Piece Written By Nkosilathi Dube, Trive Financial Market Analyst

General Electric (GE) – (ISIN: US3696043013) has experienced a challenging period since 2016, with consistent year-on-year revenue declines and four years of losses. However, in 2022, the company saw a positive shift, recording its first year of revenue growth in six years. This turnaround can be attributed to various factors that have reinvigorated investor interest and confidence in the company.

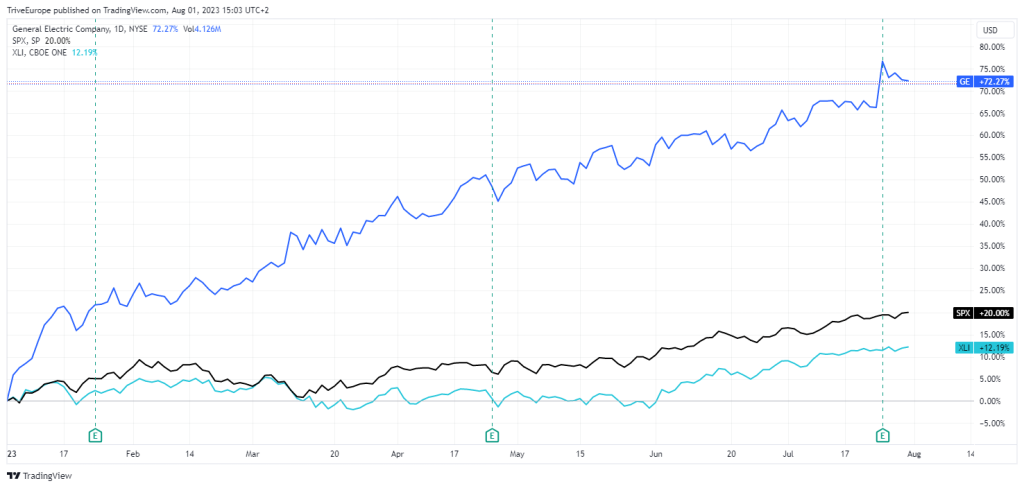

One significant factor behind GE’s recent success is the increased demand for jet engines, where the company holds a dominant market share, particularly in the narrow-body aircraft industry. This surge in demand for aircraft has boosted GE’s stock price, which has risen by an impressive 74.72% year-to-date. GE’s performance in the first quarter of the year further bolstered investor sentiment. The LEAP engine, in particular, performed well, leading to a 26% increase in orders. This success was followed by double-digit growth in operating profit and a significant reduction in the company’s debt burden.

The positive momentum continued in the subsequent quarter, with earnings surpassing Wall Street estimates by an impressive 46.97%. Earnings per share reached $0.68 on revenues of $15.85B, representing a 7.41% increase against consensus. Overall, GE appears to be turning the corner, with its focus on aviation, strong performance in the jet engine market, and successful restructuring efforts leading to improved financial results and investor confidence.

Technical

At the beginning of the year, GE’s share price experienced a bullish trend, driven by optimistic investors impressed by the Aviation segment’s positive outlook and the strong first-quarter earnings. The stock found support at $60.24 per share, and after the rejection, it surged above the previous swing high of $90.65 per share, indicating that bullish investors have had a significant impact throughout the year.

GE’s share price recently breached a resistance level of $116.32 per share, established in early 2018. This breach suggests the upward momentum is strong and may continue if the breakthrough sustains. If the share price maintains momentum above $116.32, investors will likely focus on the $149.53 per share level as the next point of interest.

On the other hand, if the share price fails to sustain momentum above the $116.32 per share level, it may face some resistance to the upside. The technical analysis indicates that the current trend is favouring the upside; however, if the share price fails to maintain its upward momentum above the mentioned resistance level, a reversal could play out, leaving $90.65 per share as the next level of significance for optimistic investors.

Fundamental

GE has demonstrated remarkable performance in the past quarter, with total orders reaching $22.0B, representing an impressive 59% growth in organic orders year-on-year. Total revenues also surged to $16.7B, marking an 18% increase from the same quarter a year ago. This growth can be attributed to the increased demand in GE Aerospace and record Renewable Energy orders, leading to a significant improvement in profit margin, which rose by 151 basis points to 8.3%.

