Investors could conclude that the banking sector crisis is now for the history books after the behemoth of JPMorgan Chase & Co (ISIN: US46625H1005) and multiple banking giants reported upbeat earnings for the current quarter.

JPMorgan’s share price surged 9.61% following its upbeat earnings results, which saw the earnings and revenues beat consensus by 20.09% and 6.16% to land on the $4.10 per share and $38.35B, respectively. Driving the positive performance was primarily the elevated interest rates environment that enabled appreciable interest earnings to flow to the top lines of the baking sector.

With the elevated interest rates likely enduring for the short to medium term, banking sector executives will be head over heels for the current environment as they score points on their bank’s upbeat performance.

Technical

On the Weekly chart, JPMorgan’s share price entered a downtrend in the second quarter of 2022 after the share price crossed below the 100-day moving average, while the market structure printed lower highs and lows. Support and resistance were established at the $76.97 and $172.06 per share levels, respectively.

Following a reversal from resistance, the share price found support at the $113.30 per share level, which coincides with the 61.80% Fibonacci Retracement ratio, as the market was unprepared to commit further bearish momentum and lead the share price towards the support level.

On the Daily chart, the share price uptrend was validated by price moving above its 100-day moving average after rejecting the Golden Ratio. Bullish Investors currently have a stronghold over the market, supported by price retracing to the 50% Fibonacci Retracement level at the $124.52 per share level before being rejected for upside favour.

If a high volume breakout above the daily resistance of $144.42 ensues, investors could probably prepare for another leg up. Bullish investors will likely send the share price towards the weekly resistance at the $172.06 per share level if they commit to the move in numbers.

Alternatively, if supply outweighs demand near the daily resistance, a retracement to either the 50% or Golden Ratio of the Fibonacci Retracement could provide ample long opportunities. Investors could consider recommencing the uptrend if the share price approaches either level on declining volume, indicating the wearing out of bearish momentum.

Fundamental

The U.S.’s biggest bank by assets recorded resounding record first-quarter revenue, up 25% to $38.35B. Net interest income surged almost 50% from the prior year thanks to higher rates that were hiked the most aggressively in decades.

The highly boosted top-line filtered through to the bottom line after JPMorgan recorded a staggering 52% jump in net income to $12.62B. This helped increase the bank’s return on common equity by 700 basis points from the first quarter a year ago, while earnings per share leapt 56% over the same period.

Despite the peak of the banking sector crisis largely behind the sector, additional risks could abound. However, in all the turmoil, JPMorgan gained as nervous customers withdrew from regional banks to deposit cash into blue-chip banks. JPMorgan’s deposits rose to $2.38T in the first quarter, up from $2.34T in the final quarter of 2022.

In addition, JPMorgan provided upbeat guidance for the remainder of 2023, with net interest income forecast to reach $81B, up $7B from the last forecast. The high-interest environment will likely serve tailwinds to the large bank, leaving the top line and earnings in a sweet spot.

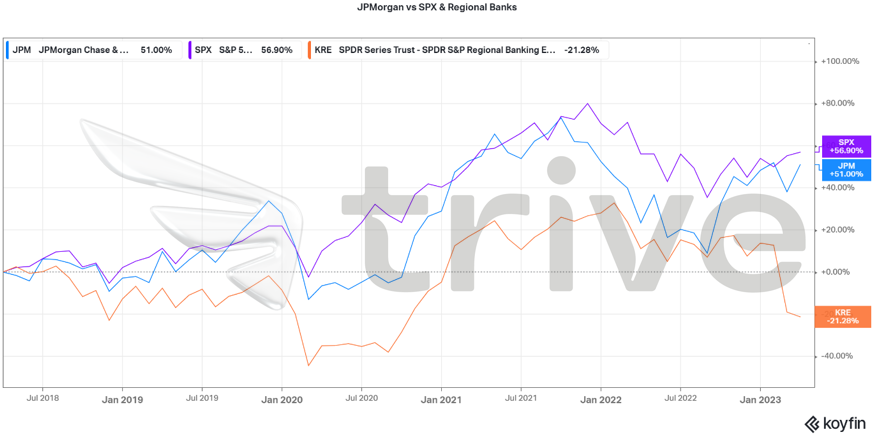

Over five years, JPMorgan has closely correlated with the broader market of the top 500 companies in the U.S. (S&P500: SPX). Despite the strong positive correlation, JPMorgan has slightly underperformed the broader market by almost 6%, although still producing a fruitful 51% return over the period. JPMorgan’s share price shines compared to the smaller regional U.S. banks, as depicted by the SPDR S&P Regional Banking ETF (ISIN: US78464A6982). JPMorgan’s blue-chip character has seen its stability attract more deposits, and this has been highlighted through the recent banking sector crisis.

