The Euro Stoxx 50 Index is a blue-chip index comprised of Europe’s top 50 companies by market capitalisation, constituting 60% of the Euro Stoxx total market index. EURO STOXX 50 ETF SPDR – FEZ ETF (ISIN: US78463X2027) tracks the performance of the Euro Stoxx 50 Index, seeking to provide investment results corresponding with the index.

2022 was an extremely gloomy year for European stocks as inflation became the driving force for their downfall. Interest rates in the Euro Area surged significantly in 2022 as the European Central Bank (ECB) was out to fight off inflation by any means. The ECB raised rates back to 2008 levels, leading to the FEZ-ETF shedding a staggering 17.27% in 2022, as borrowing costs surged, weighing down on earnings, while higher discount rates were applied to valuations, further compounding the downward pressure. The surge in interest rates globally left the investment community repelling high-risk financial instruments and leaning more toward safe-haven assets as a result.

However, 2023 has been different as the FEZ-ETF has nearly gained a fifth of its value to recover the majority of 2022’s losses. Driving the ETF higher was discounted buying and growing risk sentiment on the back of a likely pause in interest rates towards the end of the year. Is there more to come for the FEZ-ETF?

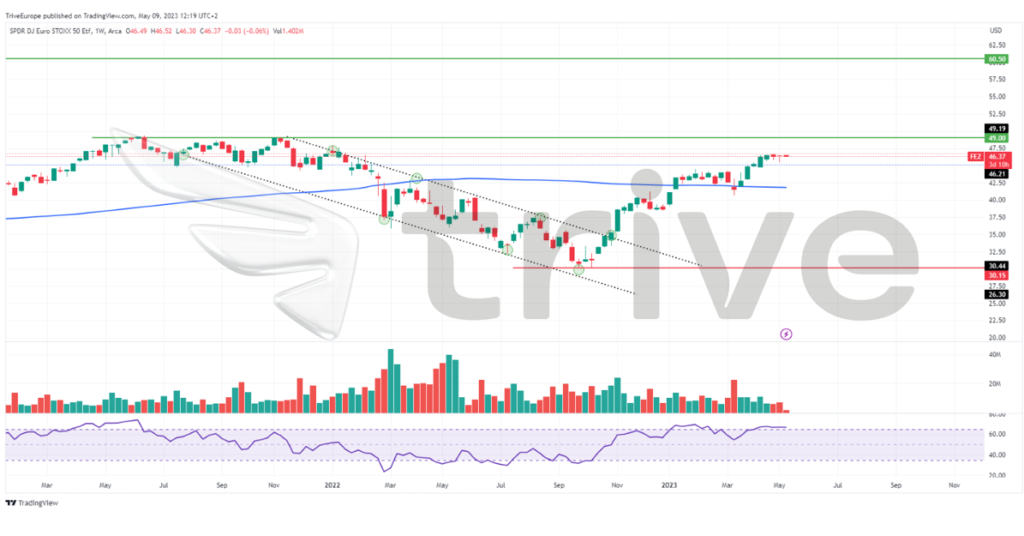

Technical

The FEZ-ETF is structurally in an uptrend after experiencing a steep selloff in the prior year. The uptrend was authenticated by the price exiting the descending channel pattern formed in 2022 and subsequently crossing over the 100-day moving average. The sharp turn higher from the $30.15 price point established a support level, while the $49.00 level established resistance.

Bullish investors have been on a roll after the FEZ-ETF was made buoyant at the start of the year, leading to a nearly 20% gain in the ETF. Price is now approaching the resistance level, and bullish investors already invested in the ETF could be looking to pursue the level.

If a textbook retracement from resistance occurs, bullish investors not currently invested in the ETF could look to buy into it at a discounted price. Declining volumes to the downside could indicate bearish momentum diminishing and a reversal imminent. The $49.00 level will likely be earmarked as a point of interest in a bull case. Alternatively, if a high volume breakout above the resistance level ensues, a leg up could play out with the next level of interest likely at the highs of 2008 at the $60.50 level.