The aerospace segment, GE Aerospace, experienced rapid growth, achieving double-digit growth in orders (37%), revenue (28%), and operating profit (29%) year-over-year. Organic orders increased primarily driven by both Commercial Services and Defense. A strong performance was observed in Commercial Engines and Services, with revenue up by 32%. Additionally, Defense contributed to near-term improvement and substantial growth, with orders more than doubling and engine output increasing by 74% year-over-year.

The Renewable Energy segment also demonstrated robust order growth, fuelled by Grid with two major projects. Organic revenue in this segment grew by 27%, driven by higher equipment deliveries across Wind and Grid segments. Profit also showed improvement year-over-year and sequentially, primarily led by price and productivity gains, especially in Onshore and Grid.

GE raised its full-year guidance based on the strong performance in the year’s first half. The company now expects organic revenue to grow in the low-double-digit range, up from the previously projected high-single-digit range. Adjusted EPS is anticipated to be in the range of $2.10 to $2.30, up from the previous projection of $1.70 to $2.00. Free cash flow is also expected to increase, with a range of $4.1B to $4.6B, compared to the previous range of $3.6B to $4.2B.

Specifically, GE Aerospace is projected to achieve high teens to 20% organic revenue growth, with operating profit in the range of $5.6B to $5.9B and a year-over-year increase in free cash flow. On the other hand, GE Vernova is expected to achieve mid-single-digit organic revenue growth, with an operating loss in the range of -$0.4B to -$0.1B, while continuing to anticipate flat to slightly improved free cash flow.

Overall, GE’s positive performance and raised guidance indicate a strong rebound for the company, driven by robust growth in its aerospace and renewable energy segments, setting a promising outlook for the future.

Source: Trive Financial Services Malta – TradingView, Nkosilathi Dube

GE’s share price has been on a strong upward trajectory, outperforming the S&P500 with an impressive 72.27% year-to-date gain compared to the SPX’s 20%. While the industrial sector (Industrial Select Sector SPDR – XLI [ISIN: US81369Y7040]) saw a 12.19% gain, GE’s healthy fundamentals have propelled it beyond the sector’s performance, making it a standout performer in the market.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

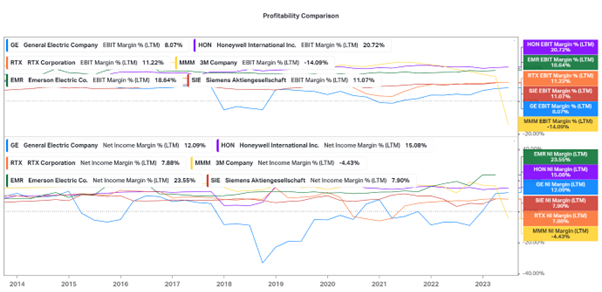

GE’s profitability, reflected by an 8.07% EBIT margin, places it in the lower tier among its industrial sector peers, which might be attributed to recent periods of weakness. However, its net income margin stands at a more competitive 12.09%, positioning it in the middle of its peer group, showing some resilience and potential for improvement.

Source: Trive Financial Services Malta – Koyfin, Nkosilathi Dube

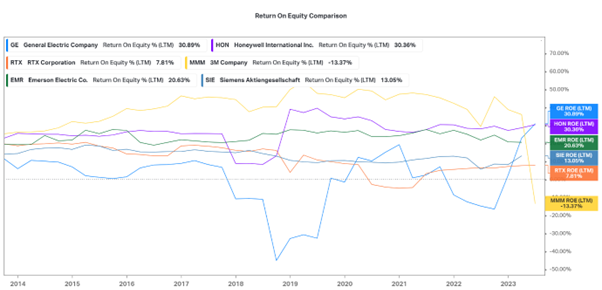

GE stands out among its industrial peers with the best Return On Equity (ROE). However, it’s important to note that the company has only recently recovered from a period of negative earnings, indicating its recent comeback to profitability. Despite its recent improvement, the company may need to sustain its positive performance to solidify its position in the industry.

After discounting for future cash flows, a fair value of $125.95 per share was derived.

Summary

Given GE’s rebound in its Aviation orders and lean restructuring, it could continue to go from strength to strength as the top line is boosted while the expenses remain subdued in the leaner organisational structure. The share price will likely converge with its $125.95 per share fair value, given that investors pile into the stock on the upbeat full-year guidance.

Sources: General Electric Company, Reuters, TradingView, Koyfin