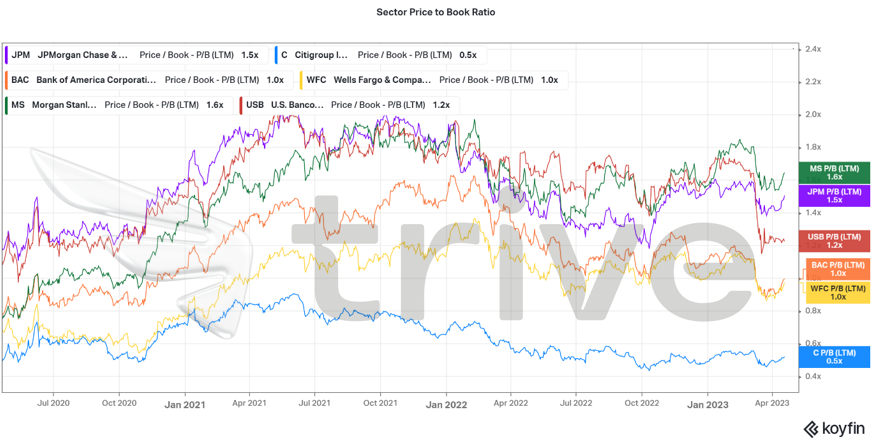

JPMorgan trades at a Price to Book (P/B) value of 1.5×, putting it second to Morgan Stanley within a group of the larger S&P500 banks. This could suggest that the market perceives the bank to be of high value as it trades at a premium to its book value. Compared to its competitors, JPMorgan is, therefore, slightly overvalued. However, given the positive earnings and guidance for 2023, the P/B ratio will probably have room to extend to the upside.

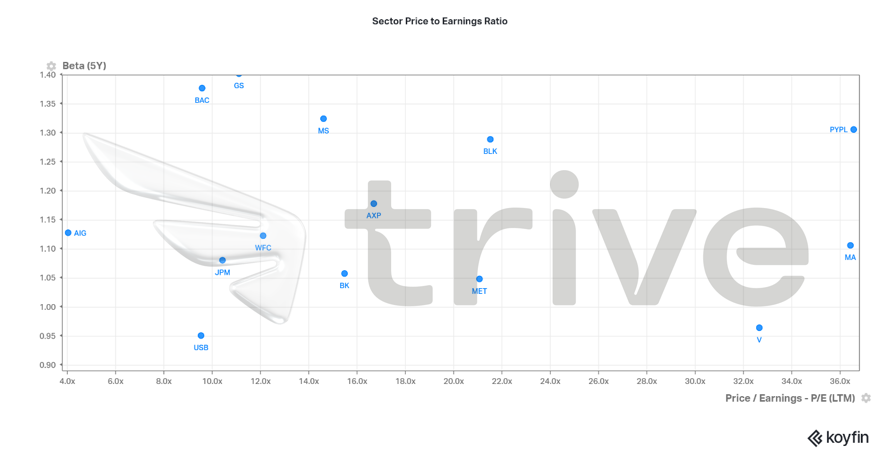

JPMorgan’s Price-Earnings multiple is below its closest competitors’ average, making it a possible value investment target. The bank’s operations remain resilient, and considering it was the top performer in the quarter within the banking sector, there could be further value creation in the near future.

After discounting for future cash flows, a fair value of $155.56 per share was derived, leaving room for a 10.14% upside gain. The fair value falls in between the daily and weekly technical resistance. If a breakout above the daily resistance level ensues, the fair value could be probable, with the next level of interest at the Weekly resistance.

Summary

Given JPMorgan’s positive guidelines and the prevailing condition of high-interest rates across the bank’s global footprints, the share price could be attracted to the upside if the bank consistently realises positive earnings and revenues. The fair value of $155.56 is highly probable in this scenario, especially if the global economy avoids an economic downturn.

Sources: JPMorgan Chase & Co, CNBC, Reuters, Forbes, TradingView, Koyfin