Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

Google’s parent company, Alphabet Inc’s (ISIN: US02079K3059) revenue and profit exceeded Wall Street expectations thanks to the rapid expansion of its cloud computing division. The financial results of Google show sustained strength in the overall business, with revenue growth accelerating across both Search and YouTube, as well as strong momentum growth in the Cloud business.

Revenue of $74.6B beat expectations by a modest 2.40%, producing earnings of $1.44 per share, which exceeded forecasts by 7.13%. This marks a fourth quarter of single-digit growth amid strained digital ad spending, which reflects poor economic sentiment within the business community. However, advertisers, who account for a sizable portion of Google’s topline, have decreased their expenditure on unproven platforms, benefiting Google’s parent company.

Technical

After over a year of a downward trend, characterised by the share price trading below the 100-day moving average within a descending channel pattern, Google’s Class A shares have pointed higher. A breakout above the descending channel pattern in the week of 20 March 2023 saw price action move higher, leading to a break above the 100-day moving average and above a key resistance level at $121.13 per share.

The low established at the $88.33 per share level forms support, while the high at 143.79, established in the second quarter of 2022, forms a resistance level. Given the shallow pullback that saw optimistic investors buy into Google stocks at the 50% Fibonacci Retracement level, upside momentum could be at play. A high volume breakout above the $129.04 per share level, which forms a swing high, could indicate strong market enthusiasm for the upside. The next level of significance could be the $143.79 per share level if the upside momentum persists.

Fundamental

With a gain of 45.05%, which is in excess of 200 basis points more than the NDX, Google has slightly outpaced the heavily tech-weighted NASDAQ100 (NDX) year-to-date. Since the NDX was just rebalanced, Google now represents around 5% of the index, highlighting the two instrument’s significant positive correlation.

Trive Financial Services Malta – TradingView, Nkosilathi Dube

Google’s revenue grew 7% year-over-year to $74.60B, with all major revenue streams recording positive growth in the quarter except for the Google Network segment, which saw revenue decline 5% to $7.85B. The major source for top line growth was the Google Cloud segment which experienced a hefty 28% growth year-on-year to $8.03B. This was followed by growth in the Google Search and Youtube Ads segments, where revenue grew 5% and 4%, respectively, to $42.63B and $7.67B.

Trive Financial Services Malta – Alphabet Inc, Nkosilathi Dube

In the second quarter of 2023, the company’s operating income showed significant growth, increasing by 12% to reach $21.84B compared to the same period the previous year. The strong performance of the cloud division of Google partly drove this growth. Notably, the cloud division achieved a major milestone in the first quarter of 2023 by becoming operationally profitable, marking a significant turnaround from the previous year when it faced a loss of $590M. In the second quarter of 2023, the division’s operating profit reached $395M, further contributing to the company’s overall growth in operating income. This led to a surge in net income to $18.37B, representing a 15% growth year-on-year.

Due to this positive development, the company’s net margin also improved, increasing by 100 basis points. The net margin grew from 28% in the previous year’s second quarter to 29% in the second quarter of 2023 year-over-year. This improvement in net margin reflects the company’s increased profitability and efficiency in managing its costs and generating revenue across its operations.

The business intends to incorporate generative AI into other products, including its Android mobile operating system, Gmail, and Google Photos. Text, photos, and videos produced using generative AI technology can resemble human-produced content, which Google aims to use to enhance its products and services. According to Google’s Chief Financial Officer, the new AI technology has a price. Servers and a “meaningful investment” in AI computing made up the majority of Alphabet’s capital expenditures in the second quarter. Net cash from investing activities more than doubled, reaching $10.8B from the quarter a year ago.

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

Google falls in the mid-tier of its competitors on a profitability level. Its Earnings Before Interest and Tax stands at 25.75%, while the Net Income is 21.05%. Although it is not the most impressive in its class, it is still considerable and relatively stable, giving its investors healthy earnings year after year.

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

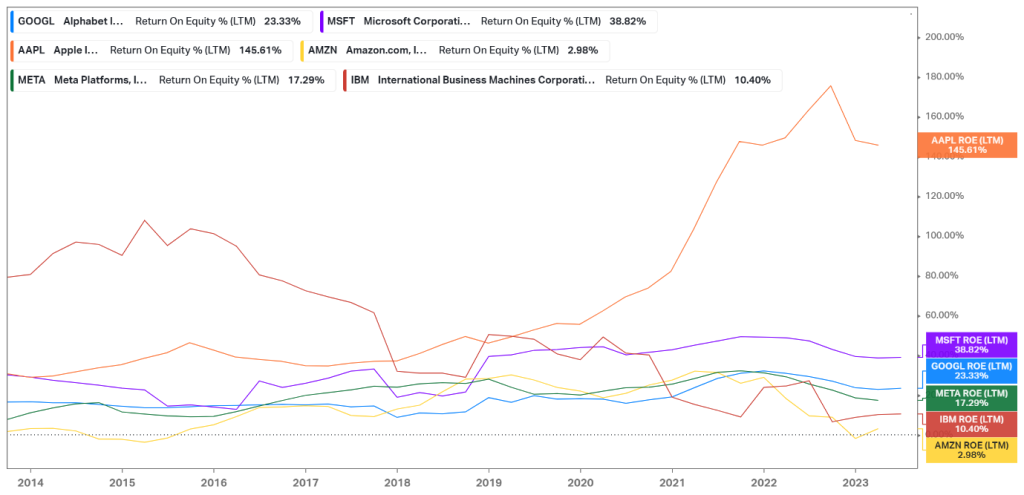

Besides Apple (ISIN: US0378331005), which has an industry-leading Return on Equity above 100%, Google is somewhat a high-return company compared to its peers. It falls behind only Microsoft Corporation (ISIN: US5949181045) with an ROE of 23.33%, which is relatively high among the competition. Investors attracted to earnings potential could look to Google as it offers steady returns consistently.

Trive Financial Services Malta – Koyfin, Nkosilathi Dube

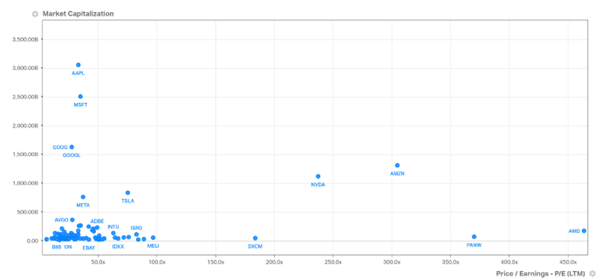

Google falls in the top tier of market valuations but still offers high growth potential as its PE falls well within the NASDAQ100’s tech sector range. Investors are willing to pay for Google’s earnings in line with what the market perceives of its major competitors.

After discounting for future cash flows, Google’s fair value was derived at $140.01 per share.

Summary

The ongoing development and incorporation of AI into Google’s service will likely create growth opportunities which could boost the company’s earnings potential. Furthermore, the market is pricing in a high likelihood of no further rate hikes this year, while the Federal Reserve anticipates that the U.S. economy will avoid a recession. These factors could feed into a higher share price for Google, given that its performance remains upbeat. The $140.01 per share level will likely materialise in the medium to long term.

Sources: Alphabet Inc, Nasdaq, CNBC, Reuters, CME, TradingView, Koyfin