Reata Pharmaceuticals Inc (NASDAQ: RETA) has invested heavily in its research and development exercise. Over the past five years, Research and development costs have surged 11% on a compounded annual growth rate basis to $169.84M, making up 60% of the expenses. Despite significant costs weighing on the bottom line, RETA’s share price has surged 146.44% year-to-date on the back of optimism surrounding RETA’s latest approved pharmaceutical products which are one of a kind.

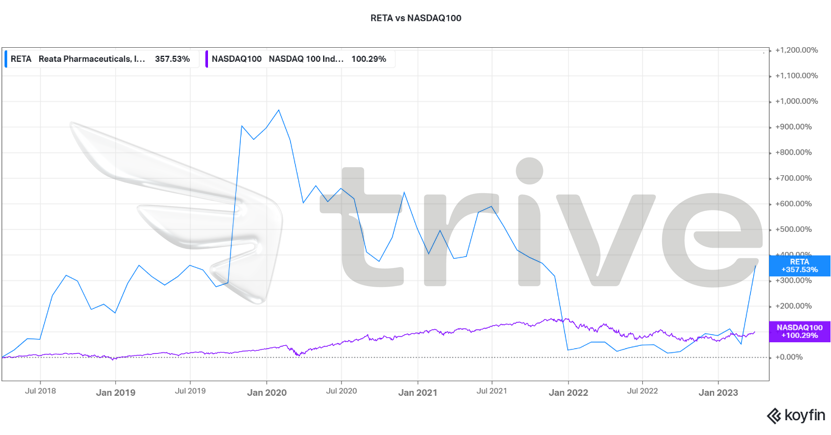

Reata’s stock price has typically outperformed the NASDAQ100 over the past five years, except in the past year, when higher borrowing costs heavily subdued stock valuations. RETA’s share price reacted adversely to the higher interest rate environment following a surge in total debt of 2154% from 2021 to 2022, which led to interest expense growing by 13% in the same period.

Technical

RETA’s share price has been in a steep downtrend characterised by a descending channel pattern formation. Support and resistance were established at the $19.17 and $115.17 per share levels, respectively. The downtrend paused as volumes declined and the share price consolidated sideways within a rectangle pattern. Price bounced between the $19.17 and $41.58 per share range over a year.

A breakout above the $41.58 per share level on high volumes could signify bullish investors eager to take the stock higher as the battle between them and bears ended with bulls on the winning side. If the bullish momentum persists, bulls will likely look to the next level of significance at the $115.17 per share level, leaving room for a 22.71% gain in the share price.

Alternatively, if bearish investors undo the work of the bulls, they will likely lead the share price into a retracement. Bulls will probably find the 61.80% Fibonacci Retracement Golden Ratio level at $41.48 as an enticing discount to buy the share if they did not participate in the move, which led to the consolidation pattern ending. However, if the golden ratio does not hold as support, price could retrace 100%, leaving $19.17 as the next probable level of interest for bullish investors to pile into.

Fundamental

From a financial perspective, RETA has performed negatively, with revenues declining annually by 80.71% to $2.22M. Despite taking a severe knock to the top line, the gross profit remained in positive territory, reaching $1.09M. However, the bottom line was left frail with a loss of $311.90M, up 4.88% a year prior.

However, with the financials pointing south, RETA’s share price has not been on a slippery slope; instead, it remained stable to positive on the back of progress in RETA’s product development. The share price surged 146.44% due to the regulatory approval of Skyclarys, a drug treating a rare neurological disorder. Analysts expect tailwinds to flow towards RETA’s revenues, with $1.2B forecast to be the peak of sales of Skyclarys within the industry. The Pharmaceuticals business’ valuation will likely point north once it realises income from new products.

After discounting for future cash flows, a fair value of $102.68 was derived, which could be probable if RETA successfully achieves sales growth on its latest products. With the current share price undervalued, this could leave room for a 10.47% upside gain toward the fair value.

Summary

Fundamentally, RETA’s performance is somewhat repellent, especially to investors driven by earnings and dividend payments. However, with the organisation committed to investing in Research and Development, new product lines could be developed, introduced and added to the revenue matrix. Bullish investors will likely be placed in a better position buying at either the $41.48 or $19.17 per share levels.

Sources: Reata Pharmaceuticals Inc, TradingView, Koyfin