged to $1.07 billion, a notable 1.32% above expectations, underscoring Snap’s commitment to resilience in a challenging economic landscape. The company’s earnings per share also mirrored this upward momentum, exceeding estimates by 2.66% with a loss of $0.24 per share.

Notably, Snap witnessed a surge in daily active users, concurrently achieving enhanced returns on advertising investments. The marriage of Artificial Intelligence (AI) and user engagement unveiled a captivating story, with Snap’s platform experiencing heightened activity. The launch of My AI Snaps for Snapchat+ subscribers enabled seamless interaction with AI-generated responses, fostering deeper connectivity.

Over 150 million users engaged in a staggering 10 billion interactions with Snap’s AI-powered chatbot, My AI. This achievement underscores its position as a premier consumer chatbot, riding the wave of AI integration while demonstrating its market appeal and transformative potential.

However, as the curtain drew on this earnings spectacle, Snap’s market value saw a dip of over 25%, a reflection of the company’s forecast falling short of analysts’ predictions for the current quarter.

Technical

After a turbulent 2022 that saw Snap’s share price plummet by over three-quarters, the storm seems to have subsided, marked by a slowdown in selling pressure as trading volumes recede. The stock’s current trading level, resting at a three-year low, remains entrenched in a downtrend below its 100-day moving average.

Notably, amidst this challenging backdrop, an ascending channel pattern has emerged in the last three-quarters, thanks to enterprising investors injecting optimism into the market. This pattern, characterized by a series of higher highs and higher lows, has instilled some buoyancy into the stock’s journey.

As the stock’s recent upward momentum faltered at the upper boundary of the ascending channel, a notable resistance point materialized at $13.15 per share. Conversely, a key support level at $7.86 per share, aligned with the ascending channel’s lower boundary and a previous stronghold from late 2022, is now in proximity.

Should the prevailing downward force persist, the stock price may gravitate toward the $7.86 per share mark. However, the dynamics could shift if buying interest outweighs selling pressure, mirroring the precedent set in prior instances. This scenario could trigger a rebound from the $7.86 level, potentially redirecting hopeful investors’ attention toward the $13.15 per share threshold as a focal point.

Fundamental

Snap Inc.’s second quarter performance paints a dynamic picture of resilience and recalibration, with both challenges and triumphs shaping its narrative. The company navigated a 4% dip in sales to $1.07 billion compared to the previous year, marking its second consecutive year-on-year revenue decline.

Source: Trive – Snap Inc, Nkosilathi Dube

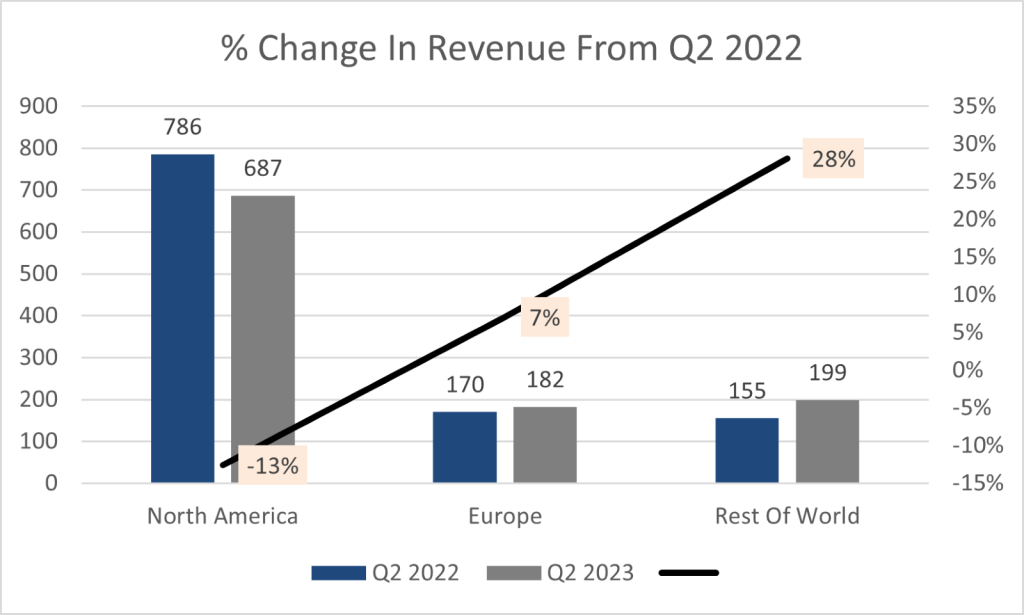

Snap’s regional revenue landscape revealed divergent paths in its second-quarter performance. While North America faced a 13% revenue decline to $687 million, Europe showcased resilience with a 7% surge to $182 million. However, the real standout was the Rest Of World segment, shining with impressive revenue growth of 28% to $199 million. North America remains the company’s most important region, contributing 64% to the top line, while the remaining regions contribute equally to the top line. However, within these financial nuances lies a tale of strategic manoeuvring and growth.

