HP Inc (NYSE: HPQ) beat consensus earnings per share by 1.38% in the first quarter of 2023. Despite positive earnings results, the share price was weighed down by declining sales Year-on-Year as HP battled to sell in the face of the high inflationary and interest rate environment presented in 2022.

HP provided an upbeat outlook for 2023 on the back of China’s reopening and a potential surge in sales, along with the effects of cost-cutting measures likely to be felt in 2023.

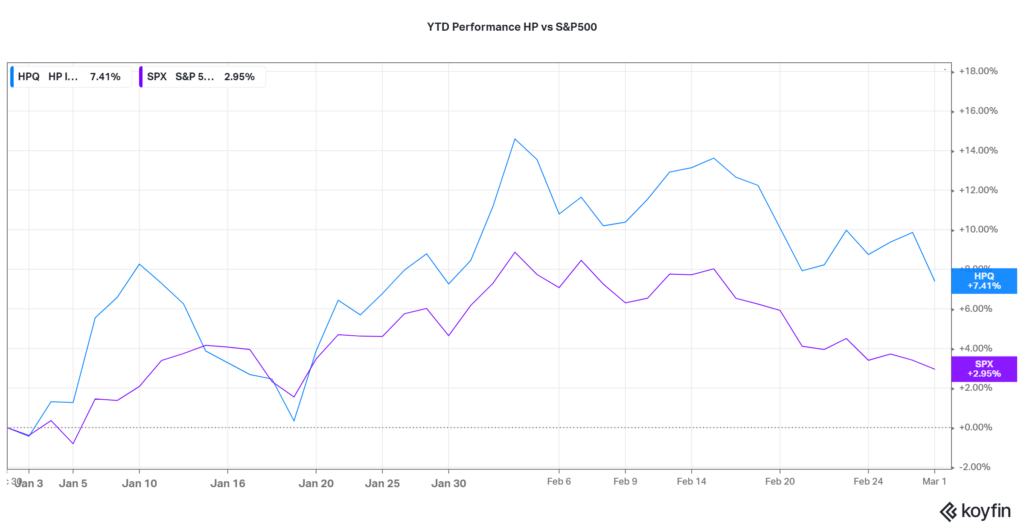

Below is the Year-to-Date performance of HP (HPQ) compared to the broader S&P 500 (SPX). HP has outperformed SPX twice over and is positively correlated with the index as movement is generally in the same direction.

Source: Koyfin

Technical

HP has been at the mercy of bears pushing the share price lower. An ascending triangle pattern formed as volumes declined to the upside, establishing resistance at the $30.99 per share level. With higher lows forming as the pattern unfolded, support was established at the $26.55 per share level.

With price now trading in the middle of the pattern, bulls and bears will equally be interested in taking price to the highs or lows of the pattern, respectively. Bulls will look to the $30.99 level with interest, while bears look to the upward-sloping trendline for take profit levels if the share price retreats.

A breakout to either side of the pattern on high volumes will likely signal the presence of traders willing to drive the share price further in the breakout direction. The $34.63 level is probable if the price breakout is above the pattern, while the $26.55 level is likely if a breakdown below the pattern occurs.

Fundamental

Following a year of high inflation and interest rates, HP’s sales were depressed as consumers reduced their spending on technology products. Sales dropped 19% year-on-year to $13.8B in the first quarter of 2023, making it the steepest drop since 2016.

According to HP’s CEO, the challenging macroeconomic conditions adversely affected consumer and corporate sales in the personal systems (PS) segment, which makes up 67% of total sales. Volumes declined year-over-year, with a 33% slump in Consumer PS shipments and a 24% decline in Commercial PS units. Consumer and commercial revenues declined 36% and 18%, respectively, highlighting weakness in consumer demand. Further exacerbating the topline was a 5% decline in revenues in the printing business, making up 33% of total revenues.

2023’s outlook is somewhat upbeat following the reopening of the Chinese economy. HP expects sales to surge as China, which is a crucial market as well as a dominant supplier of electronics components, retraces back to growth. In addition, the effects of cost-cutting measures are expected to be felt in 2023, following an announcement by HP to cut 4,000 to 6,000 jobs.

After discounting for future cash flows, a fair valuation of $31.86 per share was derived. Price currently trades at a 9.43% discount, leaving some room for upside price action.

Summary

With an ascending pattern forming, a breakout to either side of the pattern will likely occur. If HP realizes higher sales on the back of China’s demand surge, a breakout above the $30.99 per share level could validate further upside price action.

Sources: HP Inc, Reuters, Refinitiv, Gartner, TradingView, Koyfin