It was a tough first quarter for the largest U.S. home improvement chain, Home Depot Inc (ISIN: US4370761029) and will likely be an even tougher remainder of the year as the steepest rate hike cycle in decades is starting to take effect. Home Depot missed its revenue mark by 2.76% to land on $37.3B, making it the worst revenue miss in nearly 20 years. Earnings, on the other hand, beat Wall Street expectations marginally, but this was not enough to comfort investors as Home Depot provided a gloomy outlook for 2023.

Home Depot, which primarily services homeowners, has seen a slump in its top line as the housing market slumped on contraction in Residential Investments for seven straight quarters. In addition, homeowners are starting to feel the effects of high mortgage rates and are cutting expenditures to focus more on smaller projects rather than larger ones.

Technical

Home Depot’s share price currently trades at 33% off its peak over a year ago. Since its peak, the share price has traded on thinner and thinner volumes, leading it into a wide-range sideway consolidation. Support and resistance were established at the $270.72 and $340.45 per share levels, respectively, as the share price validated its downtrend with a breakdown below the 100-day moving average.

Given the downbeat first-quarter earnings and weaker guidance for the remainder of the year, the share price will likely drag lower as investors sell out to protect themselves from the downside. Support at the $270.72 level will probably be a point of interest for investors looking to go long due to the level’s history of excess demand pushing the price higher. Bullish investors will likely look to the $340.45 level as a take-profit level should they commit to the upside from the support level.

Alternatively, if the market rides on the bearish sentiment of the company, a breakdown below the $270.72 level on high volumes could prompt a leg down, leaving the next support level formed two years ago in sight for bullish investors looking to buy the stock at a further discount. If the share price approaches the level on declining volume, a reversal is likely to play out, with bullish investors probably aiming for the $270.72 per share level as the first level of interest.

Fundamental

The past three years have been a joy for Home Depot as its top line grew by $47B. However, the period of excessive sales is likely coming to an end as the world has reopened its economies and borders. More people are now looking to eat out and/or travel rather than spend on home improvements since they can spend less time at home now. Further compounding on the depressed top line is the U.S. consumer that is depressed by high-interest rates, which eat into discretionary spending.

Revenues are down 4.2% to $37,3B from the quarter a year ago, reflecting weakness in the consumer’s pockets, while Earnings followed the top line with an 8.5% decline from the year-ago quarter to $3.9B. According to Home Depot, demand for discretionary items like appliances, flooring, kitchen and bath, patio furniture and grills was weak in the quarter.

Home Depot cut its forecast for the remainder of the year, with earnings per share expected to decline between 7% and 13%, above the estimated single-mid-digit drop. Revenues are expected to fall between 2% and 5% compared to the flat sales projected before.

A fair value of $324.25 per share was derived for Home Depot after performing a discounted cash flow valuation. 15% of upside gains are probable if the share price moves higher from current levels.

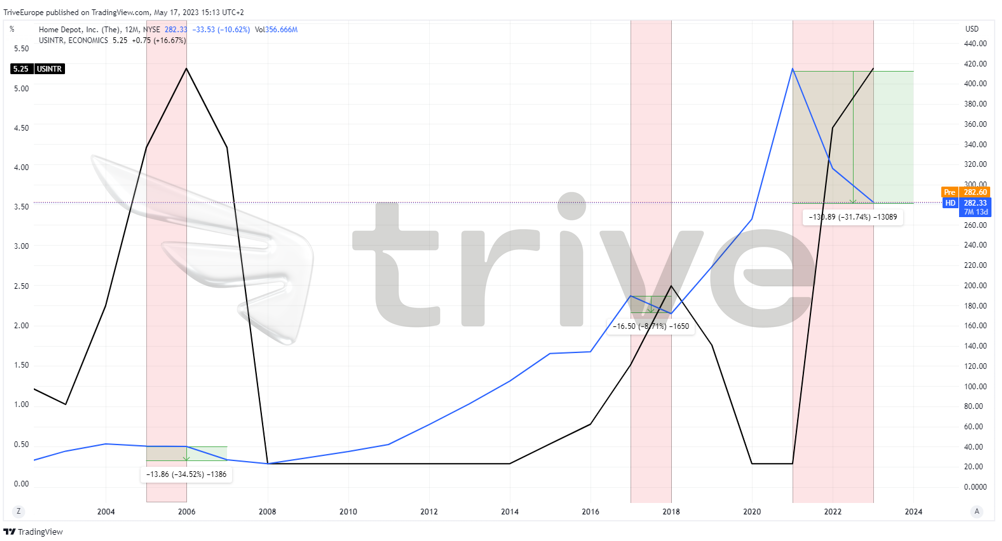

Home Depot’s share price has struggled to keep up with interest rate hikes in the past. The most prominent plunges prior to the latest tightening cycle was between 2017 and 2018, where the share price shed 8.71% after interest rates surged 100 basis points during the period. Between 2005 and 2006, interest rates were hiked by 100 basis points, taking Home Depot’s share price plummeting nearly 35%. The latest hiking cycle caused the share price to decline almost 32%, indicating that discretionary consumption is threatened by high-interest rates, which in turn threatens Home Depot’s top line and share price.

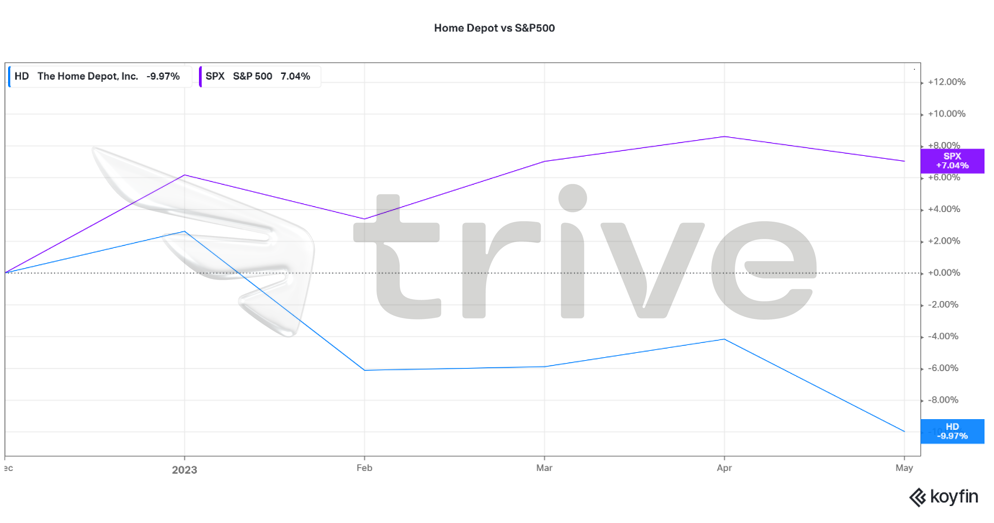

On a year-to-date basis, Home Depot’s share price, a top 20 company within the S&P500, declined 9.97% and significantly underperformed the broader S&P500 index. Investors are likely in sell mode due to the challenging macroeconomic conditions present in the market, with consumer discretionary stocks likely taking the brunt of high-interest rates.

Summary

Home Depot’s depressed earnings and outlook will likely weigh on the company’s share price as investors turn risk-off. There could be further downside price action to come before the share price rebounds to a level bullish investors deem fit to buy into. The $325.25 level could be attainable if the company’s macroeconomic environment shifts to one more supportive of consumer spending.

Sources: Home Depot Inc, CNBC, Reuters, Wall Street Journal, TradingView, Koyfin