A pivotal reduction in net loss by 11% to $377.3 million, or 24 cents per share, from last year’s $422.1 million, or 26 cents per share, showcased the company’s commitment to optimizing its financial landscape. This achievement was underpinned by an ambitious cost-cutting drive initiated in 2022, which led to an 8% year-over-year drop in operational expenses to $615 million.

The company’s cash management also exhibited marked improvement. Net cash used in operating activities declined by 34% to -$81.94 million, signalling more efficient resource utilization compared to the prior year’s more pronounced drain. Moreover, a 19% enhancement in free cash flow to -$118.88 million underscored Snap’s strategic strides.

While the financial landscape reflected some restraint, there were rays of optimism in user engagement. Daily Active Users (DAUs) surged by a robust 14%, amassing an additional 50 million users to reach a total of 397 million. This growth rippled across geographies, with North America, Europe, and the Rest of World all witnessing sequential surges. Notably, Snapchat+ subscribers crossed the 4 million milestone, attesting to the platform’s resolute and expanding popularity.

Snap’s content ecosystem also flourished, with the total time spent on Spotlight content soaring over threefold compared to the previous year. This growth propelled Spotlight’s monthly active viewers to exceed 400 million, marking a remarkable 51% uptick from the previous quarter.

These augmented activity levels bore fruits for advertisers as well. Snap’s resolute focus on bolstering user engagement translated into a more favourable return on investment for advertisers. Noteworthy, the “purchase-related conversions” metric experienced a notable 30% surge compared to the first quarter, evidencing the positive impacts of Snap’s platform improvements.

Source: Trive – Koyfin, Nkosilathi Dube

Snap Inc.’s share price journey in 2023 has been a rollercoaster of volatility. Despite delivering a 3.35% gain year-to-date, it lags significantly behind the S&P500’s robust performance, reflecting a fourfold difference. The tug-of-war between Snap’s share price and the market index underscores the intricate interplay between company-specific dynamics and broader economic trends. Recent turbulence, sparked by guidance disparities, showcases how swiftly investor sentiment can alter the trajectory, underlining the profound influence of market sentiment on the stock’s performance.

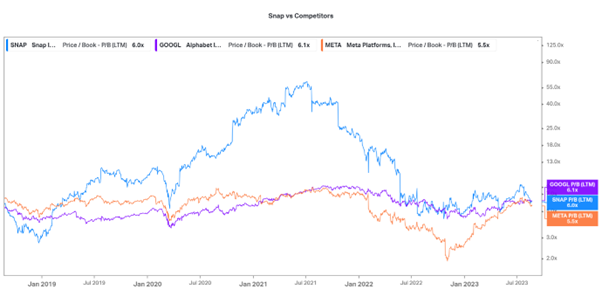

Source: Trive – Koyfin, Nkosilathi Dube

Snap Inc.’s price-to-book ratio of 6.0× places it alongside tech giants like Alphabet Inc (ISIN: US02079K3059) (6.1×) and Meta Platforms Inc (ISIN: US30303M1027) (5.5×). However, this parity disguises a deeper nuance. Despite comparable ratios, Snap’s lack of consistent profitability suggests caution. The absence of year-on-year returns could imply an overvaluation.

After discounting for future cash flows, a fair value of $10.10 per share was derived.

Summary

Against a backdrop of fiscal challenges, Snap’s ability to harness its resources, amplify user engagement, and enhance advertiser ROI highlights some encouraging progress in the business’s dynamics. As Snap readies for the future, the past quarter’s story is one of adaptation, growth, and strategic promise within a dynamic tech landscape. Its fair value of $10.10 per share could materialise, given that it continues to march forward toward profitability.

Sources: Snap Inc, Reuters, CNBC, TradingView, Koyfin

This material is provided for informational purposes only and does not constitute financial, investment or other advice. No opinion contained in this material constitutes a recommendation by Trive Financial Services Malta Limited or its author as to any particular investment, transaction or investment strategy and should not be relied upon in making any investment decision. In particular, the information does not take into account the individual investment objectives or financial circumstances of the individual investor. Trive Financial Services Malta Limited shall not be liable for any loss, damage or injury arising from the use of this information.