Fundamental

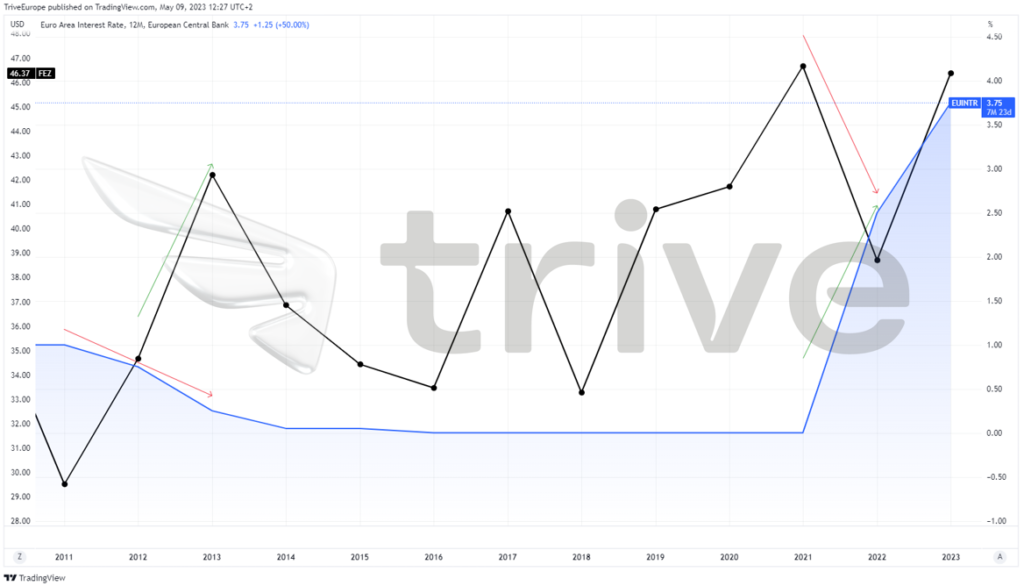

As depicted below, the FEZ-ETF price and Euro Area Interest Rates have a strong inverse relationship. During the period 2011 to 2013, the ECB lowered interest rates from 1% to nearly 25 basis points. The FEZ-ETF gained a mouth-watering 43% as earnings and expansion efforts were boosted by lower borrowing costs. The interest rate hikes which commenced in 2021 led to a decline in the FEZ-ETF’s value. After rates surged 2.50% in a year, the ETF’s value plunged 17% as borrowing costs weighed on the company’s bottom lines.

The FEZ-ETF is highly concentrated in the Consumer Discretionary, Financials and Information Technology sectors, which comprise just over 50% of the 11 sectors that the Euro Stoxx is exposed to. The consumer discretionary and tech sectors suffer the most from interest rate sensitivity. Consumers feel the pinch when borrowing costs rise and tend to limit budgets and divert consumption to more necessity goods, putting pressure on the top line of consumer discretionary companies. Tech stocks tend to have high growth potential, funded by borrowing, and when interest rates increase, these stocks are weighed down severely by increased interest rate payments. The FEZ-ETF has limited exposure to defensive stocks, leaving it prone to swings caused by interest rate changes.

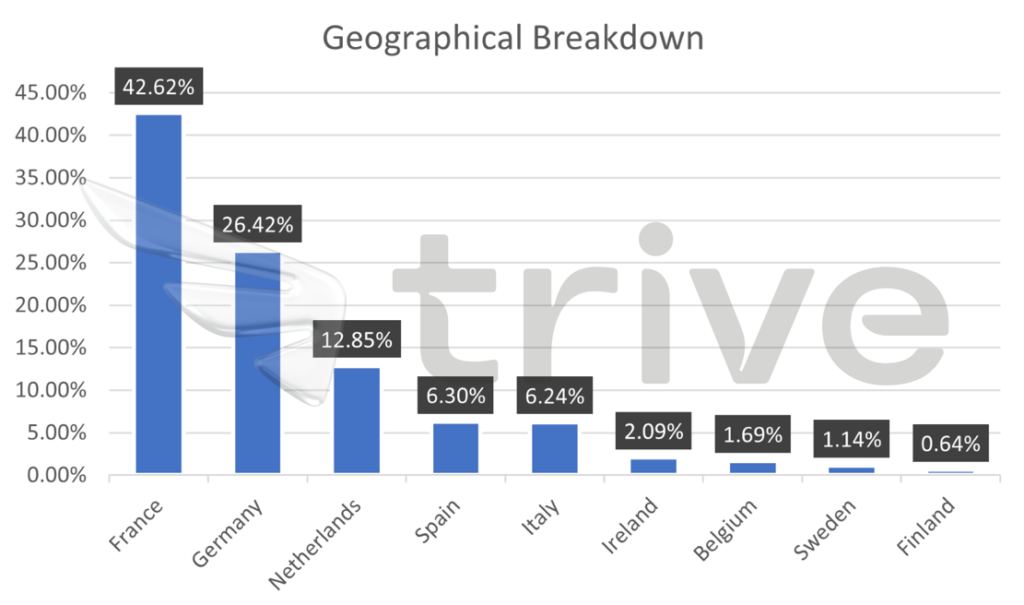

The FEZ-ETF is highly exposed to France and Germany’s macroeconomic conditions, with over 69% of the ETF’s exposure coming from the two countries. The ECB has been committed to fighting inflation in the region, leading to rising borrowing costs. The FEZ-ETF was largely weighed down and could experience further headwinds if interest rates continue to surge dramatically.

Summary

With the tightening season seemingly coming to an end, European stocks could finally see light at the end of the tunnel. There could be further upside gains, given that the ECB does not hike rates by jumbo-sized chunks. The $49.00 level will likely be within reach in the medium to long term.

Sources: EUREX, State Street Global Advisors, Reuters, TradingView