Despite multiple curveballs presented in 2022, Adobe Inc (NASDAQ: ADBE) concluded a bliss year realising record revenues and operating cash flows. Due to its industry-leading innovative services and strong demand for its offerings, Adobe was able to shake off rampant inflation and elevated interest rates.

Adobe has projected an even better 2023, and with earnings set to be released next week, investors will be glued to see if the quarter’s earnings will spell out the beginning of a better year for the organisation.

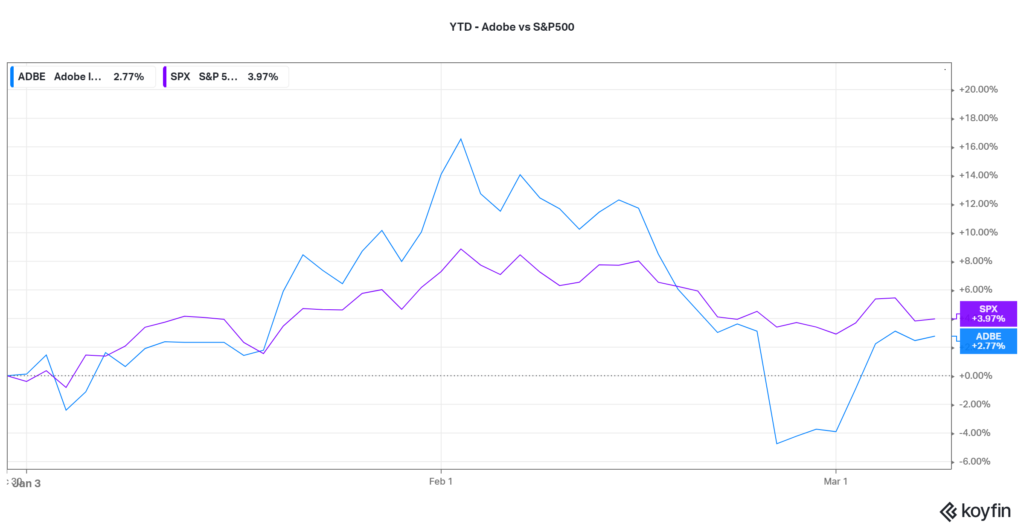

On a year-to-date basis, Adobe has underperformed the S&P500 slightly, partly due to an adverse reaction by investors to the potential blockage of the acquisition of Figma by the U.S. Justice Department. Adobe planned to buy the startup for $20B to compound its synergies. The possible blockage of the transaction caused a sharp 7.55% nosedive in the share price as investors turned gloomy.

Technical

Adobe’s share price has trended lower since the end of 2021 as bears took over the broader market. Support and resistance were established at the $273.32 and $393.81 per share levels, respectively. Following a rejection of resistance, price was dragged lower towards the 61.80% Fibonacci Retracement Golden Ratio before bullish investors entered the market to trigger the level as a support zone.

If bullish investors stick to their guns, Adobe’s share price will likely find upside price action in the medium to long term. The next probable point of interest for a bull case is the $393.81 per share level set at resistance.

Alternatively, if bearish investors overturn the current sentiment of the market, the share price will likely recommence its downtrend with the $273.32 level a point of interest for the downside.

Fundamental

With Adobe operating in a digital-first world, it is placed in an excellent position to take advantage of the digital growth opportunities presented year after year. 2022 was no different, as revenues reached $17.61B to produce a record year in top-line performance. Revenues surged 15% year-over-year, leading to record operating cash flows and boosted profitability.

All of Adobe’s business segment incomes improved for the year, with the most notable improvement coming from the Document Cloud segment, with $619M in revenues and the Digital Media segment, with $3.30 billion in revenue, representing 16% and 10% year-over-year growth, respectively.

Adobe forecasts an upbeat 2023, with revenue forecast to grow by 9%. The more significant contributors to revenue growth are the Digital media and Digital experience segments, with a projected 9% and 13% growth, respectively.

Adobe has a certain degree of credibility within the investment community. The top two largest asset managers by Assets Under Management, BlackRock Fund Advisors and Vanguard Group, own 5.02% and 8.18% of Adobe, respectively. This could be an indication of the quality and value that Adobe has to offer investors across the world, including the top asset managers with the most capital to invest.

After discounting for future cash flows, a fair value of $381.64 was derived. Price currently trades at a 9.38% discount to fair value, leaving significant room for upside price action.

Summary

Next week’s earnings release will finely define Adobe’s share price direction. If earnings are better than expected, the upside will probably be easygoing and vice versa. An uptrend could be validated by a breakout above the $393.81 per share level, while the downtrend could still be in play if the share price respects the level.

Sources: Adobe Inc, CNBC, CNN Business, TradingView, Koyfin