Cintas Corporation (NASDAQ: CTAS), a leader in its class with a 6.25% market share, posted solid third-quarter results, with earnings and revenues beating expectations by 3.74% and 1.70%, respectively. The share price surged 4.84% post-earnings as bullish investors gained confidence in the company’s relative value.

Cintas Corporation rode a wave of economic recovery, post the pandemic, which practically slowed down business activity across the board. The return to normalcy has resulted in increased client counts and penetration per client.

Technical

CTAS has traded in an uptrend since the second quarter of 2022, forming support and resistance at the $380.78 and $469.59 per share levels. A retracement from the resistance level over 14 weeks led the price into the 50% Fibonacci Retracement level at the $425.37 per share level. The $425.37 per share level acts as a support level within the upward trend after investors rejected the idea of moving lower from the level.

With Bullish investors firmly in control following the positive earnings result, the share price surged towards resistance at the 469.59 per share level. If bullish investors commit to the upside, a breakout above resistance on high volumes could indicate bullish momentum undoing any form of resistance, with pressure building up for the upside. Bullish investors will likely be enticed to enter on a breakout with hopes of the trend continuing towards $508.47 per share.

Alternatively, if bullish momentum begins thinning, bullish investors could look to buying at a 50% discount or the $425.37 per share retracement level. The next probable level of interest for bullish investors will likely be the $380.78 level if bears have downside plans set out for them.

Fundamental

CTAS’s customer base is split into two. The business serves 70% of its customers in services-providing sectors, including healthcare, hospitality, and food service. In comparison, the remaining 30% comprises customers in the goods-producing sectors of manufacturing, construction, and more. With the pandemic period in the rearview, CTAS has found itself in a prime position where the world is recovering from post-pandemic economic constraints.

Positive volume growth from new customers and effective penetration of existing customers with additional products and services resulted in CTAS achieving double-digit increases in operating income, rounded off.

Revenues for the quarter surged 11.7% year on year to $2,2B, due to higher segmental revenues, with the main revenue-generating segment, the Uniform Rental and Facility Services, up 10.5%. The improved performance in the top line filtered through the income statement as operating income and net income rose 9.6% and 3.3%, respectively. Both figures represent enhanced operational efficiency and the ability to turn a profit.

The income statement’s positive health shined through favourable margin news, with gross and operating margins expanding compared to the last year. The gross margin grew by 140 basis points from the quarter a year ago.

The balance sheet was also bolstered by the asset base growing by 4%, exceeding growth in liabilities of 1%. The business is better positioned to meet its obligations even if it has to liquidate some of its assets.

After discounting for future cash flows, a fair value of $508.47 per share was derived. The share price currently trades at an 8.62% discount, leaving decent room for upside exposure.

The company forecasts an upbeat 2023 and now expects revenues of $8.74 to $8.80B, compared with $8.67 to $8.75 billion anticipated earlier. Earnings of $12.70-$12.90 per share for the current fiscal year, compared with $12.50-$12.80 estimated earlier, add to the rosy outlook.

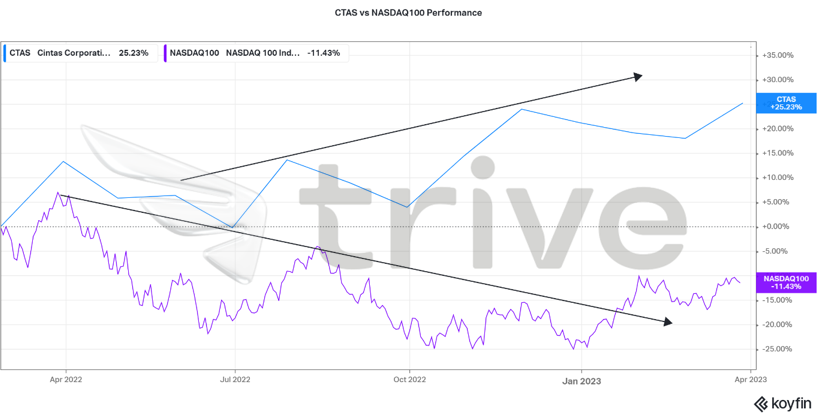

With U.S. interest rates surging at the fastest pace in their history, borrowing costs followed suit, dampening valuations of listed companies in the U.S. This is depicted in the above illustration with the price performance of the NASDAQ100, compared to CTAS. CTAS’s share price grew, against the odds, compared to the 100-company index, which declined due to higher borrowing costs.

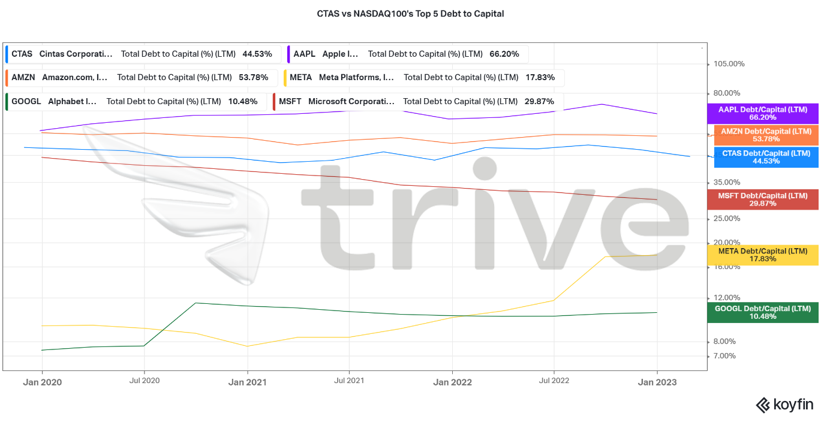

CTAS’s share price was driven higher by positive sentiments surrounding its earnings and positive earnings through the prior quarters. In addition, compared to the top 5 companies in the NASDAQ100 by market capitalisation, CTAS’s debt-to-capital ratio was among the few which started a downward trend in 2022. With interest rates surging, CTAS’s debt holdings declined compared to its total capital, giving it an edge over other listed companies.

Summary

If Cintas Corporation continues its positive trend, the share price will likely find upside momentum, making the $508.47 per share level probable. Headwinds will probably come from further interest rate hikes in its battle against inflation, leading to higher borrowing costs and a possible mild recession.

Sources: Cintas Corporation, NASDAQ, TradingView, Koyfin